- Ethereum price holds $4,509, with buyers testing the $4,560 resistance that has capped rallies since August.

- U.S. Treasury exempts ETH from 15% corporate tax, boosting confidence in institutional adoption.

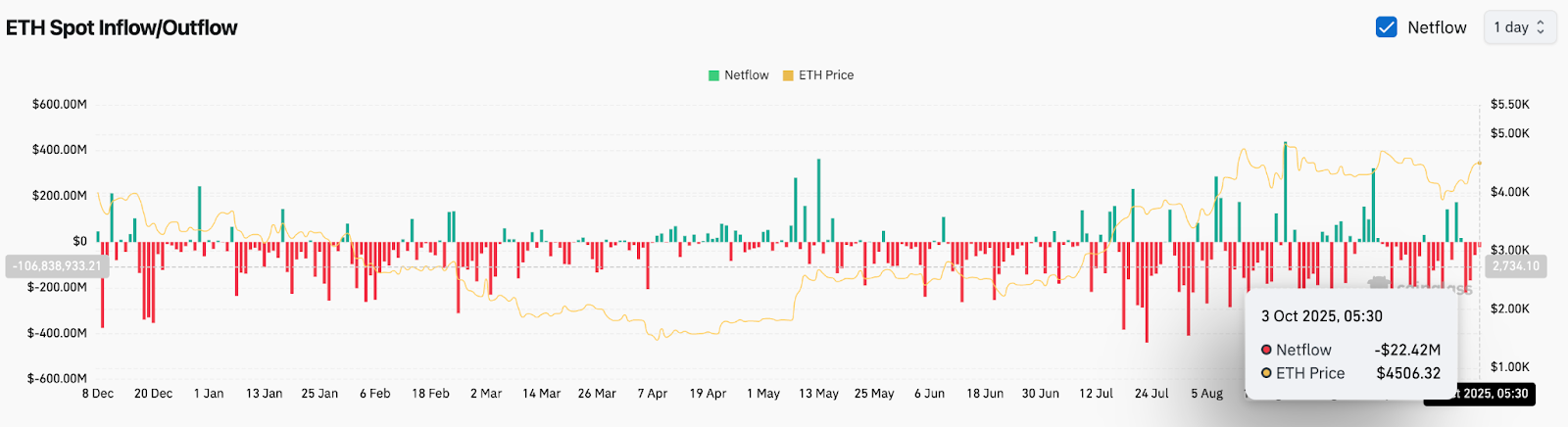

- On-chain flows show $22.4M net outflows, signaling mild accumulation but uneven conviction.

Ethereum price today is trading at $4,509, recovering momentum after bouncing from the $4,307 support zone. Buyers are pressing against a descending resistance line near $4,560, which has capped multiple attempts since August. The market focus now shifts to whether ETH can break this ceiling or slip back toward deeper support levels.

Ethereum Price Holds Triangle Structure

The daily chart shows Ethereum coiling within a symmetrical triangle pattern. Support is anchored by the rising trendline from April, converging with the 20-day EMA at $4,307. Resistance remains firm near $4,560, the descending line that has repeatedly rejected rallies.

Momentum is improving, with the RSI at 57 pointing toward neutral-to-bullish conditions after rebounding from oversold territory. A successful break above $4,560 would clear the path toward $4,700 and potentially $4,850, while failure at this level risks a pullback to $4,238 and $3,906, where the 100-day EMA and trendline support converge.

U.S. Treasury Tax Exemption Fuels Optimism

Ethereum received a strong fundamental catalyst this week after the U.S. Treasury exempted ETH from the 15% corporate tax. This decision provides a regulatory tailwind, positioning Ethereum more favorably for institutional adoption.

Analysts argue the exemption reduces long-term cost barriers for corporations holding ETH on their balance sheets. Market reaction has been cautiously bullish, with sentiment improving across futures markets and staking inflows. Traders see this as a validation step that strengthens Ethereum’s standing against competing layer-1 networks.

On-Chain Flows Reflect Mixed Sentiment

Exchange data shows $22.4 million in net outflows on October 3, highlighting modest accumulation as ETH reclaimed $4,500. While this suggests buyers are positioning on dips, flows remain uneven compared to July’s heavy accumulation streaks.

Spot activity has yet to show strong conviction, as alternating inflows and outflows indicate traders remain cautious about committing at current levels. Futures open interest has stabilized, showing defensive positioning rather than aggressive long exposure. Analysts warn that without consistent net outflows, Ethereum price action could remain range-bound within the triangle.

Technical Outlook For Ethereum Price

Ethereum price prediction for the short term depends on whether buyers can secure a breakout:

- Upside targets: $4,560, $4,700, $4,850

- Downside support: $4,307, $4,238, $3,906

- Trendline defense: $3,456 as the last major support

The broader uptrend remains intact as long as ETH stays above $3,900. A decisive break through $4,560 would open the door toward $4,850 and potentially $5,000 in the coming weeks.

Outlook: Will Ethereum Go Up?

Ethereum enters October at a pivotal technical juncture. The exemption from U.S. corporate tax provides a powerful narrative boost, while chart compression signals that a larger move is near.

If ETH clears $4,560 with momentum and sustained outflows support the breakout, analysts expect price to advance toward $4,850–$5,000. However, failure to hold above $4,307 could delay the bullish thesis and expose the $3,900 zone. For now, Ethereum remains balanced between strong fundamentals and key technical barriers, with buyers looking for confirmation of the next leg higher.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.