- Ethereum trades near $4,518, pressing resistance at $4,584–$4,672 after rebounding from $4,300 support.

- SharpLink commits $3.7B to Ethereum treasury, with 837K ETH treated as a long-term reserve asset.

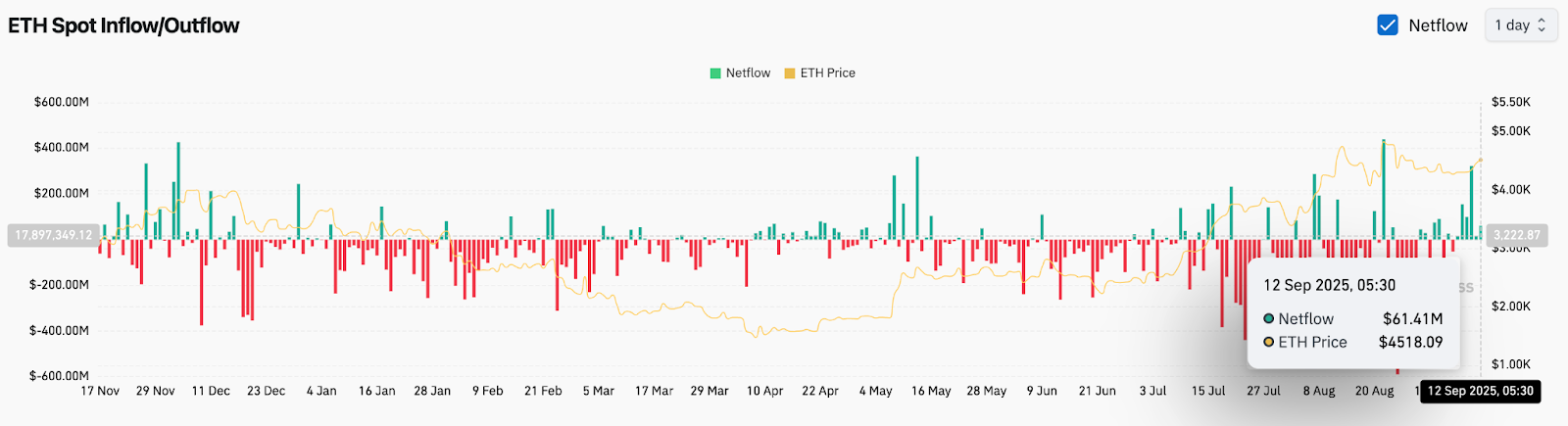

- On-chain inflows of $61.4M show renewed demand, but $100M+ needed to confirm breakout conviction.

Ethereum price today is trading near $4,518, extending gains after rebounding from the $4,300–$4,370 support zone. Price action now presses against the descending resistance trendline, with bulls eyeing a move toward the $4,584–$4,672 Fibonacci cluster. The question is whether inflows and institutional accumulation can drive a decisive breakout.

Ethereum Price Tests Resistance Zone

The 4-hour chart shows ETH climbing steadily through its EMA cluster, with the 20-, 50-, and 100-period EMAs all flipping supportive near $4,372–$4,399. A push above the 0.5 Fibonacci retracement at $4,584 and the overhead descending trendline would confirm bullish momentum.

The RSI stands at 67, nearing overbought territory but still leaving room for continuation. Bollinger compression from earlier sessions has unwound, signaling fresh volatility as ETH retests a multi-week resistance.

A failure to clear $4,584–$4,672 could trigger another pullback toward the $4,387 pivot, where the 38.2% Fib retracement sits aligned with EMA support.

Treasury Strategy Branded A “White Swan” For Ethereum

Market sentiment improved after SharpLink Gaming’s co-CEO Joseph Chalom described his firm’s $3.7 billion Ethereum treasury as a “white swan event” for institutional adoption. The company currently holds over 837,000 ETH, amounting to nearly 0.7% of circulating supply.

Chalom emphasized that SharpLink treats Ethereum as a reserve asset rather than trading inventory, drawing parallels with Michael Saylor’s Bitcoin accumulation playbook. Weekly disclosures of holdings and staking rewards aim to build transparency, distancing the approach from opaque practices of failed firms like FTX.

Analysts suggest that sustained corporate accumulation may stabilize supply dynamics, particularly as tokenization and stablecoin demand accelerate through 2025.

On-Chain Flows Show Renewed Buying Pressure

On-chain exchange flow data reveals a $61.4 million net inflow on September 12, marking one of the strongest accumulation signals in recent weeks. This pickup follows months of mixed activity where sharp outflows dominated earlier in the year.

Rising inflows reflect traders positioning for a potential breakout above $4,600. However, analysts caution that sustained net inflows above $100 million would be required to validate conviction buying and establish momentum for a rally toward $4,800–$4,950.

At the same time, futures open interest remains stable, pointing to spot-led accumulation rather than overleveraged positioning.

Supertrend And Parabolic SAR Flip Bullish

Additional technical signals reinforce ETH’s improving structure. The Supertrend indicator flipped bullish near $4,337, while the Parabolic SAR dots shifted beneath price action, confirming short-term upside bias.

The next challenge sits at the $4,672–$4,797 supply band, where prior rejections triggered sharp reversals. Clearing this zone would open a path toward the 0.786 Fib retracement at $4,797 and eventually the $4,950 psychological barrier.

If momentum stalls, downside cushions remain well-defined at $4,399 and $4,300, with the 200-period EMA near $4,279 forming the last key line of defense before deeper retracements.

Outlook: Will Ethereum Go Up?

Ethereum’s near-term trajectory hinges on whether institutional accumulation and on-chain inflows can overpower technical resistance near $4,600. With SharpLink’s treasury narrative strengthening the case for adoption and exchange data turning supportive, the bias tilts cautiously bullish.

A breakout above $4,672 would likely attract momentum buyers, targeting $4,797 and $4,950. Conversely, failure to clear resistance could prolong consolidation, sending ETH back toward $4,300 support.

As long as price holds above $4,300 and inflows remain positive, analysts see Ethereum favoring the upside into mid-September.

Ethereum Price Forecast Table

| Indicator/Level | Bullish Scenario | Bearish Scenario |

| Key Support | $4,399 / $4,300 | Break below $4,279 exposes $4,100 |

| Key Resistance | $4,584 / $4,672 | Rejection keeps ETH capped under $4,500 |

| RSI (4H) | 67, room before overbought | Potential pullback if RSI exceeds 70 |

| On-Chain Flows | $61.4M inflows, supportive | Weak inflows under $20M reduce breakout odds |

| Supertrend / SAR | Flipped bullish above $4,337 | Bearish reversal if price closes below $4,300 |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.