- High leverage trading leads to massive losses, with $44M lost in just 40 days.

- Ethereum longs face extreme risk as liquidation sits only $100 below entry price.

- ETH shows bearish pressure with RSI near 33.9 and MACD signaling weak momentum.

One of the most closely watched accounts in crypto trading circles has racked up more than $44 million in losses in just 40 days. According to EmberCN data, the individual first saw $35.8 million vanish on an Ethereum long, then followed with a $7.5 million loss shorting Bitcoin.

Despite the string of setbacks, he has returned to the market with another aggressive bet, a massive Ethereum long. The move highlights both the scale of volatility in crypto and the risks of narrow-margin leverage.

Pattern of Costly Missteps

The trader’s strategy has repeatedly ended in liquidation. His long on Ethereum lasted less than 12 hours before a sharp price drop erased $2.4 million. He then shifted into a Bitcoin short, only to lose another $7.5 million as markets moved against him.

Following these losses, he withdrew $450,000 from his Hyperliquid account into Crypto.com, seemingly stepping away from the market. However, this break was short-lived.

Related: Ethereum Fusaka Upgrade Slated for Dec 3 With Scaling Boosts

New Long, Risk Level Tightened

Just five hours ago, he reopened a massive Ethereum long, this time buying 15,700 ETH worth $65.4 million at $4,178. His liquidation level sits precariously close at $4,078 just $100 below his entry price. This narrow margin highlights the extreme risk, suggesting either confidence in a rebound or a final gamble.

Ethereum Under Pressure at $4,000

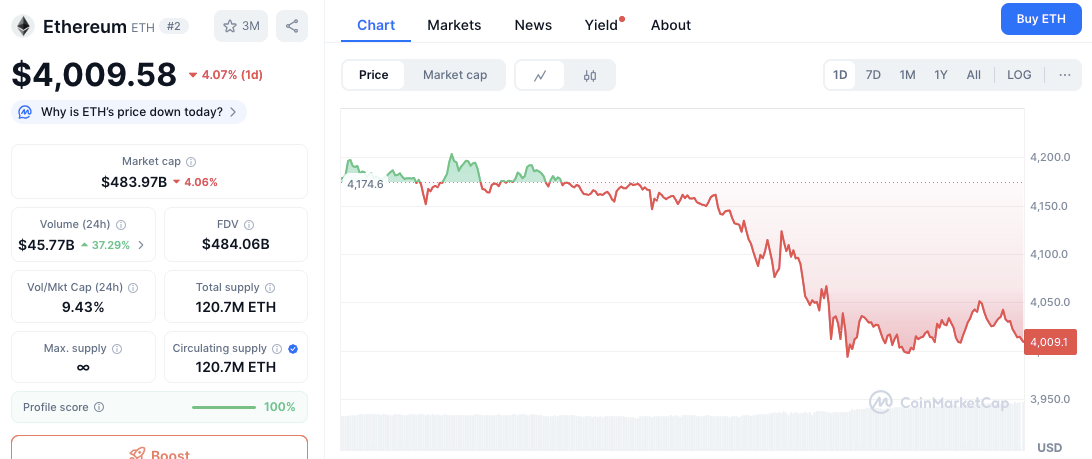

Ethereum itself has been under pressure. The asset opened near $4,174 but slipped to $4,009, marking a 4% daily decline. Attempts to climb above $4,150 have consistently failed, signaling strong resistance. The $4,000 mark now acts as critical psychological support, while further downside could expose $3,950 and $3,900 levels.

Trading volume rose 37% in the past 24 hours, showing that the decline was not due to thin liquidity. Instead, it may reflect distribution or profit-taking by larger holders. Market cap now sits at $483.9 billion, with liquidity indicators suggesting conditions remain volatile.

Indicators Point to Weakness

Technical indicators underline the bearish sentiment. The MACD shows weakening momentum with downside pressure intact.

Meanwhile, RSI has slipped to 33.9, nearing oversold territory. This could attract bargain hunters, yet a deeper correction remains possible before any recovery.

Related: Vitalik Buterin Defends ETH’s Long Unstaking Queue as Bulls Eye $4,700

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.