- Ethereum defends $3,940 support, signaling renewed buyer strength into Q4.

- Open interest hits $46.8B, reflecting growing institutional confidence in ETH.

- Break above $4,270 may trigger recovery toward $4,476 and $4,758 targets.

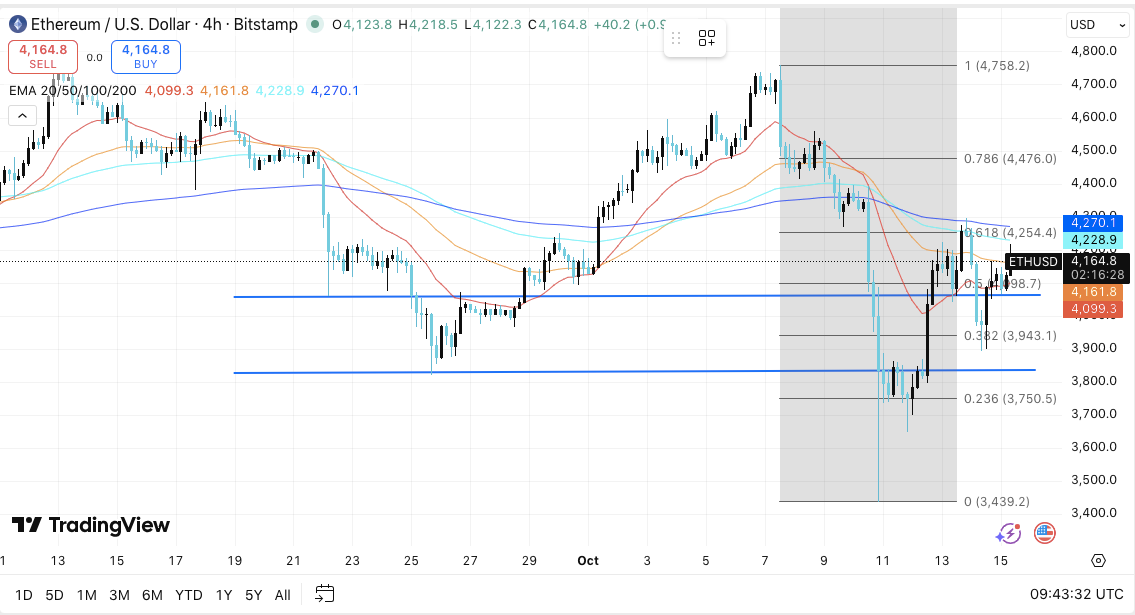

Ethereum is showing renewed resilience after a sharp retreat from its recent $4,758 high, with price action suggesting growing market confidence. On the 4-hour chart, ETH trades around $4,164, attempting to reclaim short-term moving averages. The recovery coincides with rising futures activity and improving exchange flows, both hinting at a potential rebound phase forming after weeks of consolidation.

Buyers Defend the $3,940 Support Zone

Significantly, Ethereum has maintained strong defense above the $3,940–$3,950 zone, which aligns with the 0.382 Fibonacci retracement. This level has served as a key base since early October, preventing further downside moves.

Holding above it reinforces short-term stability and supports the argument for renewed accumulation. Immediate resistance now lies between $4,250 and $4,270, where the 200-EMA and 0.618 Fibonacci retracement converge. A clean breakout beyond this region could expose higher targets near $4,476 and eventually $4,758.

Moreover, the 20-day EMA is approaching a bullish crossover above the 50-day EMA, signaling early signs of recovery momentum. Still, broader trend confirmation requires a sustained close above the 200-EMA.

Related: Dogecoin Price Prediction: Institutional Merger Fuels Bullish Momentum

Until then, traders remain cautious, with $4,098 and $3,943 acting as critical downside supports. A failure to defend these levels may push ETH back toward $3,750 and $3,439, where deeper bids could reemerge.

