- Ethereum broke key price ranges in late January as selling pushed prices to around $1,900.

- Record IBIT ETF options volume coincided with crypto losses after leverage limits were lifted.

- BitMine boosts ETH stash despite selloff, holds 4.28M ETH with zero debt.

The Ethereum price decline in 2026 intensified through late January and early February as selling pushed prices well below prior trading ranges. Market commentary and balance-sheet disclosures published over the period point to a sudden appreciation rather than a correction, with activity centered during U.S. trading hours and tied to elevated derivatives volume.

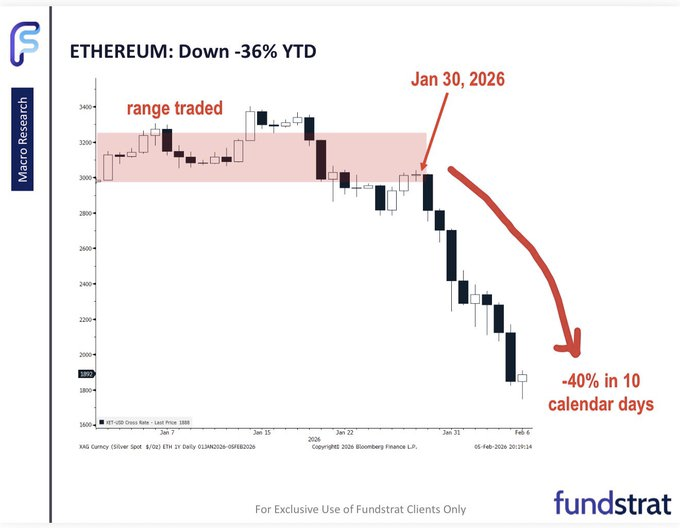

According to a chart shared by Fundstrat, Ethereum is already down about 36% year to date, with a break below the $3,000–$3,200 range around January 30, 2026. After that move, prices slid toward the $1,900 area over roughly 10 days, marking an additional drop of about 40%.

Fundstrat’s Thomas Lee noted that drawdowns of this scale have occurred repeatedly since 2018, with Ethereum experiencing declines of 60% or more in most calendar years. He added that the 2026 decline unfolded alongside improving on-chain activity, contrasting with earlier crypto winters when usage fell.

ETF Options Volume and Timing

Further attention centered on unusually high trading activity tied to spot Bitcoin ETFs. Commentary referenced record daily volume and options premiums in IBIT. Many observers pointed to the removal of exchange-imposed options contract caps in late January, which expanded leverage availability across major Bitcoin and Ethereum ETFs.

No formal disclosures have yet confirmed the identity of any large holder involved, and filings that could clarify exposures would not appear until later reporting windows.

Treasury Activity and Staking Data

Amid the selloff, BitMine Immersion Technologies reported continued accumulation. The firm said it added 41,788 ETH in the recent week, lifting total holdings to 4,285,125 ETH, alongside 193 Bitcoin and $586 million in cash. The company disclosed zero debt and noted that roughly two-thirds of its ETH holdings are staked, generating staking income at the prevailing network rate.

BitMine also reported that Ethereum daily transactions and active addresses reached record levels in early 2026, even as prices fell from roughly $3,000 to the low $2,000s.

Related: Ethereum Price Prediction: ETH Downtrend Persists While Developers Face Calls for Real Innovation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.