- Glassnode alerts revealed in a tweet today that ETH’s number of exchange withdrawals (7d MA) has reached a 1-month low.

- This fresh low was recorded just 24 hours after the metric’s previous 1-month low.

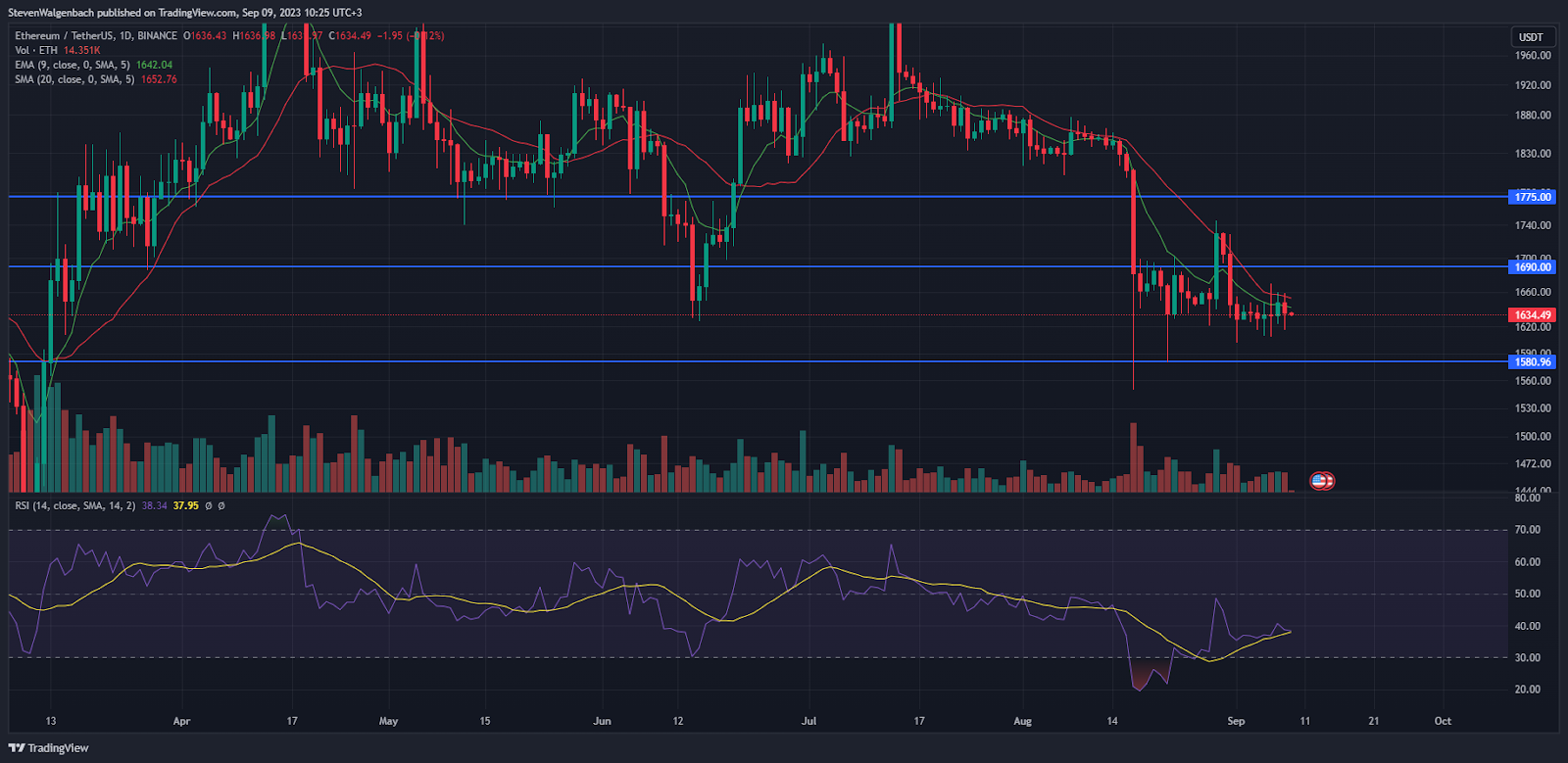

- Meanwhile, technical indicators suggested that ETH’s price may drop in the coming week.

Glassnode alerts, the on-chain tracking platform, revealed in a tweet earlier today that the amount of Ethereum (ETH) that has been withdrawn from exchanges has dropped to a 1-month low. According to the post, ETH’s number of exchange withdrawals (7d MA) reached 3,109.756.

This recent low follows just a day after the metric reached its previous 1-month low yesterday. Glassnode alerts added in their tweet that ETH’s number of exchange withdrawals (7d MA) reached 3,110.208 24-hours ago.

Meanwhile, the leading altcoin’s price slipped 0.74% throughout the past day of trading according to CoinMarketCap. Subsequently, ETH was changing hands at $1,634.03 at press time. Despite the negative daily performance, the cryptocurrency was still up 0.17% for the week.

Along with the price increase, the daily trading volume for ETH also rose 13.20% during the previous day of trading. As a result, the total stood at $4.956 billion.

Meanwhile, a notable bearish technical flag was on the verge of being triggered at press time, as the daily RSI line was looking to cross below the daily RSI SMA line. If these 2 technical indicators cross, it will signal that sellers have the upperhand. Consequently, ETH’s price may drop in the following few days.

If this potential technical flag is validated, ETH’s price may retest the next key support level at $1,580.96. On the other hand, if the cryptocurrency is able to close a daily candle above the 9-day EMA line at around $1,642.12 then the bearish thesis may be invalidated.

Thereafter, ETH’s price could continue to climb to break above the 20-day EMA line before potentially flipping the resistance level at $1,690 into support. Continued buy support may lead to ETH challenging the next threshold at $1,775 over the following week as well.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.