Ethereum price today is trading at $4,333, consolidating near the lower end of its descending channel. Traders are weighing technical signals, on-chain inflows, and cycle-based breakout patterns against news that the Ethereum Foundation will sell 10,000 ETH to fund ecosystem development.

Ethereum Price Holds Channel Support

The 1-hour chart shows ETH pinned inside a falling channel since late August. Support remains clustered around $4,250–$4,280, where repeated defenses have stalled sellers. Overhead resistance sits near $4,420, aligned with the 200-hour EMA. Clearing this threshold could trigger upside momentum toward $4,600 and $4,700, the next supply zones on the chart.

Related: Cardano (ADA) Price Prediction: Analysts Predict $0.92 Breakout

RSI readings hover around 49, indicating neutral momentum. The alignment of short-term EMAs just above spot levels continues to cap rallies, but flattening momentum suggests sellers are losing grip. A decisive push through $4,420 would flip near-term structure bullish.

Analysts Highlight Historical Breakout Patterns

Popular market strategist Mister Crypto pointed out that Ethereum’s long-term cycles show a recurring breakout structure. His chart compared the 2017, 2020, and 2025 setups, each forming a tightening wedge before breaking higher. “Every cycle plays out the same for Ethereum. This time won’t be different,” he said in a post on X.

The comparison has fueled optimism that ETH may be coiling for another major breakout, especially if it clears the $4,600 barrier in the coming days. Cycle analysis suggests a larger rally could extend toward $5,000 later this year if history repeats.

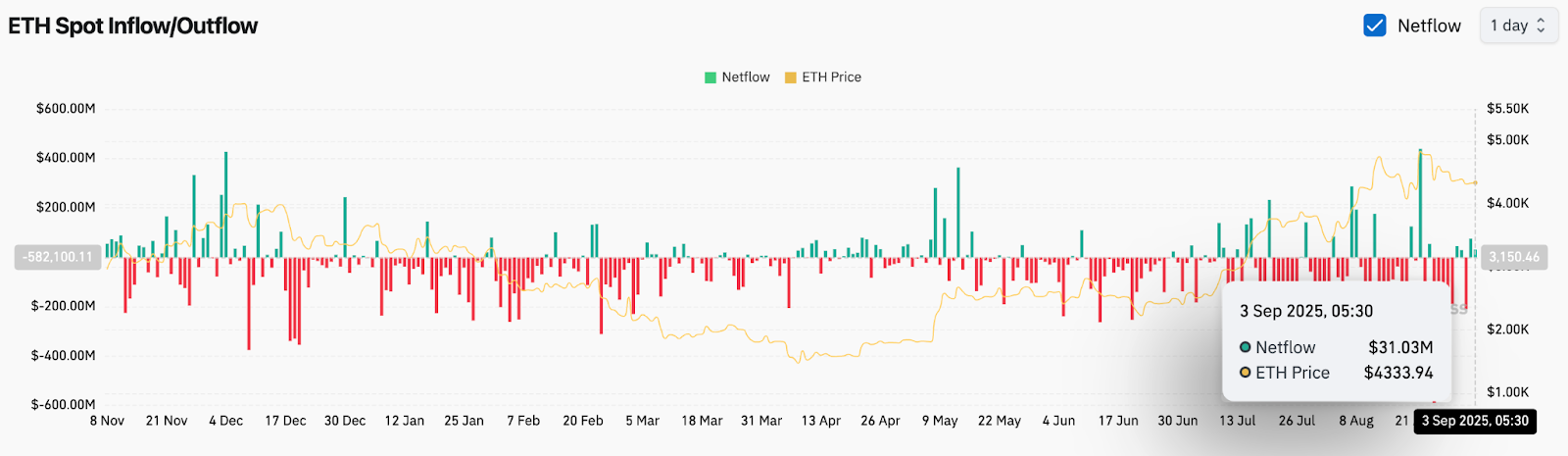

On-Chain Data Points To Fresh Inflows

Exchange data shows a $31 million net inflow on September 3, signaling renewed accumulation at current levels. This marks one of the larger single-day inflows since mid-August, hinting that traders are positioning for a breakout despite price consolidation.

Flows remain volatile, with weeks of heavy outflows giving way to sudden bursts of buying. Analysts note that sustained inflows above $50 million would be needed to confirm conviction, but the recent pickup provides early evidence of improving sentiment.

Related: Solana (SOL) Price Prediction: Can Bulls Push Through $220?

Foundation Sale Sparks Market Debate

News of the Ethereum Foundation’s plan to sell 10,000 ETH — worth about $43 million — has introduced caution. The Foundation said the sales will occur gradually through centralized exchanges to fund research, grants, and donations.

While some traders see the sale as a bearish supply injection, others highlight its relatively modest scale compared to daily market volumes. The move follows a similar 10,000 ETH sale in July to SharpLink Gaming, underscoring the Foundation’s new treasury strategy that caps annual spending and prioritizes long-term reserves.

Technical Outlook For Ethereum Price

ETH’s immediate roadmap centers on the $4,250 support floor and the $4,420 resistance ceiling. A clean break above $4,420 would likely invite momentum traders, targeting $4,600–$4,700 in the short term.

Failure to defend $4,250 could expose ETH to $4,100, with deeper risks toward $3,900 if selling pressure accelerates.

Related: XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout

Outlook: Will Ethereum Go Up?

Ethereum’s short-term trajectory hinges on whether bullish cycle narratives and rising inflows can offset concerns around Foundation sales. Analysts remain cautiously optimistic: as long as ETH holds above $4,250, the bias leans toward a rebound.

A breakout above $4,420 would strengthen the case for $4,600 and $4,700 retests, while losing $4,250 could delay the bullish cycle thesis. For now, ETH remains at a pivotal juncture where technical compression, institutional flows, and Foundation decisions will determine the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.