- El Salvador’s Bitcoin holdings hit 5.87k BTC by Sept 1, 2024, showing steady growth.

- Bitcoin’s price ranged from $57.9K to $58.5K in early Sept, highlighting market volatility.

- President Bukele admits adoption challenges but stays committed to Bitcoin inclusion.

El Salvador remains committed to Bitcoin, as evidenced by its growing holdings throughout August 2024. Despite facing hurdles in achieving widespread crypto adoption, the country continues to buy the dip, demonstrating its unwavering belief in Bitcoin’s potential.

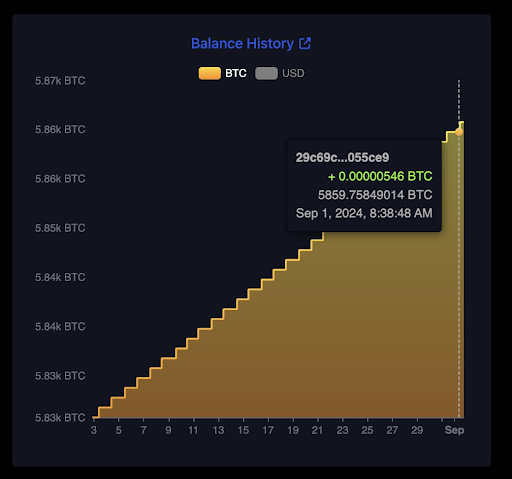

Throughout August 2024, El Salvador’s Bitcoin balance slowly increased, reaching approximately 5.87k BTC by September 1, 2024. The Bitcoin balance history chart reveals a consistent accumulation pattern, with the account receiving small but noticeable amounts of Bitcoin.

On September 1, 2024, the balance held steady at 5.86K BTC, showing a recent increase of +0.00000546 BTC. This upward trend displayed a strategic approach to Bitcoin acquisition, possibly through joined transactions or regular deposits, leading to the overall growth in the country’s Bitcoin holdings.

Bitcoin’s price showed considerable volatility, shifting between approximately $57,900 and $58,500. Early on September 2, 2024, the price experienced a drop, dipping below the $58,000 mark and entering a bearish phase.

However, the market showed persistence as the price recovered by mid-morning, peaking at around $58,380 by midday. This recovery demonstrates investor confidence in Bitcoin despite the temporary downward pressure.

Similarly, President Nayib Bukele acknowledged that although El Salvador’s Bitcoin holdings are still increasing, the country’s acceptance of Bitcoin has fallen short of expectations. Bukele noted in an interview with TIME magazine that the primary goal of crypto assets was not met in terms of its widespread use.

However, he emphasized that no one is forced to adopt Bitcoin, as it remains a form of currency within the country. El Salvador continues to work on integrating Bitcoin into its economy and maintains its policy of buying BTC for the national treasury.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.