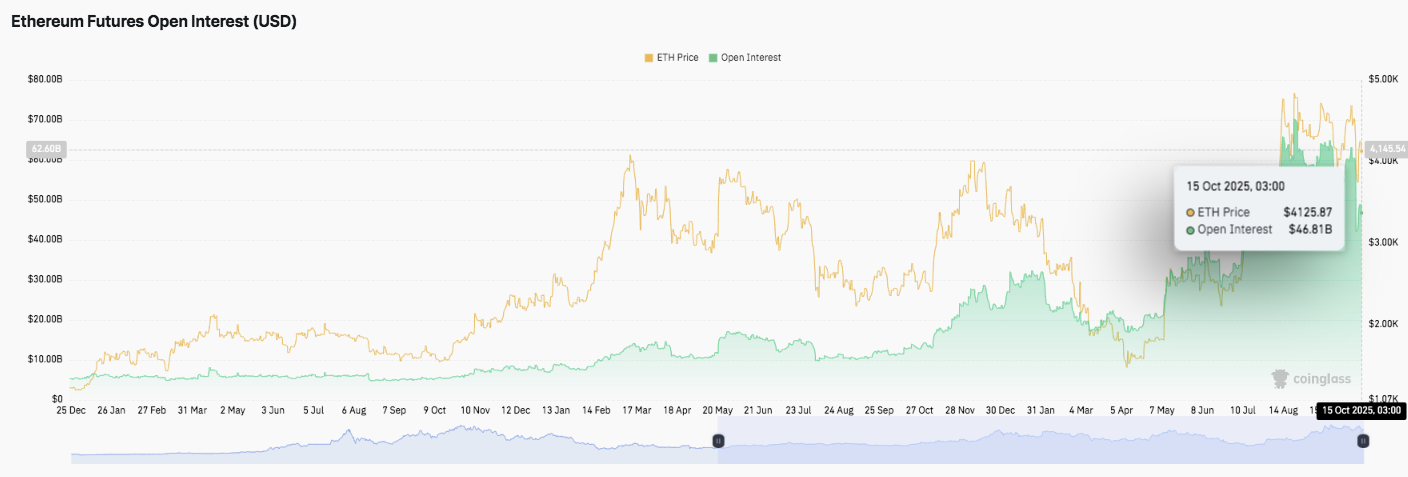

Derivatives Data Reflects Institutional Confidence

Besides spot movements, derivatives metrics reveal mounting confidence. Ethereum’s open interest in futures markets reached $46.81 billion on October 15, marking one of the highest readings this year.

The steady increase from below $20 billion earlier in 2025 signals growing speculative and institutional participation. This rising interest mirrors the stabilization in ETH price, showing traders are rebuilding long positions following the summer’s broad accumulation phase.

Consequently, the surge in leveraged exposure suggests investors anticipate increased volatility into late Q4. Sustained open interest alongside stable funding rates implies optimism rather than excessive risk-taking, providing a supportive backdrop for continued recovery.

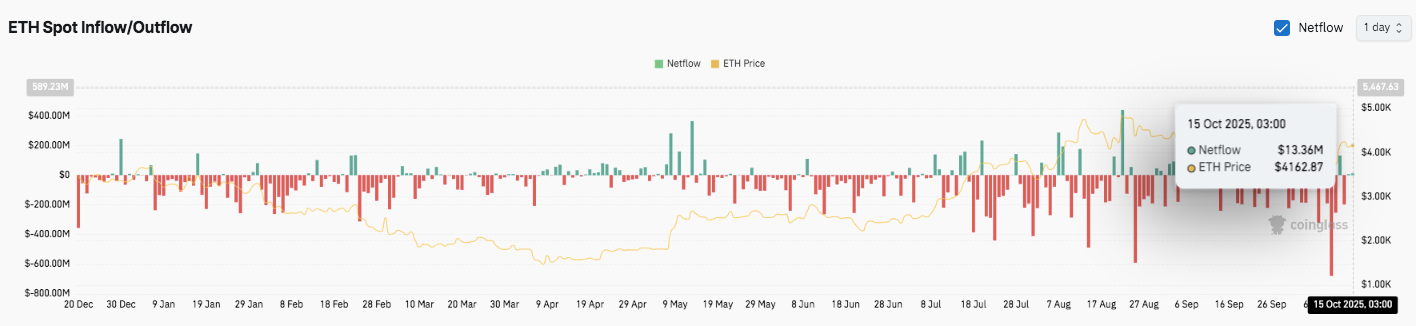

Exchange Flows Indicate Accumulation Rebound

Additionally, Ethereum’s spot netflow data shows a notable shift in exchange activity. After weeks of heavy withdrawals, October 15 recorded net inflows of $13.36 million, suggesting fresh accumulation interest near the $4,160 region. This reversal follows over $600 million in outflows during early October, reflecting renewed demand from traders positioning for upside continuation.

Related: Bitcoin Price Prediction: BTC Consolidates as Derivatives Activity Surges

Technical Outlook for Ethereum (ETH/USD): Key Levels Define Recovery Path Ahead of Q4

Ethereum’s technical setup remains constructive after a sharp correction from its $4,758 peak, with price consolidating above the crucial $3,940–$3,950 support area. This zone aligns with the 0.382 Fibonacci retracement and has served as a strong defensive base throughout October.

- Upside levels: Immediate resistance sits at $4,250–$4,270, coinciding with the 0.618 Fib and 200-EMA both key thresholds for reclaiming bullish momentum. A breakout and sustained close above this range could lift ETH toward $4,476 (0.786 Fib) and potentially retest the $4,758 high.

- Downside levels: Initial support lies near $4,098, while deeper support remains at $3,943. A breakdown below $3,940 could invite further selling toward $3,750 (0.236 Fib) and $3,439, where prior consolidation zones may provide relief.

- Resistance ceiling: The $4,270 region remains the key ceiling to flip for medium-term trend reversal. A decisive move above it would likely validate a recovery structure heading into late Q4.

The broader structure suggests Ethereum is coiling between converging moving averages, reflecting compression before a possible volatility expansion. The 20-EMA crossing above the 50-EMA signals improving short-term momentum, yet confirmation depends on a sustained flip above the 200-EMA.

Will Ethereum Sustain Its Recovery?

Ethereum’s trajectory hinges on whether buyers can defend the $3,940 base while absorbing renewed inflows. Spot data recently showed positive netflows of $13.36 million, marking renewed accumulation after heavy outflows earlier this month. Combined with open interest reaching $46.8 billion the highest since early 2025 the market reflects strengthening conviction among both retail and institutional participants.

If bullish momentum persists, ETH may test the $4,476 – $4,758 resistance cluster. However, failure to hold above $3,940 runs the risk of extending the correction toward $3,750 or lower. The fourth quarter remains pivotal as technical compression, macro sentiment and derivatives positioning all converge, setting the stage for Ethereum’s next major directional move.

Related: VeChain Price Prediction: VET Battles Resistance as Traders Watch Open Interest Surge

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.