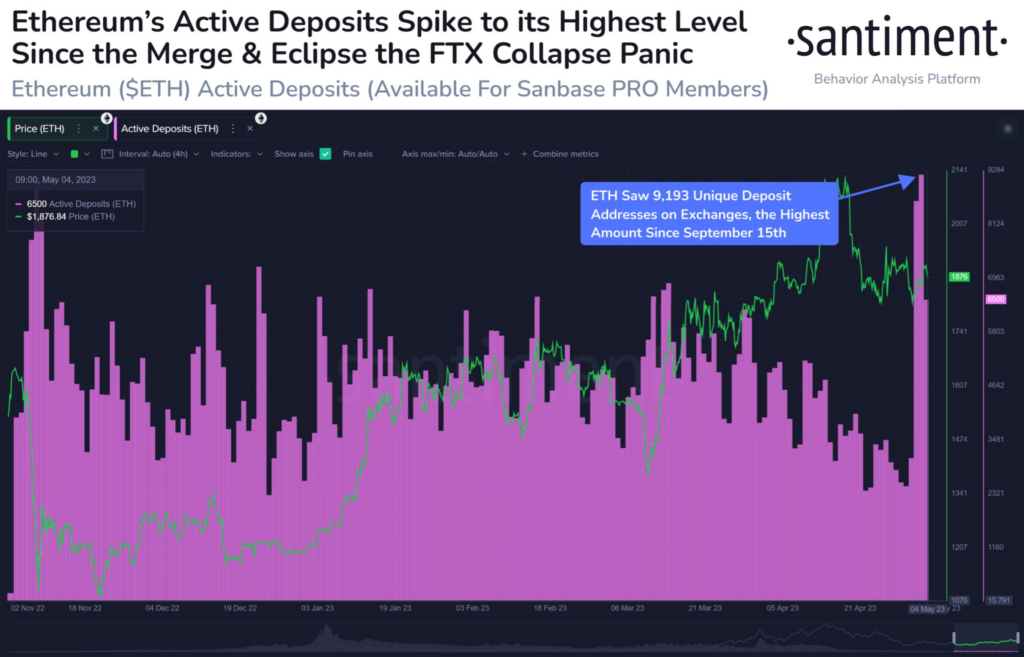

- Santiment tweeted this morning that ETH’s active deposits reached an 8-month high.

- This milestone may be followed by increased volatility for ETH according to the post.

- At press time, ETH was trading at $1,900.06 after experiencing a 24-hour drop.

The blockchain intelligence firm Santiment shared a recent milestone for Ethereum (ETH) in a tweet this morning. According to the post, Ethereum’s active deposits recently hit an 8-month high. As a result, Santiment predicts that there will soon be an increase in ETH’s volatility – similar to the volatility spikes seen during the Merge and FTX collapse.

ETH’s active deposits (Source: Santiment)

The post showed that ETH saw 9,193 unique deposit addresses on exchanges. This is the highest that this metric has been since 15 September 2022.

At press time, CoinMarketCap indicated that ETH’s price had experienced a 24-hour drop. As a result of the price drop, ETH was changing hands at $1,900.06. ETH had also weakened against the market leader Bitcoin (BTC) by 0.14% over the same time period.

Along with the negative price performance, ETH’s 24-hour trading volume was also down 21.63%. This drop in trading volume had brought down the total to approximately $6.77 billion at press time.

Daily chart for ETH/USDT (Source: TradingView)

ETH is attempting to break the $1,900 resistance level after trading just below the key price point for the last 3 days. The daily RSI flagged bullish at press time, with the daily RSI line positioned above the daily RSI SMA line.

Furthermore, the daily RSI line was also positively sloped towards overbought territory. This suggested that ETH’s price could break above $1,900 in the following 24-48 hours.

If ETH’s price fails to close above the aforementioned $1,900 mark today, then the altcoin’s flat price movement may continue for the next 24-48 hours. Thereafter, its price may look to drop to the nearest support at $1,790. On the other hand, a close today above $1,900 will see ETH rise to $2,030.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.