- Ethereum price today consolidates near $4,160 inside a year-long triangle, facing key resistance at $4,396.

- Derivatives open interest nears $50B with 69% higher volume, signaling stronger speculative positioning.

- $86M in outflows deepen liquidity squeeze, but momentum depends on a breakout above $4,400.

Ethereum price today trades near $4,160, holding above short-term moving averages as market sentiment steadies after a volatile October. The asset is consolidating inside a large symmetrical triangle, with buyers attempting to push price back toward the upper resistance at $4,396. The key tension now lies between growing derivatives activity and soft spot outflows that continue to weigh on upside conviction.

Buyers Reclaim Momentum As ETH Tests Triangle Resistance

On the daily chart, Ethereum price action has rebounded from the ascending trendline near $3,900, supported by the 20-day EMA at $4,048 and 50-day EMA at $4,129. The broader structure remains compressed between $3,591 and $4,396, forming a year-long symmetrical triangle.

The Parabolic SAR has flipped bullish, printing below the candles for the first time since early October, signaling improving trend strength. Still, the upper trendline near $4,400 marks a crucial ceiling. A clean break above this could open the path toward $4,750–$4,800, where prior rejection zones align.

On the lower side, a close below $3,950 would invalidate the short-term bullish setup, exposing the 200-day EMA around $3,590. Momentum indicators suggest caution, with the RSI hovering around neutral territory at 56, reflecting consolidation rather than breakout strength.

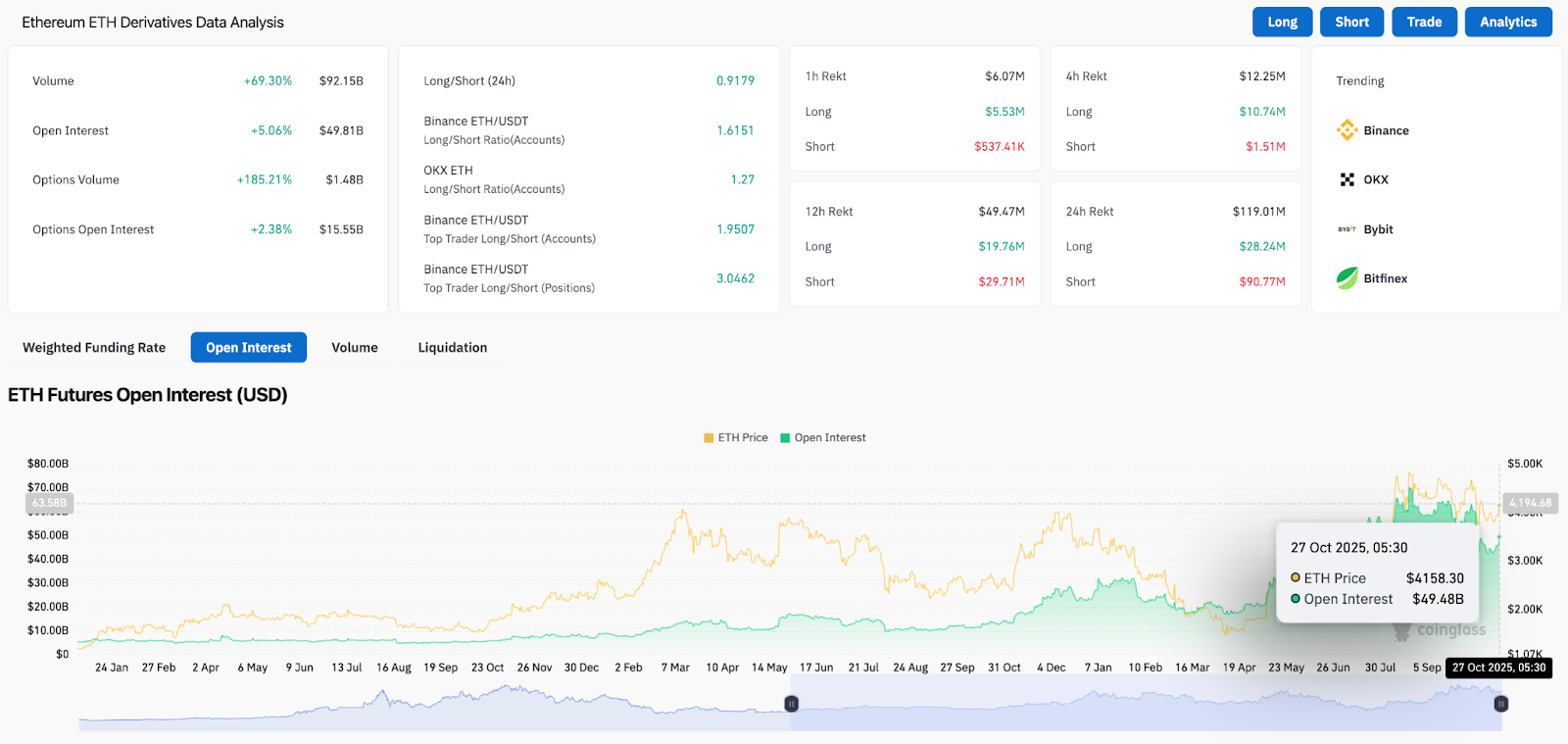

Derivatives Activity Surges As Open Interest Climbs Toward $50B

Derivatives traders have turned active again. Data shows Ethereum open interest rising 5.06% to $49.81 billion, while total volume spiked 69% to $92.15 billion in the past 24 hours. Options volume also surged 185% to $1.48 billion, hinting at renewed speculative appetite.

