- ETH short-term momentum shifts into correction after sellers regain control of trend.

- Multiple resistance zones cap ETH, requiring reclaim to shift momentum back to buyers.

- Bitmine stakes 86.8K ETH, signaling fresh on-chain strength amid weak spot flows.

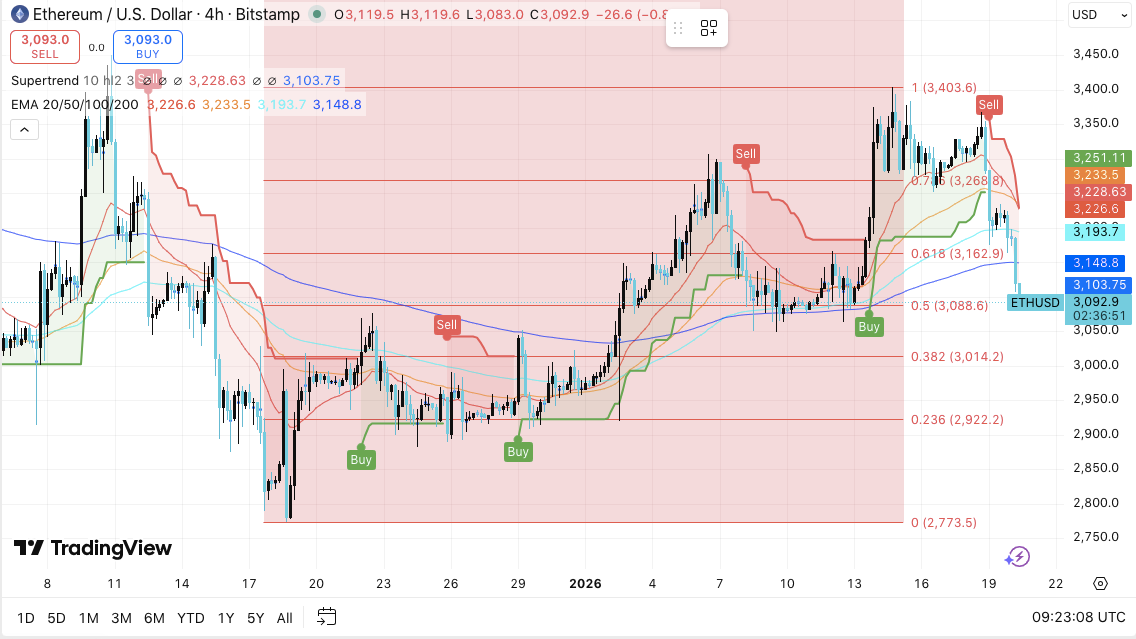

Ethereum traded near $3,093 on the 4-hour chart after a sharp pullback from the $3,403 peak, as sellers regained control and pushed price below key trend signals. The retreat followed a strong rally, but the latest move suggests short-term momentum has shifted into correction mode.

Besides weakening price structure, traders are also watching leverage and spot flow behavior, which still point to cautious market positioning. Consequently, ETH now sits at a key decision point where bulls must defend nearby support levels and reclaim overhead resistance to restart upside continuation.

ETH Faces Heavy Resistance Zones

ETH remains capped below $3,163, which aligns with the 0.618 Fibonacci level and stands as the first upside hurdle. Additionally, a tighter resistance zone sits between $3,227 and $3,233, where moving averages and the Supertrend sell signal converge. This cluster has acted as a ceiling, and ETH needs a clean 4-hour reclaim to shift momentum back in favor of buyers.

Moreover, the $3,268 level, marked by the 0.786 Fibonacci zone, adds another barrier after earlier rejection. A renewed push toward $3,403 would likely require a stronger breakout above all three resistance zones.

Downside levels have become more important as ETH hovers close to $3,088, a key midpoint Fibonacci support. Hence, this level now acts as the immediate line that could decide the next swing. If ETH breaks below $3,088, the next downside target comes near $3,014, followed by deeper support at $2,922.

