- Ethereum declined 10.32% this week, currently hovering around $4,000.

- Key resistance levels: $4,158, $4,307, and $4,505; support zones: $3,515, $3,020, and $2,772.

- Despite the drop, optimism persists for a potential breakout toward $10,000 by year-end.

The price of Ethereum (ETH) is under significant bearish pressure, currently trading near $4,014 after a 10.32% decline over the past week. This pullback follows a volatile September, leaving traders watching key price levels that could determine the next major move.

Ethereum Price Resistance Zones Above $4,000

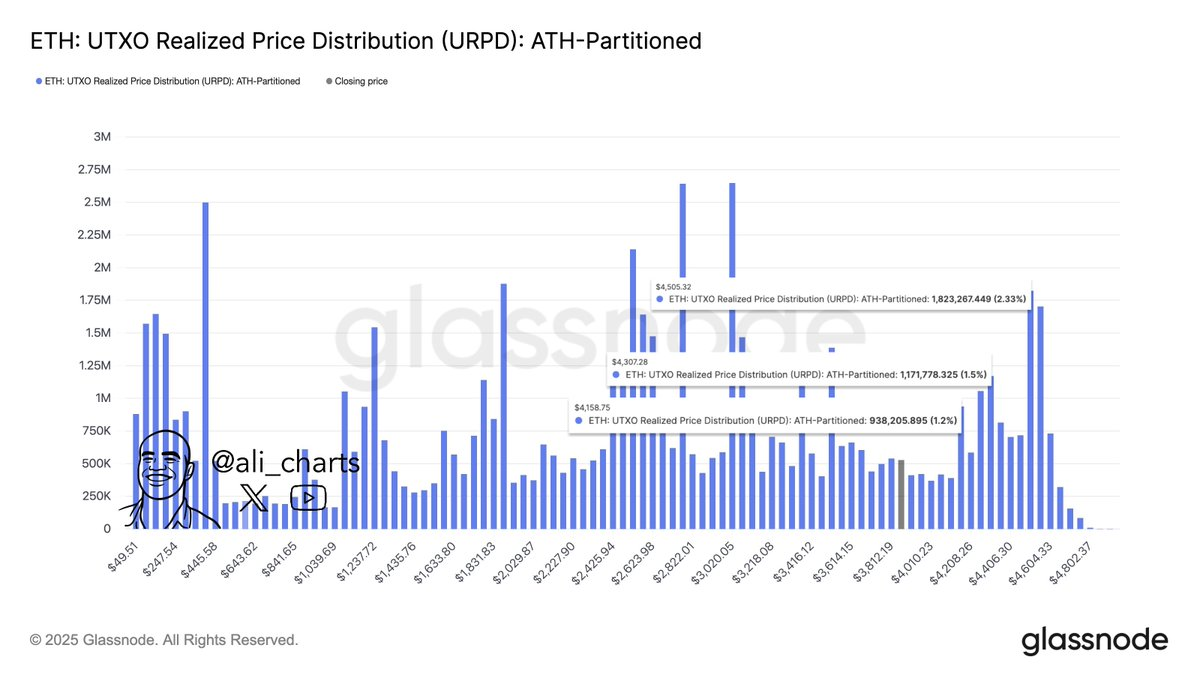

In a recent tweet, market analyst Ali Martinez identified three critical resistance levels based on Glassnode’s UTXO Realized Price Distribution (URPD) data. These levels are clustered around $4,158, $4,307, and $4,505, which are key areas Ethereum must break through to make a run toward a new all-time high.

Notably, these price points represent zones of heavy historical buying. If Ethereum attempts a rebound, these levels could act as selling pressure zones as investors who bought near previous highs may look to exit at breakeven.

However, if the bulls dominate and ETH successfully overcomes this resistance, it could open the door to higher price targets.

Ethereum last reached an all-time high of $4,950 in August and is currently down over 19% from that peak. While many analysts remain optimistic about a move above $5,000 this year, Ethereum must first conquer these current resistance levels to regain bullish momentum.

