- Ethereum spot ETFs recorded a total net inflow of $295 million on Monday.

- Spiking inflow highlights growing ETH ETF adoption.

- ETH has surged over 42% in the past seven days.

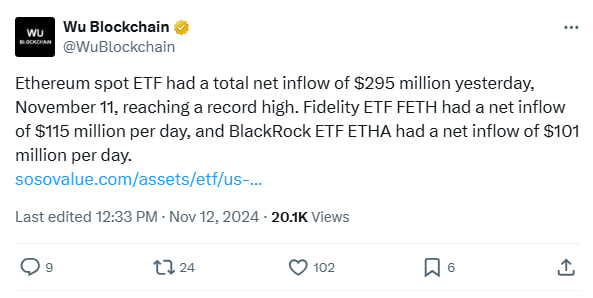

Data from Soso Value show that Ethereum spot ETFs saw a total net inflow of $295 million on Monday, November 11. The two products with the largest inflows were Fidelity ETF (FETH), which had a $115 million daily inflow, and BlackRock’s ETHA, which had a $101 million inflow.

Meanwhile, Soso Value’s data reveals Grayscale’s Ethereum ETF attracted a $63.32 million inflow, while Bitwise’s product, ETHW, had a $15.57 million inflow to complete the total inflow for the day.

The high inflow rates in spot Ethereum ETF products indicate growing adoption and capital moving into the cryptocurrency ecosystem last week. A bullish market shows that investors are returning and that new users are entering the crypto industry.

Focusing on the specifics, Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a general surge in capital inflow. Ethereum’s market cap was $209.04 billion on November 5, the day of the U.S. presidential election. One week later, the market cap reached $407.89 billion.

The capital inflow reflects on the Ethereum network’s native cryptocurrency, ETH, which surged 42.07% in the past week, rising from a $2,379 low on November 5 to trade for $3,388 at the time of writing, according to data from TradingView.

Read also :Ethereum ETFs: Slow Start, But Future Bright, Says Bitwise CEO

Analysts say that spot ETF products give certain investors a way to explore cryptocurrency investments. These investors include institutional investors who may not want direct crypto market exposure but want to use the advantages of this technology.

From a developmental perspective, increasing spot ETF inflow is good for Ethereum. It shows that more people are using the ecosystem and that institutional investors believe it is a good product to hold for a long time. This information may be helpful to retail investors who want to follow what large investors do in the crypto market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.