Ethereum price today is trading at $4,386, showing resilience after rebounding from the late August dip that tested $4,200. Buyers have managed to stabilize the structure, with ETH holding above the 20-day EMA at $4,377. This rebound keeps Ethereum inside its ascending channel, though the pace of gains has cooled compared to the July surge.

The recovery comes as traders weigh strong on-chain accumulation against lingering resistance in the $4,500 zone. Analysts remain divided on whether Ethereum’s current structure is a pause before a parabolic extension or an early warning of another corrective leg.

Ethereum Price Holds Firm as Ascending Channel Supports Structure

The daily chart highlights a clear ascending channel that has guided price since June. Ethereum’s rebound from the channel base at $4,200 confirms continued bullish interest. Immediate support is stacked at $4,015 and $3,533, while overhead resistance sits at $4,530 and $4,800.

Related: XRP (XRP) Price Prediction: Breakout or Breakdown Ahead?

Momentum indicators lean neutral. The 14-day RSI reads 52.5, showing balance after cooling from overbought peaks earlier in August. MACD remains above its signal line, hinting that upward momentum still has room to reassert. Analysts such as EtherNasyonaL noted that ETH “is literally on the verge of a parabolic run,” comparing the setup to Ethereum’s 2017 breakout that preceded a vertical rally.

Whale Inflows and Accumulation Strengthen Bullish Case

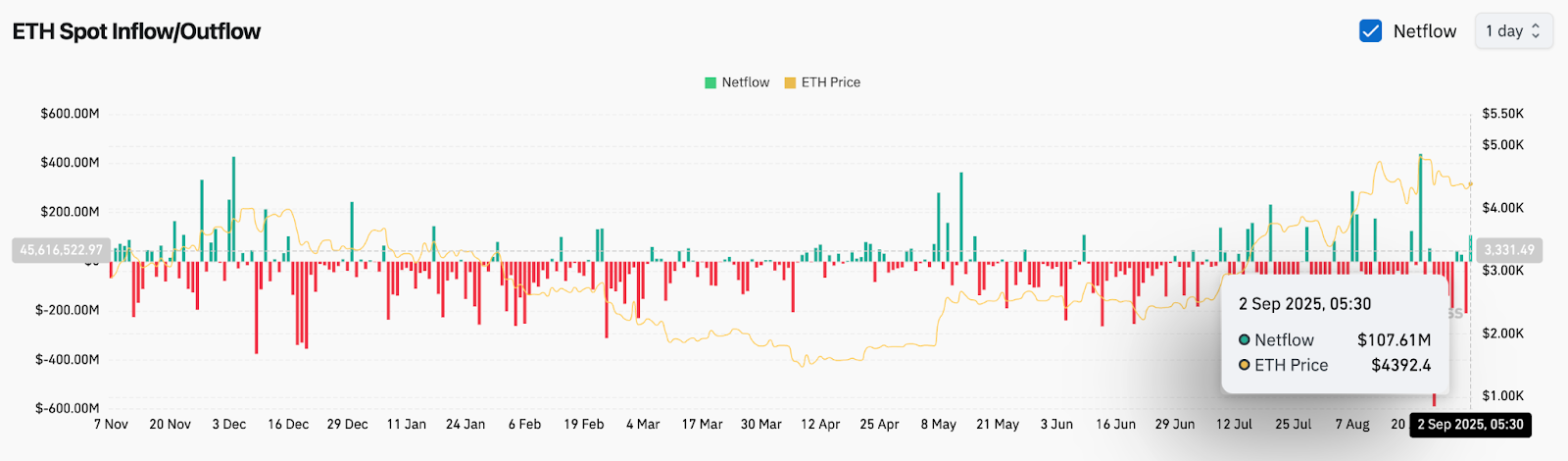

On-chain flows underline bullish undercurrents. Spot exchange data shows $107.6 million in net inflows on September 2, one of the strongest accumulation days in recent months. This spike in deposits coincided with price stabilizing near $4,390, suggesting whales are positioning ahead of potential upside.

Institutional sentiment also plays a role. ETF-linked flows in late August showed gradual rotation back into ETH after a quieter July. Analysts argue that consistent inflows above $4,000 reinforce Ethereum’s resilience despite wider crypto volatility. At the same time, U.S. macro policy easing has reduced risk-off pressure, allowing large players to accumulate.

Related: Pi Coin (PI) Price Prediction for September 2025

Contrasting Views: Bulls eye $5,000, Bears Warn of Channel Break

Bulls argue that Ethereum is mirroring its 2017 breakout. If the ascending channel holds, a clean break above $4,530 could open targets at $4,800 and eventually $5,000. EtherNasyonaL emphasized that ETH “hasn’t even started its parabolic run yet,” projecting that 2025 could mirror the explosive post-resistance rally seen in 2017.

Bears, however, highlight risk factors. The supertrend on the 4-hour chart remains bearish below $4,543, while Parabolic SAR levels also cap upside momentum at $4,473. If ETH fails to reclaim these zones, price could revisit $4,015 and possibly test $3,533, where the 100-day EMA provides major support. A breakdown of the channel base could trigger a deeper retracement toward $3,130.

Ethereum Short-Term Outlook: Breakout or Pullback Next?

In the short term, Ethereum price action hinges on whether bulls can reclaim the $4,530–$4,550 zone. Closing above this level would flip the supertrend bullish again, aligning with whale inflows to set up a run toward $4,800. A break there would bring $5,000 into view.

If momentum stalls, ETH risks slipping back toward the $4,200–$4,015 support cluster. Failure to hold this region would tilt control to bears and open the door to $3,533. With RSI neutral and flows showing accumulation, the bias leans constructive, but volatility is expected to remain elevated in the coming sessions.

Related: Official Trump (TRUMP) Price Prediction for September 2025

Ethereum Price Forecast Table

| Indicator | Signal | Levels/Notes |

| Price Today | $4,386 | Stabilizing above 20-day EMA |

| Support | $4,200 / $4,015 / $3,533 | Channel base and EMA clusters |

| Resistance | $4,530 / $4,800 / $5,000 | Key breakout targets |

| RSI | 52.5 | Neutral, room for expansion |

| MACD | Positive bias | Momentum tilted upward |

| Pattern | Ascending channel | Trend intact above $4,200 |

| Flows | +$107.6M inflow | Whale accumulation confirmed |

| Supertrend | Bearish below $4,543 | Needs breakout confirmation |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.