Ethereum price today is trading around $4,661, consolidating after a strong rally from $4,300 earlier this month. The token is holding above short-term supports, with traders watching whether momentum can carry ETH toward the critical $4,800 resistance zone.

Ethereum Holds Strong After Breakout

The 4-hour chart shows ETH breaking free from a descending triangle earlier this week, with price reclaiming levels above $4,600. Resistance now sits at $4,665, while the upper Bollinger Band around $4,812 marks the next supply zone.

Related: XRP (XRP) Price Prediction For September 16

Support remains layered between $4,490 and $4,440, where the 20- and 50-period EMAs cluster. A deeper pullback could test $4,365 and $4,326, zones that acted as pivotal bases during the September breakout. As long as ETH stays above these levels, the broader bias leans bullish.

Momentum indicators show resilience. The RSI remains near neutral but above midline, signaling room for another leg higher. MACD signals are tilted positive, with narrowing Bollinger Bands pointing toward another volatility expansion.

Golden Cross Strengthens Long-Term Bullish Case

Investor optimism surged after Ethereum completed a golden cross on higher timeframes, where the 50-period moving average crossed above the 200-period. Analysts view this as a powerful bullish continuation signal, historically preceding major rallies in 2020 and 2023.

Market watchers highlight the cyclical setup, noting that Ethereum’s prior golden crosses sparked sustained breakouts that carried the asset to fresh all-time highs. The latest crossover has fueled speculation that ETH may follow a similar trajectory toward $5,000 and beyond in the coming months.

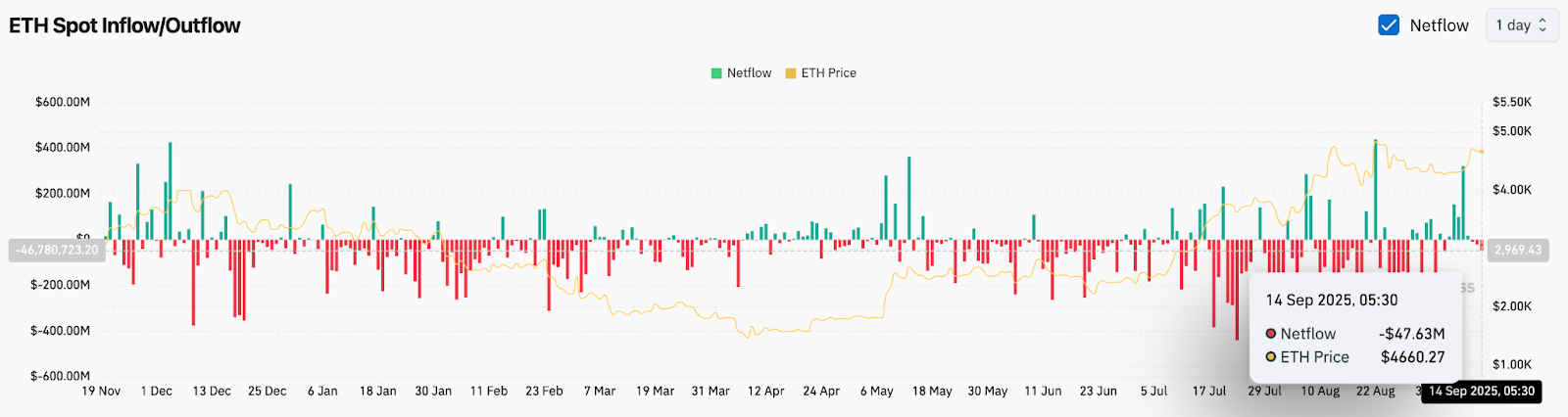

On-Chain Flows Reflect Mixed Positioning

Despite the technical breakout, on-chain flows reveal caution. Data shows a $47.6 million net outflow on September 14, suggesting that some investors booked profits into strength. This contrasts with the bullish chart setup, highlighting short-term positioning risk.

Over the past two weeks, flows have oscillated between large inflows and heavy outflows, reflecting indecision among participants. Analysts argue that sustained net inflows above $100 million would provide the conviction needed to support a rally beyond $4,800. Until then, ETH may face resistance at higher levels despite the golden cross narrative.

Technical Outlook For Ethereum Price

Upside targets remain well-defined. A clean breakout above $4,665 would likely propel ETH toward $4,812, with the psychological $5,000 mark next in line. Clearing this zone could confirm the cycle breakout case and extend gains toward $5,200.

On the downside, losing $4,490 would weaken near-term structure, exposing $4,365 and $4,326 as the next layers of support. A failure to defend these bases could trigger a deeper correction back toward $4,200.

Outlook: Will Ethereum Go Up?

Ethereum’s short-term outlook hinges on whether the golden cross narrative can outweigh the caution seen in on-chain flows. As long as ETH defends $4,490, momentum favors a push toward $4,800 and potentially $5,000.

Without stronger inflow confirmation, however, traders should remain alert to profit-taking risks that could slow the rally. For now, Ethereum sits at a pivotal zone, where technical compression, long-term bullish signals, and cautious flows converge to decide the next move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.