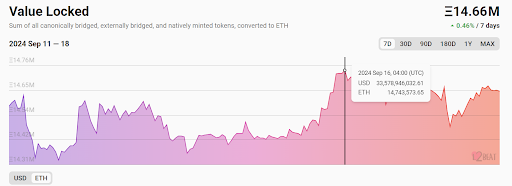

- Ethereum Layer 2 adoption has reached an all-time high of 14.65M ETH locked.

- The value of ETH locked has grown 109.61% over the past year.

- The total value locked in USD has reached $33.95 billion, marking a 199.03% yearly increase.

Ethereum’s Layer 2 networks are gaining traction, with 14.65 million ETH currently locked in various protocols. The locked value has skyrocketed by 109.61% in the past year, according to the latest data from L2Beat.

Ethereum’s Layer 2 solutions are built to deliver faster and more affordable transaction processing compared to the main Ethereum network (Layer 1). In the last 30 days alone, the amount of ETH locked in Layer 2 solutions grew by 6.75%, showing consistent growth. This week, the figure hit an all-time high of 14.77 million ETH valued at over $33 billion.

“Ethereum’s Layer 2 is Unstoppable” — Top Analyst

Leon Waidmann, Head of On-chain Insight, weighed in on the latest data, noting, “The adoption of Ethereum’s Layer 2 is unstoppable.” According to him, the steady increase in ETH locked is key to an increased value of Ethereum, not just in monetary terms.

Looking at the increase in ETH locked in terms of US dollars, the total value locked (TVL) is also trending upwards. Right now, the TVL of Ethereum layer two stands at $33.95 billion, a 199.03% increase over the year.

However, the USD value has dropped significantly on the monthly and quarterly timeframes. This is because of Ethereum’s weak price performance over the last six months. It’s important to note that the current $33.95 billion is much lower than the peak of $48.6 billion seen in June.

Essentially, while the amount of ETH locked has grown steadily to an all-time high, the cryptocurrency market’s volatility has affected the USD equivalent.

But the overall trend remains positive, as shown by a sharp increase in value over the year. The steady rise in locked ETH on layer twos highlights growing trust in Ethereum’s scaling capabilities and increasing demand for decentralized applications (dApps) and DeFi solutions within its ecosystem.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.