Related: Shiba Inu Price Prediction: SHIB Traders Turn Cautious as Outflows Keep Building Below Zero

Significantly, $2,922 stands out as a bounce-or-break zone, based on past reactions. If selling pressure grows, the broader structure stays anchored at $2,773, which marks the range low.

Leverage Cools While Spot Flows Stay Weak

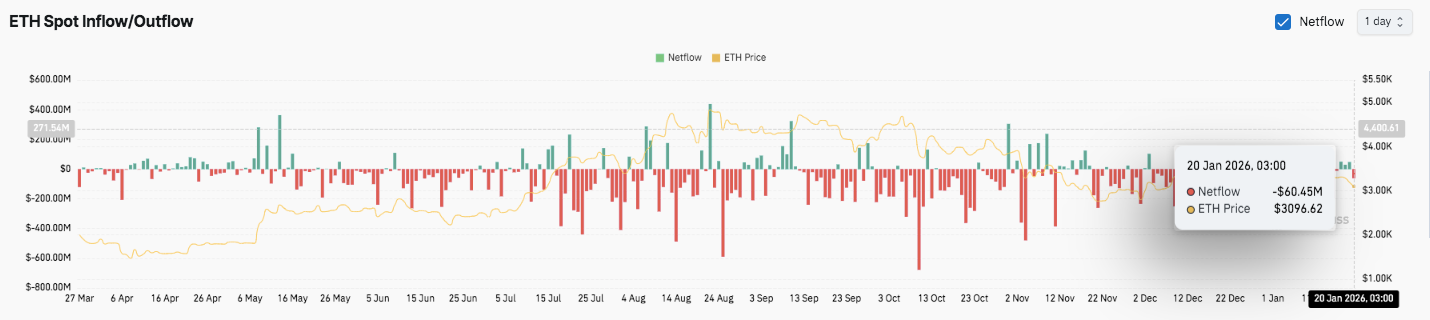

Ethereum futures open interest has followed a clear build-and-reset cycle over the past year, rising sharply during the rally and later unwinding. However, it remains elevated at about $40.31 billion as of Jan. 20, 2026, showing traders still hold sizable exposure.

Spot flow data has leaned bearish for months, with repeated net outflows and limited inflow follow-through. Moreover, recent net outflows near $60 million suggest buyers still lack conviction during rebounds.

Bitmine Staking Adds a Fresh On-Chain Signal

Lookonchain reported that Tom Lee’s Fundstrat-linked Bitmine staked another 86,848 ETH worth about $277.5 million. Additionally, Bitmine’s total staked balance has reached 1,771,936 ETH, valued near $5.66 billion. This activity adds a new on-chain headline as ETH tests key support and traders watch for the next directional break.

Related: Bitcoin Price Prediction: $108M Long Liquidations Break EMA Cluster…

Technical Outlook for Ethereum Price

Key levels remain clearly defined as Ethereum trades within a corrective phase after a strong rally.

Upside levels include $3,163 as the first hurdle, followed by the $3,227–$3,233 resistance cluster. A breakout above this zone could open a path toward $3,268, with $3,403 standing as the major swing-high target.

On the downside, $3,088 acts as immediate support. A loss of this level exposes $3,014, then $2,922 as the next key demand zone. The broader structure remains supported near $2,773.

The technical picture suggests ETH is consolidating after momentum cooled, with price compressing between Fibonacci support and moving-average resistance. This setup often precedes volatility expansion.

Will Ethereum Go Up?

Ethereum’s near-term direction depends on whether buyers can reclaim $3,163 and hold above the $3,233 cluster. Strong follow-through could revive bullish momentum toward $3,403.

However, failure to defend $3,088 risks deeper downside toward $3,014 and $2,922. For now, ETH remains at a pivotal inflection zone where confirmation, not anticipation, will drive the next move.

Related: Oasis Price Prediction 2026: ROFL “Trustless AWS” & Franklin Templeton Pilot Target $0.04-$0.06

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.