- Ethereum’s exchange outflows hint at accumulation, signaling a potential supply shock.

- Rising trading volume suggests heightened market activity despite Ethereum’s price drop.

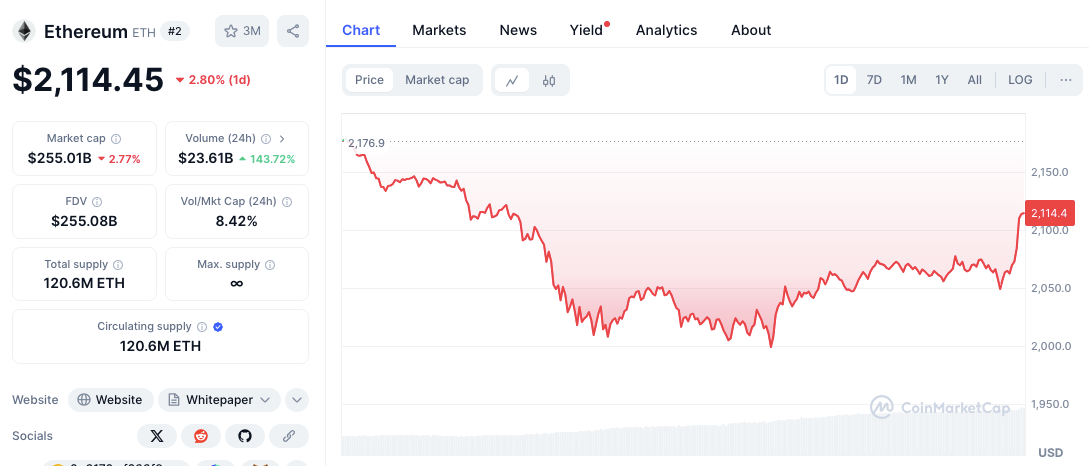

- ETH faces key resistance at $2,176 and a breakout could signal a trend reversal.

Ethereum (ETH) is undergoing a significant shift in market dynamics. Exchange outflows suggest a potential supply shock.

Data from analyst Ali Martinez indicates that over the past week, more than 600,000 ETH have been withdrawn from crypto exchanges. This mass withdrawal may indicate an accumulation phase by investors. This accumulation could influence Ethereum’s price movement soon.

Volatility Persists: $230M in ETH Long Positions Liquidated Amid Price Decline

Despite these bullish signals, the market remains volatile. $230 million worth of Ethereum long positions were liquidated recently. This event shook out overleveraged traders. As the price of ETH drops, investors are carefully watching key support and resistance levels. They aim to determine the next likely trend..

ETH Price Dips 2.7% in 24 Hours, Trading Volume Surges 136%

As of press time, Ethereum is trading at $2,119.85, marking a 2.71% drop in the last 24 hours. Its market capitalization has also declined by 2.64%, reflecting a decrease in valuation. However, trading volume has surged by 136.14%, indicating strong market activity.

This surge points to strong market activity. This also implies that even though the price fell, traders are actively participating. They are likely reacting to the sharp decline followed by slight recovery and consolidation. Such a surge in trading volume can lead to greater volatility. This volatility makes upcoming price movements more unpredictable.

Related: Ethereum’s Pectra Upgrade Activated: Sepolia Testnet Is a Success

Key Resistance at $2,176.9; Support Found Near $2,000 and $1,950

Ethereum is approaching crucial price levels that could determine its next move. The primary resistance level is positioned at $2,176.9. This level was the previous high before the recent decline. Should ETH break through this level, it could signal a trend reversal and further price gains. However, failure to breach this resistance could mean continued downward pressure.

Psychological $2,000 Level Crucial; $1,950 Support Zone to Prevent Further Downtrend

On the downside, Ethereum has found support around $2,000. The price previously consolidated around this level before showing signs of recovery. A stronger support zone exists at $1,950. This zone represents the lowest point in the recent downtrend.

If selling pressure increases and ETH drops below $2,050, the $2,000 psychological level will be the next critical point to watch. A break below this could trigger further declines.

RSI at 38.35 Suggests Oversold Conditions; MACD Histogram Hints at Bearish Momentum Weakening

Technical indicators suggest mixed signals regarding Ethereum’s next move. The Relative Strength Index (RSI) currently stands at 38.35. This reading is below the neutral 50 mark. This level indicates that Ethereum is in oversold territory. However, it may also be preparing for a reversal. If the RSI climbs above 40-45, it could signal a shift towards bullish momentum.

Related: Ethereum’s Lack of Washington Policy Presence Raises Eyebrows Ahead of Crypto Policy Summit

At the same time, the MACD (Moving Average Convergence Divergence) indicator confirms a bearish trend. The MACD line (-178.9) remains below the signal line (-170.0). Nonetheless, the MACD histogram is showing signs of recovery. This histogram suggests that bearish momentum is weakening. If this trend continues, Ethereum could stabilize and attempt to regain lost ground.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.