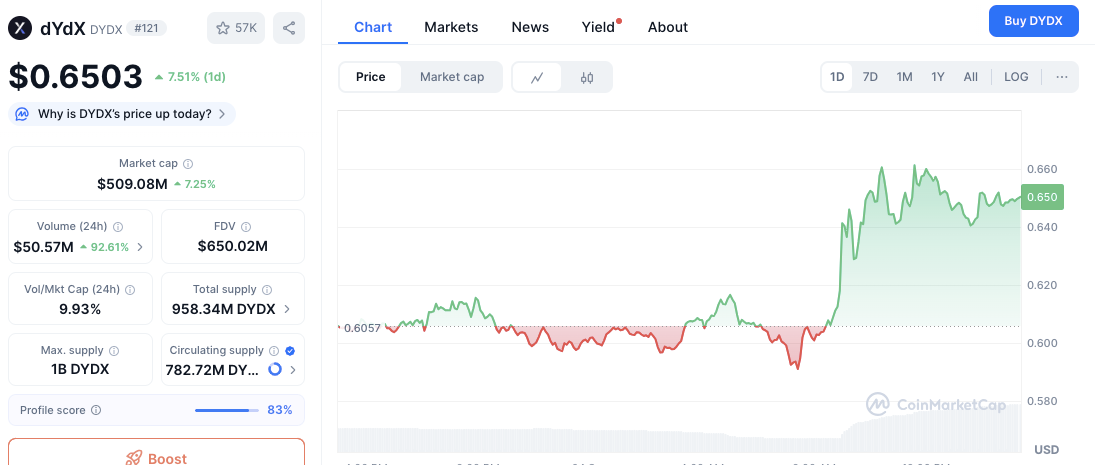

- DYDX price surges 7% as traders anticipate September 24 major announcement

- Key $0.600 support holds strong, while resistance at $0.665 caps current upside

- Trading volume spikes 90%, signaling stronger conviction for potential rally ahead

dYdX is once again back in the spotlight after confirming that a major announcement will be released today, September 24. The news comes at a time when the decentralized derivatives exchange token has been staging a sharp recovery in price.

Traders have shown renewed interest, lifting DYDX nearly 7% in the last 24 hours to trade around $0.6474. The sudden surge not only marks a shift in momentum but also sparks speculation about whether the upcoming announcement could drive the next leg higher.

Key Technical Levels Driving Momentum

The price structure has shown clear signs of strength after consolidating near its floor. The $0.600 to $0.607 area has acted as a consistent support, cushioning repeated declines. This zone now serves as a short-term base, offering bulls confidence to push higher. Once DYDX cleared $0.620, buying activity accelerated and confirmed the breakout.

Currently, the token faces a critical resistance between $0.660 and $0.665. Sellers have already tested this zone, slowing the advance. A decisive break above this range could unlock a path toward $0.70, which many traders are closely watching.

Besides price action, the trading volume paints an equally telling story. Daily trading activity jumped 90%, underlining strong conviction behind the upward move. A spike of this scale often precedes continuation rallies, suggesting further gains remain possible.

Indicators Signal Early Bullish Shift

Momentum indicators are aligning with the bullish tone, though with measured strength. The MACD recently turned positive, hinting at a potential momentum shift. However, the histogram remains close to zero, showing that conviction is still building.

At the same time, the Relative Strength Index is holding near 53. The neutral reading indicates neither overbought nor oversold conditions. Still, the indicator has rebounded from the low-40s, giving traders reason to lean toward a positive outlook.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.