- A Bitcoin OG whale has rotated over $1 billion from BTC into Ethereum and staked it all

- Santiment data shows ETH whales are in a major accumulation phase, adding 260k ETH in 24 hours

- US spot ETH ETFs saw $3.8B in inflows in August, and public companies now hold 3.1M ETH

While Ethereum’s price has corrected from its recent ATH of about $4,947 to trade around $4,386 on Tuesday, September 2, 2025, on-chain data shows a completely different story playing out behind the scenes.

Whales, institutions, and even Bitcoin OGs are aggressively accumulating ETH, signaling a massive vote of confidence despite the short-term price weakness.

Whales and Institutions Are Buying the ETH Dip

The “smart money” is clearly using this dip as an accumulation opportunity, with multiple on-chain metrics flashing bullish.

What is the latest Santiment data showing?

According to on-chain data analysis from Santiment, Ethereum wallets with a balance of between 10k and 100k Ether added 260 ETH coins during the last 24 hours. As a result, this group currently holds a total of 29.62 million Ethereum coins.

Are Bitcoin whales rotating into ETH?

Yes, capital rotation is happening from BTC to ETH. Arkham Intelligence has tracked a Bitcoin OG whale (holding over $5B in BTC) who has been aggressively selling BTC to accumulate over $1 billion worth of ETH in the last two days. The whale now holds over 886,000 ETH and has staked all of it.

What are the spot ETFs and corporations doing?

The institutional demand is just as strong. U.S. spot Ether ETFs saw over $3.8 billion in net inflows in August, according to SoSoValue.

At the same time, data from CoinGecko shows that 11 publicly traded companies, led by BitMine, now hold nearly 3.1 million ETH (worth over $13B) in their corporate treasuries.

Why Are Whale Investors Bullish On ETH Amid Choppy Markets?

This massive on-chain accumulation is being backed by an increasingly bullish macroeconomic picture.

Is a Fed rate cut the main catalyst?

The market is now pricing in an 80% chance of a Fed rate cut on September 17, according to prediction market Kalshi. A rate cut is a major tailwind for risk assets like Ethereum.

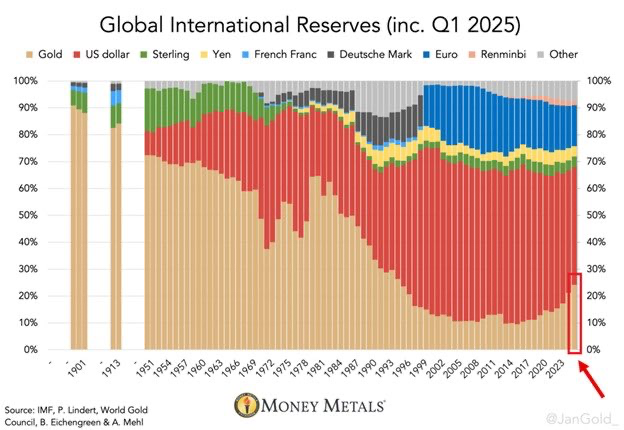

Gold Reigns Over Fiat Currencies

The demand for Gold as a global reserve asset is rising, recently hitting 24% of global reserves. According to a Q1 report on global international reserves, the use of Gold as a global reserve currency increased by 3% to 24% whereas that of the U.S. dollar declined by 2% to 42%.

With Ethereum perceived as a better sound money following its years of development, its demand is expected to grow in tandem with that of gold. Moreover, the altcoin market has a high correlation with Bitcoin, which also has depicted significant correlation with the Gold price action.

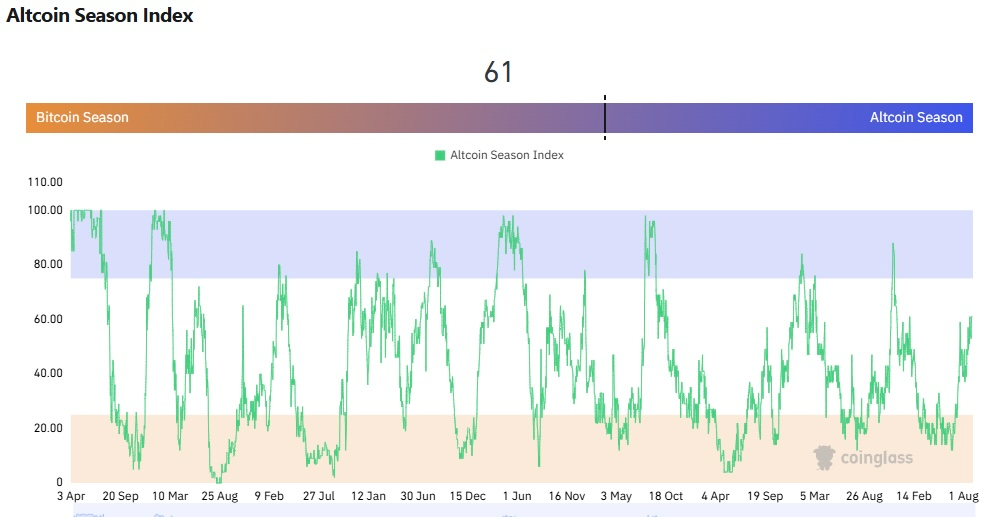

Is “Altseason” finally here?

The Altcoin Season Index from CoinGlass has surged to 61%, its highest level this year. This indicates that capital is flowing strongly into altcoins, with Ethereum leading the charge.

ETH Chart: A Multi-Year Breakout

From a technical perspective, the long-term chart for Ethereum also looks incredibly bullish.

What does the long-term technical pattern show?

According to analyst Michaël van de Poppe, ETH has already broken out of a multi-year megaphone structure.

He believes the price is now approaching an “irresistible accumulation zone” before an expected major rally in Q4.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.