- Ethereum dropped over 6% to $4,172, its lowest since August.

- Analysts highlight the $4,100–$4,000 zone as a key area for accumulation.

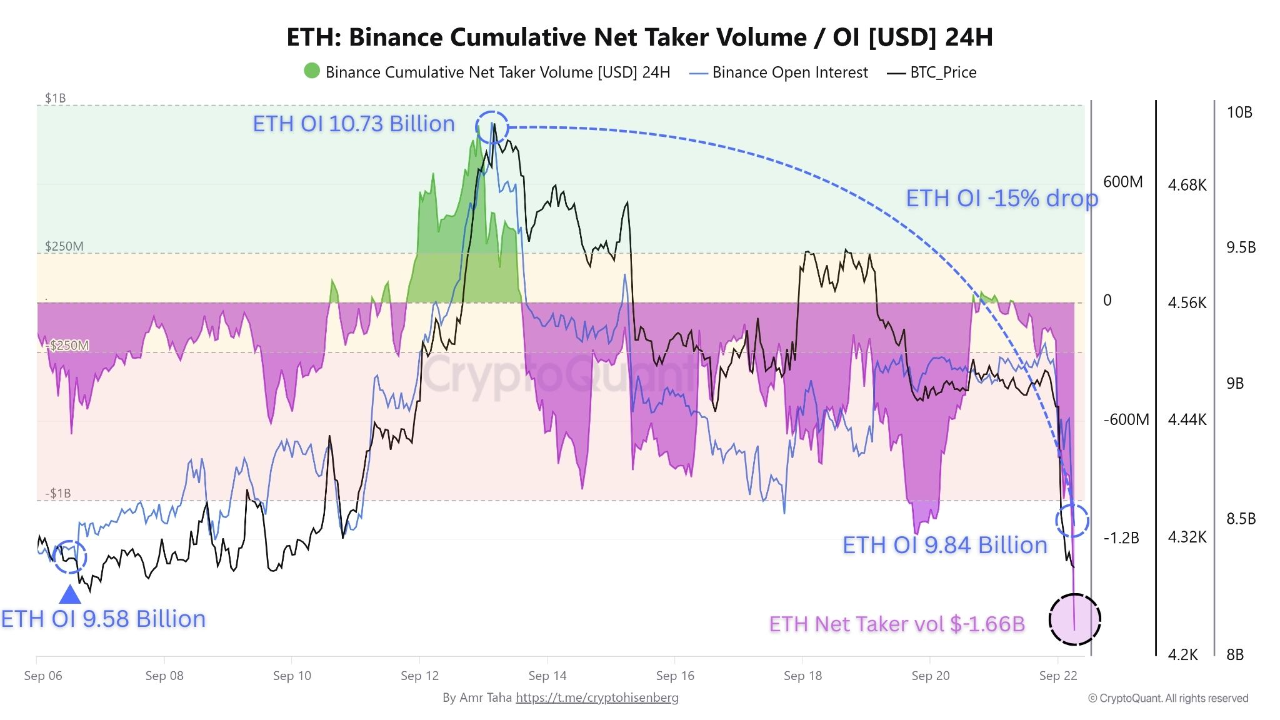

- Derivatives data shows aggressive selling but also hints of capitulation.

Ethereum has fallen sharply, dropping more than 6% in the past 24 hours to trade near $4,172, its lowest level since early August. The sharp decline wiped billions from ETH’s market cap, which now sits near $505 billion.

The move has stirred concern among retail traders, but analysts say this reset may set up the next phase of accumulation.

Van de Poppe sees his chance around $4,000

Market analyst Michael van de Poppe described the drop as a “market flush” and pointed to the $4,100–$4,000 range as an area where long-term buyers could step in.

According to his chart, ETH pressing into this zone after losing short-term momentum suggests conditions where accumulation typically builds.

Chart Levels Traders Are Watching

If Ethereum manages to stabilize and reclaim higher ground, the next significant objective lies near $5,766 , which aligns with economist Donald Dean’s retracement target for the ETH to BTC ratio.

On the other hand, a failure to hold above $4,000 could invite a deeper correction into the $3,600 to $3,800 range, where stronger liquidity sits. A deeper decline would expose further support levels at$ 2,630, $2,400, and even $2,100.

Derivatives Data Signals Capitulation

According to CryptoQuant, ETH Open Interest on Binance has dropped by about 15% since mid-September, falling back to levels last seen earlier in the month.

Net taker volume has turned deeply negative, a sign of aggressive sell-side pressure, while funding rates across major exchanges have shifted into negative territory.

It is clear that short positions are dominating and many long positions entered at higher prices have been unwound. Historically, such conditions at key supports often align with capitulation and oversold conditions.

Retesting Support Could Fuel a Rebound

Donald Dean added that ETH is now retesting a high-volume trading shelf near $4,200. If buyers defend this band, ETH could begin carving a recovery path toward $5,766.

But if $4,000 fails to hold, traders will look for demand zones lower down, starting near $3,800 and extending into the mid-$3,000s.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.