- Ethereum price today trades near $3,948 after breaking below the $4,000 level and key EMAs.

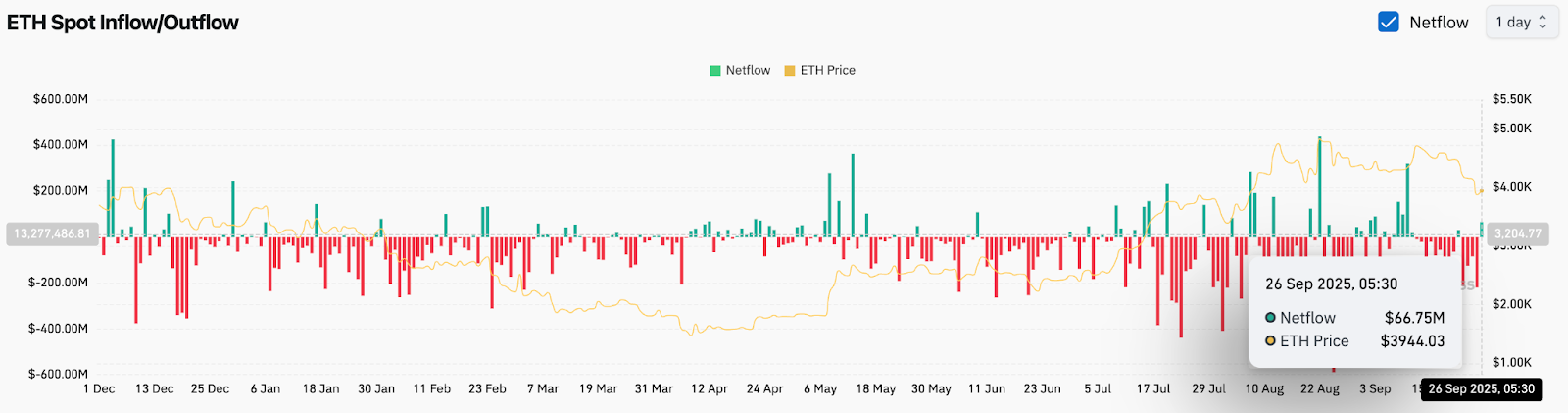

- $66.7M in net inflows mark one of September’s largest, signaling stronger selling pressure on exchanges.

- Whale wallets dump holdings, with addresses above 100K ETH declining sharply, raising bearish concerns.

Ethereum price today is trading near $3,948, slipping below the $4,000 mark after a sharp breakdown from its ascending trendline. The decline comes as whales accelerate selling, while inflows into exchanges highlight growing caution. Traders are watching the $3,800–$3,850 support zone as the key line of defense.

Ethereum Price Struggles Below Key Trendline

The 4-hour chart shows Ethereum breaking decisively under its multi-week ascending trendline around $4,200. Sellers forced price below the 20-, 50-, and 100-EMAs, which are now clustered between $4,083 and $4,238 and acting as resistance.

Related: XRP Price Prediction: Futures Data Highlights Cautious Positioning

Immediate support sits near $3,800, aligned with June’s consolidation floor. A failure to hold this region risks exposing deeper liquidity zones near $3,500–$3,400. On the upside, ETH would need a close back above $4,083 to ease bearish pressure and target $4,330 as the next resistance.

Momentum indicators reflect the weakness. The RSI is at 29, showing oversold conditions, though such extremes often precede relief bounces. For now, price action favors sellers until ETH can reclaim its broken EMAs.

On-Chain Flows Reveal Exchange Inflows

Spot exchange flow data shows a $66.7 million net inflow on September 26, coinciding with ETH’s drop below $4,000. This marks one of the largest daily inflows of September, suggesting traders are sending coins to exchanges to sell rather than hold.

The shift follows weeks of mixed activity, where inflows and outflows offset each other. With sentiment leaning defensive, the latest inflow spike highlights that selling pressure could persist if inflows remain elevated. Unless this reverses to consistent outflows, Ethereum price action may continue facing downside risk.

Whales Accelerate Ethereum Selling

Market concern has intensified after whale wallets dumped significant ETH holdings. Data from Alpharactal, shared by Mister Crypto, shows a steep decline in addresses holding more than 100,000 ETH.

Related: Solana Price Prediction: SOL Struggles at $196 as Futures Interest Drops

Such movements often precede or coincide with market corrections, as large holders front-run retail activity. Analysts warn that without whale accumulation returning, Ethereum price volatility could remain tilted to the downside. The concentration of selling pressure at the same time as technical breakdown compounds the bearish case.

Technical Outlook For Ethereum Price

Ethereum price prediction hinges on whether buyers can defend the $3,800–$3,850 support band.

- Upside levels: $4,083 and $4,331 if ETH regains momentum.

- Downside levels: $3,800 as immediate support, with $3,500–$3,400 as deeper liquidity zones.

- Trend markers: 200-day EMA near $3,350 remains the last structural defense.

Outlook: Will Ethereum Go Up?

Ethereum’s path in the coming days depends on whether oversold RSI levels spark a relief rally or if inflows and whale selling deepen the decline. Holding $3,800 could stabilize the market and allow a retest of $4,083, but failure here would open room toward $3,500.

Related: Pi Coin Price Prediction: Pi Struggles To Recover After Breakdown

Analysts remain cautious. As long as ETH trades below its broken EMAs, the bias leans bearish in the short term. A decisive close above $4,083 would be the first sign of recovery, while continued inflows suggest further volatility may lie ahead.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.