- Ethereum price today trades near $4,031 after breaking below the $4,239–$4,360 EMA support cluster.

- Net outflows of $175M show profit-taking, but exchange balances drop to nine-year lows at 14.8M ETH.

- Long-term supply squeeze supports a bullish thesis, with upside targets at $4,712 and $5,000.

Ethereum price today is trading near $4,031, slipping almost 3% after losing the $4,239–$4,360 support cluster. The breakdown has put sellers in control, though shrinking exchange supply and long-term accumulation trends suggest the downside may be limited.

Ethereum Price Breaks Below EMA Support

Ethereum daily chart shows ETH falling below the 20- and 50-day EMAs, which are now acting as resistance near $4,239 and $4,360. Price has also dipped beneath the ascending trendline that supported the rally since July, confirming a shift in momentum.

The next major support sits around $3,850, where the 100-day EMA aligns with previous demand zones. If this level fails, deeper losses toward $3,392, the 200-day EMA, could unfold. On the upside, buyers must reclaim $4,239–$4,360 to reestablish bullish momentum, with $4,712 and $5,000 remaining the larger resistance targets.

Related: XRP Price Prediction: Can SEC ETF Approval Spark A Rebound Above $3?

Momentum indicators are tilting bearish. The Parabolic SAR has flipped above price action, while RSI is slipping toward neutral territory, signaling that bulls are losing control after months of higher highs.

On-Chain Flows Show Heavy Outflows

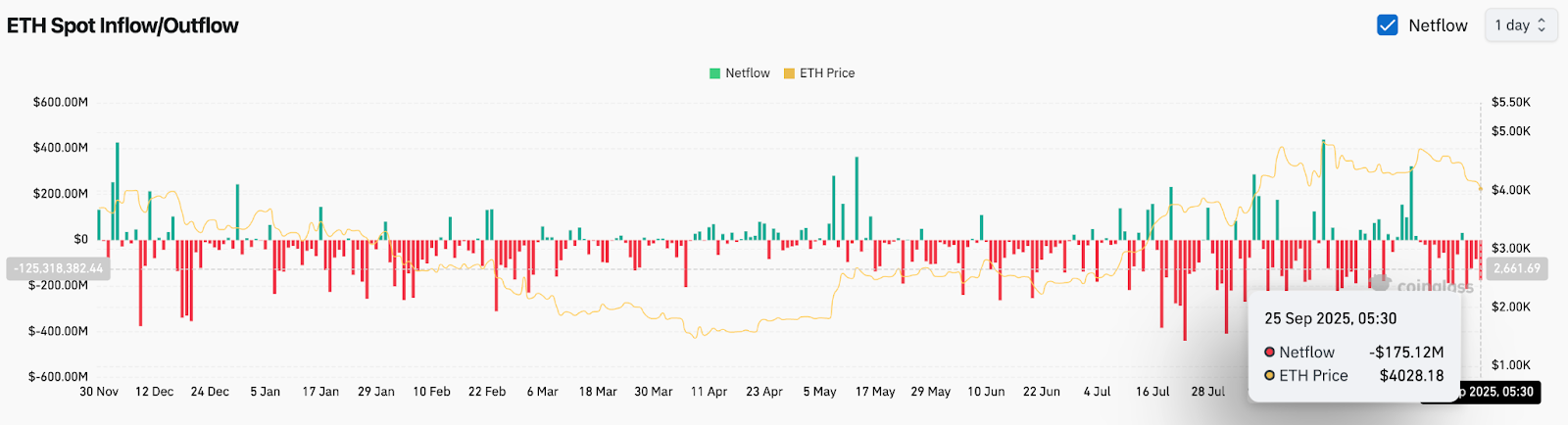

Exchange flow data highlights renewed selling pressure. ETH recorded a $175 million net outflow on September 25, aligning with the pullback from $4,200 levels. Persistent redprints on netflow charts throughout September reflect rising exchange deposits and profit-taking.

However, the broader picture remains constructive. According to Glassnode, Ethereum supply on exchanges has dropped to a nine-year low of 14.8 million ETH, underscoring the long-term accumulation trend. Reduced liquid supply often acts as a cushion against extended downside, even when near-term flows are negative.

Shrinking Supply Strengthens Bullish Narrative

The structural decline in ETH balances on exchanges points to growing investor conviction. With more ETH locked in staking contracts, DeFi protocols, and long-term wallets, selling pressure from centralized venues is at its weakest point since 2016.

Related: Bitcoin Price Prediction: BTC Holds $111K As ETF Demand And Corporate Buying Absorb Supply

This tightening supply narrative echoes past cycles where Ethereum’s reduced availability coincided with sharp rebounds. Analysts suggest that if inflows stabilize, ETH could regain traction and revisit the $4,600–$5,000 resistance band later this year.

Technical Outlook For Ethereum Price

Ethereum price prediction for the short term highlights key levels in play:

- Upside targets: $4,239, $4,360, and $4,712 if buyers reclaim momentum. Beyond this, $5,000 remains the breakout level.

- Downside risk: $3,850 as immediate support, followed by $3,392 as the deeper defense zone.

- Trend context: The long-term uptrend remains intact above the 200-day EMA, but short-term structure is under pressure.

Outlook: Will Ethereum Go Up?

The immediate trajectory for Ethereum depends on whether buyers can defend the $3,850 support floor after losing the EMA cluster near $4,239. On-chain data signals accumulation despite temporary outflows, while exchange balances hitting multi-year lows add weight to the bullish long-term thesis.

If ETH can recover above $4,360, momentum traders may target $4,712 and $5,000 in the coming weeks. Failure to hold $3,850, however, could extend the correction toward $3,392 before any rebound attempt. For now, Ethereum remains in a corrective phase within its broader bullish cycle.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.