- The second largest crypto by market cap saw a 12% drop in its price over the last weekend alone.

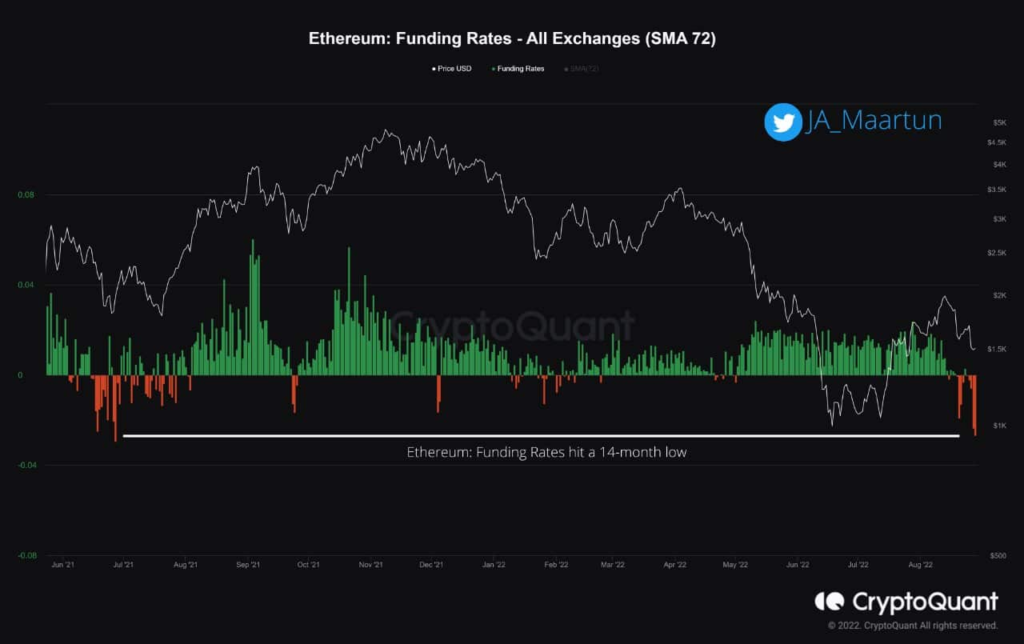

- ETH’s funding rate has dropped to negative.

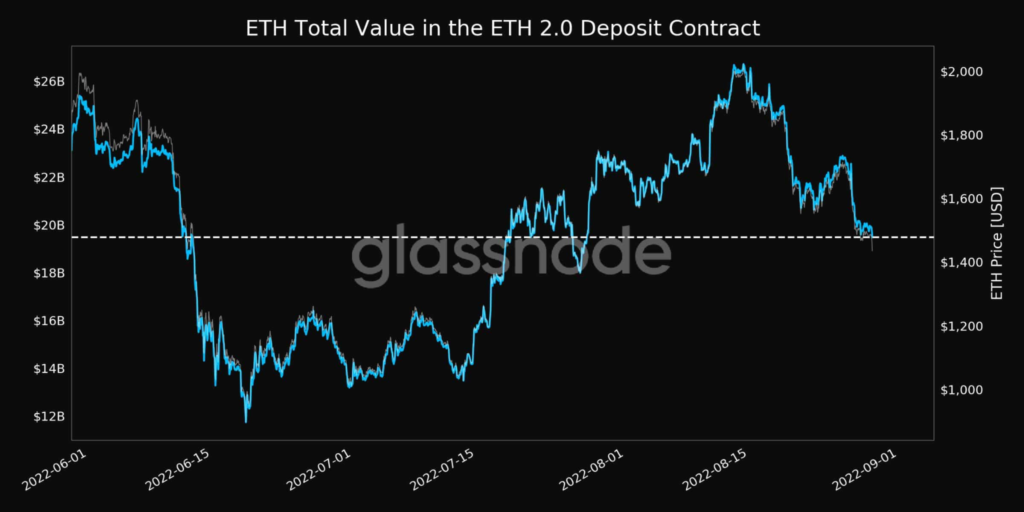

- ETH 2.0 Deposit Contract just reached a 1-month low of $19,475,07,788.75.

After the FED reiterated its desire to deal with inflation in the US in a speech on Friday last week, things have not been going well for cryptocurrencies as they are now under severe pressure. The second largest crypto by market cap, Ethereum (ETH), saw a 12% drop in its price over the weekend alone.

According to the market tracking website, CoinMarketCap, ETH is currently trading at $1,446.37. This means that ETH is down 2.63% over the last 24 hours and 9.72% in the red over the last week. This all comes despite the fact that the Merge is expected to happen within a mere 16 days.

Data from CryptoQuant also indicates that ETH’s funding rate has dropped to negative, hitting a new 14-month low. This could indicate a very strong bearish sentiment among ETH traders.

The last time the ETH funding rates were this negative was in July of 2021, right before a huge short-squeeze on Bitcoin and Ethereum.

Also, ever since the implementation of the EIP-1559 protocol in 2021, the annual rate of inflation for ETH has dropped by 50.77%.

In addition to this, the total value in the ETH 2.0 Deposit Contract just reached a 1-month low of $19,475,07,788.75. The previous low was observed on August 27 at $19,589,437,125.96.

As mentioned before, the speech from the FED chairman also addeed pressure to ETH’s situation at the moment. Further tightening measures could put evenmore pressure on equity and the crypto market as a whole. Considering ETH’s growing correlation to the S&P 500, this could hugely impact the altcoin.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.