- M2 Capital invests $20M in Ethena’s ENA to expand digital asset infrastructure in the Middle East.

- Ethena’s TVL surpasses $14.55B with 78,220 holders, showing strong adoption and steady distribution.

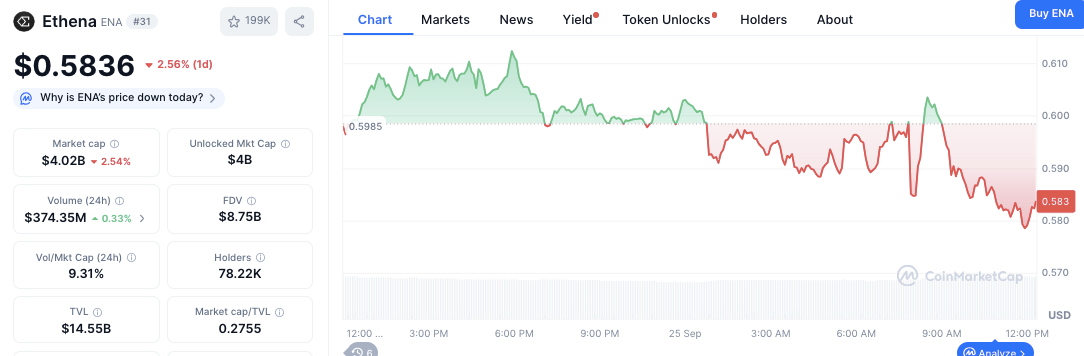

- ENA trades at $0.5836 with $374M volume, reflecting volatility but strong market participation.

M2 Capital Limited, the investment arm of UAE-based M2 Holdings, has committed $20 million to Ethena’s governance token ENA. The group said the deal fits with its plan to build out digital asset infrastructure in the Middle East while staying aligned with global financial markets.

M2’s affiliate, M2 Global Wealth, will also integrate Ethena’s products into its portfolio, giving clients regulated exposure to the protocol. Kim Wong, head of treasury at M2, described the move as setting a new standard for trust and security in the regional market.

The allocation follows M2’s earlier backing of the Sui blockchain, underlining the company’s broader strategy of supporting emerging crypto networks.

Related: YZi Labs Expands Ethena Investment to Boost USDe and Digital Dollar Infrastructure

Ethena’s Synthetic Dollar Protocol

Ethena runs a synthetic dollar protocol that issues USDe and its yield-bearing counterpart sUSDe. Both are backed by crypto collateral and hedging strategies designed to limit volatility. Since launching in 2024, the protocol has attracted more than $14 billion in deposits, making it one of DeFi’s largest players.

Related: Ethena’s USDtb Becomes First Stablecoin With a Clear Path to US Compliance

Latest figures show total value locked (TVL) at $14.55 billion with a market cap-to-TVL ratio of 0.2755. The project also counts 78,220 holders, signaling steady distribution. By combining stablecoin utility with a yield component, Ethena is positioning itself as a central fixture in decentralized finance.

ENA Token Performance and Trading Activity

Despite the strong fundamentals, Ethena’s ENA token has struggled to hold ground above the $0.60 mark.

On September 25, the token slipped 2.56% to $0.5836, after touching a session high of $0.5985. Sellers pushed the price lower by midday, showing renewed pressure near the $0.58 level.

Ethena’s market capitalization stands at $4.02 billion, with a fully diluted valuation of $8.75 billion. Trading remains active: 24-hour volume reached $374.35 million, equating to a volume-to-market-cap ratio of 9.31%. Analysts note that such activity reflects strong market participation even during short-term pullbacks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.