- Ethereum trades near $4,505, consolidating between $4,200 support and $4,600 resistance.

- Liquidity heatmaps show whale clusters at $4,000–$4,200 and $4,600–$4,700, signaling breakout risk.

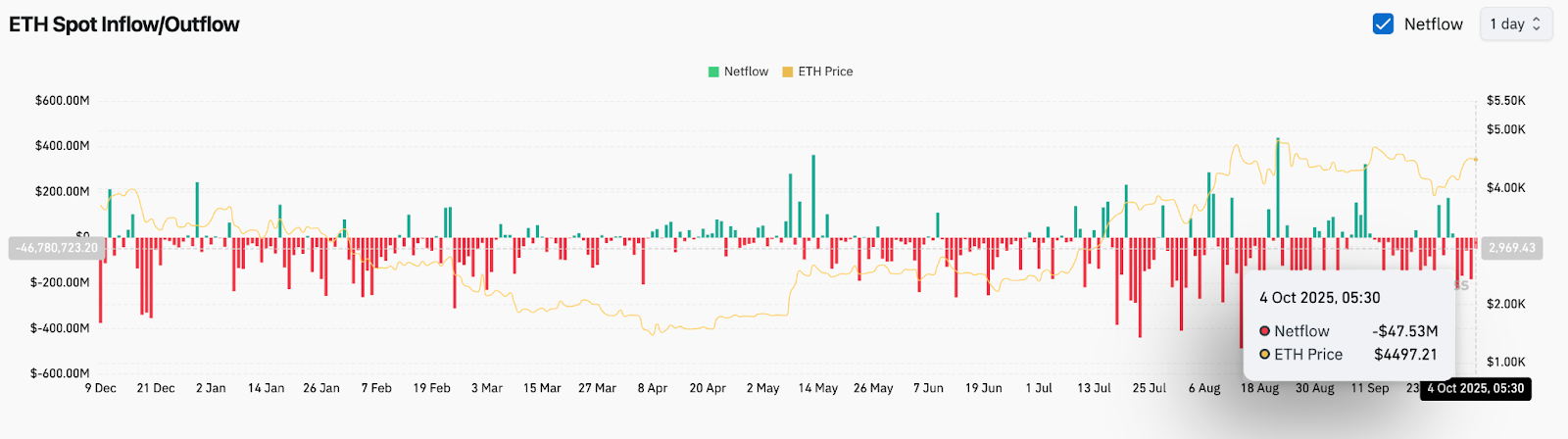

- On-chain data reveals $47.5M in outflows, suggesting moderate accumulation despite volatile flows.

Ethereum price today trades near $4,505, hovering just below resistance at $4,600 as traders weigh whether whales will defend lower liquidity zones or push for an upside breakout. Market attention is focused on the $4,000–$4,200 support region highlighted by liquidity heatmaps, with the $4,600–$4,700 range emerging as the next major test.

Ethereum Price Holds Compression Zone

The daily chart shows that Ethereum is consolidating below a descending trendline from its late-August highs. Price remains compressed between the 20-day EMA at $4,327 and the upper boundary near $4,600, forming a tightening structure that often precedes volatility expansion.

Momentum signals remain neutral. The RSI at 57 reflects balanced sentiment, while flattening EMA slopes indicate traders are waiting for confirmation before committing to direction. The 50-day EMA at $4,249 continues to act as pivot support, aligning with the $4,200 liquidity band observed on derivative order books.

If Ethereum breaks above $4,600, momentum traders could drive a quick retest of $4,700–$4,800, but failure to clear this ceiling may pull the token back toward $4,200–$4,000, where demand has repeatedly stepped in.

Liquidity Clusters Define Whale Battleground

Analyst Ted Pillows noted that Ethereum liquidity clusters are concentrated around $4,000–$4,200 on the downside and $4,600–$4,700 on the upside, creating an equilibrium that could soon be disrupted by whale activity.

His liquidity heatmap shows deep resting orders in both zones, suggesting whales are waiting to trap short-term liquidity before choosing direction. Historically, similar setups have preceded large directional moves once one side’s liquidity is consumed.

For now, ETH could experience a minor pullback that could sweep the lower liquidity zone before a renewed push higher. A clean absorption of bids near $4,200 would reinforce bullish continuation toward $4,700.

On-Chain Flows Show Renewed Accumulation

Exchange netflow data from Coinglass shows a $47.53 million outflow on October 4, reflecting moderate accumulation. Despite the ongoing volatility, outflows in early October indicate investors are positioning for potential continuation, mirroring accumulation phases seen in August before ETH’s rebound above $4,000.

This shift in exchange behavior supports a constructive tone, as reduced supply on exchanges often precedes tightening float and price expansion. However, the magnitude of flows remains below the $100 million threshold that typically confirms institutional conviction, leaving room for caution if short-term profit-taking resumes.

Technical Outlook For Ethereum Price

- Upside levels: $4,600, $4,700, and $4,800

- Downside levels: $4,200, $4,000, and $3,918

- Trend support: $3,466 (200-day EMA)

Outlook: Will Ethereum Go Up?

Ethereum’s near-term direction hinges on whether whales trigger a liquidity sweep below $4,200 or force a breakout above $4,600. On-chain outflows and steady EMA alignment suggest buyers still have control, but thin liquidity between $4,200 and $4,700 raises the risk of sharp whipsaws.

Analysts maintain a cautiously bullish bias as long as the Ethereum price today holds above $4,200. A decisive breakout above $4,600 could extend the rebound toward $4,800–$5,000, while a breakdown below $4,200 would shift focus back toward $3,900. For now, Ethereum remains in a critical compression zone where whale positioning will decide the next trend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.