Related: Bitcoin Price Prediction: BTC Bulls Regain Control Despite Mt. Gox Repayment Delay

The Binance ETH/USDT top trader long-short ratio now stands at 3.04, reflecting aggressive positioning from high-volume traders. The broader long-short ratio across exchanges remains slightly bullish at 0.91, implying a cautious bias toward upside continuation.

Despite the jump in open interest, funding rates remain steady, indicating balanced leverage rather than excessive euphoria. This equilibrium suggests traders are building directional exposure without overly extending risk, which could support gradual price appreciation if spot flows stabilize.

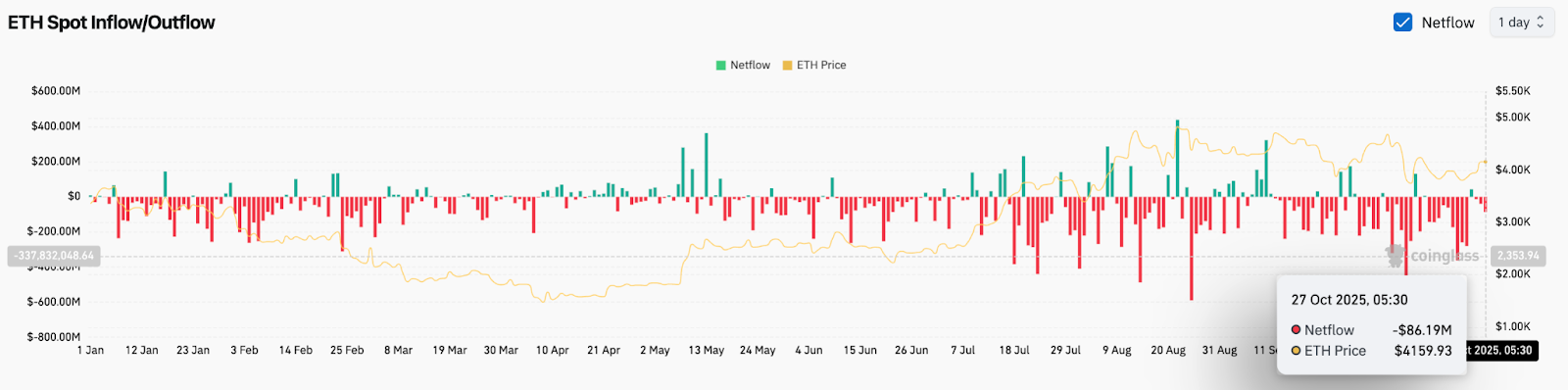

Spot Outflows Deepen But Hint At Long-Term Accumulation

Ethereum spot data shows net outflows of $86.19 million on October 27, marking the fifth consecutive day of negative exchange flows. Over the past two weeks, outflows have averaged over $200 million daily, underscoring a sustained tightening of liquid supply.

Historically, prolonged exchange outflows align with accumulation phases, where investors move assets into self-custody. The current ETH price near $4,150 has coincided with rising wallet activity and a decline in short-term selling pressure.

Still, the scale of redemptions across spot venues has yet to translate into aggressive price momentum, suggesting that institutional demand remains selective amid the broader crypto market’s cautious tone.

Short-Term Structure Shows $4,228 As Key Intraday Resistance

On the 30-minute chart, Ethereum price retreated slightly from its $4,228 intraday high, where the Supertrend indicator flipped bearish. The RSI, now cooling near 46, confirms a short-term loss of momentum after an overbought reading earlier in the session.

Related: Solana Price Prediction: $66M Outflows Hit as Derivatives Surge Ahead Of $225 Target

If ETH price reclaims $4,228, short-term traders may eye a move toward $4,300, while a failure to hold $4,120 could trigger a pullback to $4,000, aligning with lower Supertrend support. The intraday setup favors consolidation before the next breakout attempt.

Outlook: Will Ethereum Go Up?

The Ethereum price prediction remains cautiously optimistic as technical and on-chain indicators show mixed signals. Bulls have regained control above key EMAs, and derivatives positioning suggests traders are leaning long. Yet, persistent spot outflows and a still-neutral RSI temper near-term upside potential.

For Ethereum price to confirm a breakout, it must close decisively above $4,396, validating the upper triangle boundary and signaling a renewed bullish phase toward $4,750. If sellers regain control below $3,950, the focus would shift back to $3,600, where long-term support and the 200-day EMA converge.

Until then, ETH remains in a holding pattern — stable but waiting for a catalyst strong enough to unlock the next directional wave.

Related: Cardano Price Prediction: Can 2,100 Validators and $1M Outflows Push ADA Higher?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.