- Ethereum remains pinned below its descending trendline and stacked EMAs, keeping the broader structure bearish.

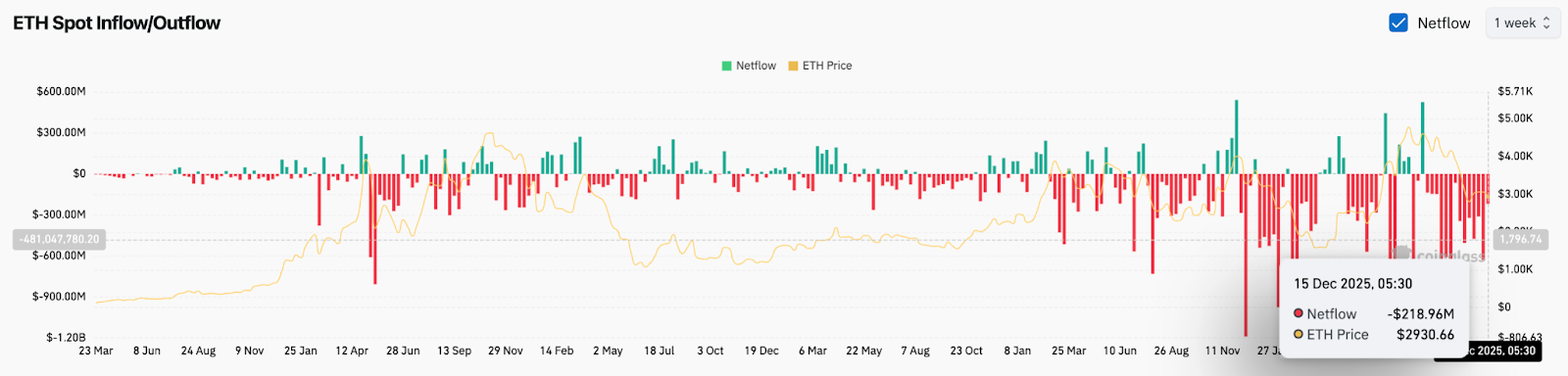

- ETF outflows topped $220 million in recent sessions, reinforcing institutional distribution rather than accumulation.

- Price is holding $2,880–$2,900 support, but a breakdown risks extension toward $2,750 and $2,500.

Ethereum price today trades near $2,925 after failing to sustain a short-term rebound earlier this week. The market remains under pressure as sellers continue to control structure, with price pinned near the lower boundary of a declining channel while institutional flows stay negative.

Downtrend Structure Remains Intact

On the daily chart, Ethereum continues to trade below a descending trendline that has capped rallies since October. Each attempt to push higher has been rejected beneath this diagonal resistance, reinforcing the bearish structure.

Price remains below all major EMAs. The 20-day EMA near $3,074 and the 50-day EMA around $3,249 now act as immediate resistance. Above that, the 100-day EMA near $3,452 and the 200-day EMA around $3,429 reinforce the broader downtrend and highlight how far price has slipped from trend control.

Related: Mantle Price Prediction: Can MNT Sustain Its Uptrend Above $1.23?

As long as Ethereum trades below this EMA cluster, upside moves remain corrective rather than trend-forming. Sellers continue to defend rallies, keeping pressure on any recovery attempt.

Support Zone Faces A Key Test

Despite the weak structure, Ethereum has not broken down decisively. Price is consolidating just above the $2,880 to $2,900 zone, an area that has absorbed multiple selloffs over the past two weeks.

This range aligns with the lower boundary of the recent descending channel and has acted as a short-term demand area. The absence of aggressive follow-through to the downside suggests sellers are slowing, but buyers have yet to show conviction.

A daily close below $2,880 would expose the next downside target near $2,750, followed by the $2,500 region if selling accelerates. Holding above current levels keeps Ethereum in consolidation rather than continuation lower.

ETF Outflows Continue To Weigh On Sentiment

On December 16 alone, Ethereum ETFs recorded net outflows of approximately $224.2 million. BlackRock accounted for roughly $221.3 million of that total, marking one of the largest single-day withdrawals in recent weeks.

Spot flow data tells a similar story. Ethereum has seen repeated sessions of net exchange outflows turning negative, signaling distribution rather than accumulation.

Related: Bitcoin Price Prediction: BTC Extends Fragile Phase as Technical Pressure…

Data for the week starting December 15 shows continued ETF outflows of around $220 million in 3 days, extending a trend that has been in place since September.

Intraday Charts Show Fragile Balance

On the 30-minute chart, Ethereum is not trending. Price is consolidating after the sharp breakdown, trading inside a tight horizontal range between $2,880 and $2,980.

This is a post-selloff base, not an extension of downside.

The Supertrend remains above price near $2,970, confirming that short-term trend control has not flipped back to buyers. However, repeated failures by sellers to push price below $2,880 show that downside pressure has stalled.

Parabolic SAR dots have shifted closer to price and begun to flatten, reflecting loss of bearish momentum, not a renewed sell impulse. The earlier aggressive SAR expansion has ended.

Outlook. Will Ethereum Go Up?

Ethereum remains trapped between weakening momentum and a developing support base. The short-term outlook hinges on whether buyers can defend current levels against continued institutional selling.

- Bullish case. A daily close above $3,074, followed by a reclaim of the 50-day EMA near $3,249, would signal improving momentum and open the path toward the $3,450 resistance zone.

- Bearish case. A decisive breakdown below $2,880 would confirm renewed downside pressure and expose $2,750, with risk extending toward $2,500 if outflows persist.

Related: Solana Price Prediction: SOL Faces Short-Term Pressure as Traders Reassess Momentum

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.