Related: Ethereum Price Prediction: ETH Slides To $3,990 As ETF Outflows Weigh On Sentiment

ETH Price Support Levels

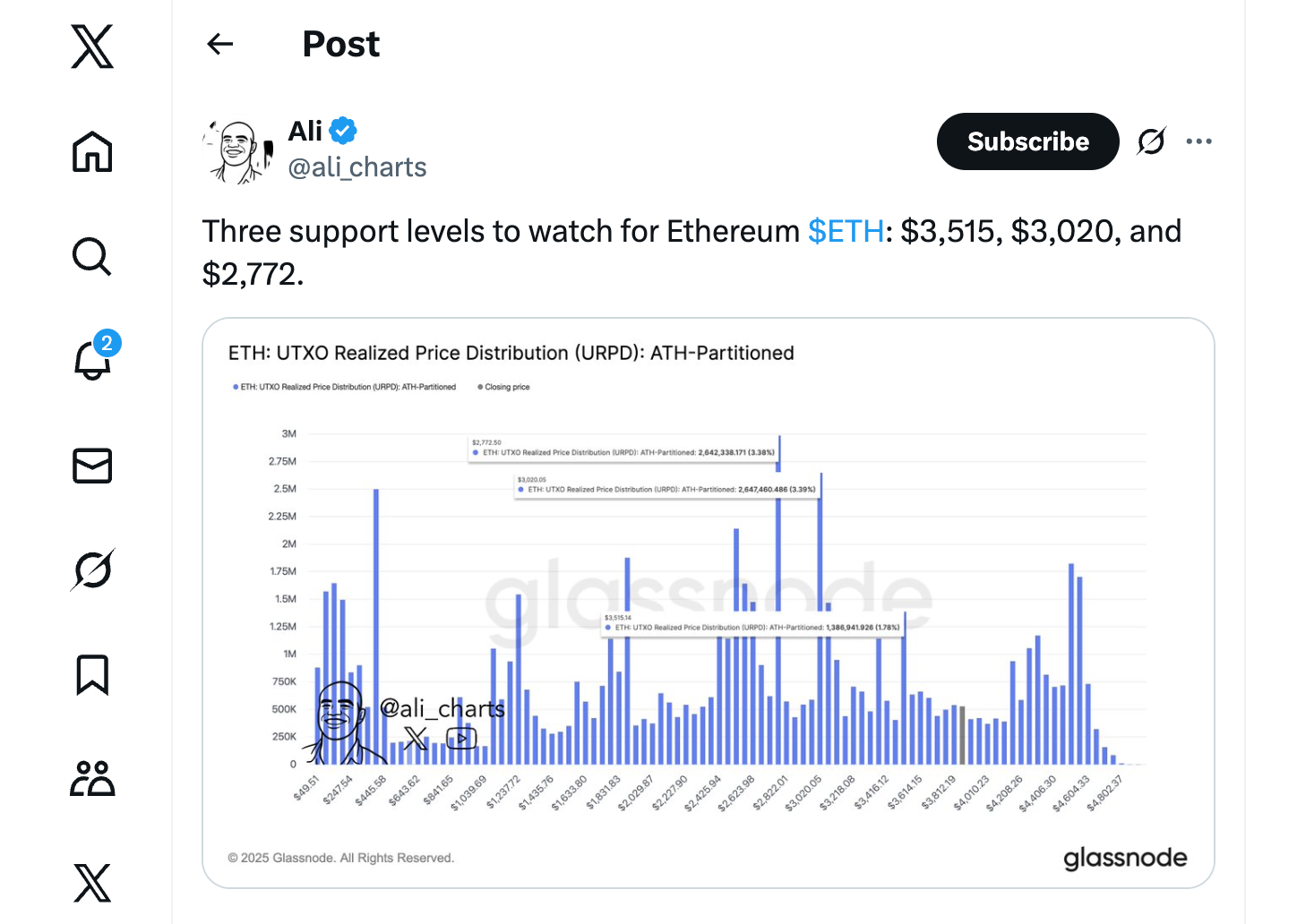

Martinez also highlighted three major support zones where large volumes of ETH were previously moved: $3,515, $3,020, and $2,772. These levels could serve as key areas of buyer interest if the decline continues.

After ETH initially dropped below $4,000, Martinez warned that there was little meaningful support until $3,500. During the ongoing bearish phase, ETH briefly touched $3,820 before rebounding slightly to $4,000, though the recovery has lacked strong momentum.

Market Outlook: $10,000 ETH Still Possible

URPD data shows where people have bought in the past, helping traders spot key price levels. With Ethereum just above $4,000, traders are watching closely to see if the price will drop further or start climbing back toward its all-time highs.

Despite market challenges, optimism around Ethereum remains strong. Some analysts believe it could hit $10,000 this year.

Tom Lee, co-founder of Fundstrat and chairman of BitMine, predicts Ethereum could reach $10,000–$12,000 by year-end as it enters what he calls “real price discovery”. He cites Ethereum’s neutrality, scalability, and growing support from Wall Street and policymakers as key factors driving this outlook.

Backing this belief, BitMine has shifted its treasury strategy to focus heavily on Ethereum. The firm now holds 2.41 million ETH, worth over $10 billion, making it the largest Ethereum treasury in the world.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.