- Ethereum tests $4,700 resistance with bullish EMA alignment and RSI at 58.7.

- On-chain inflows of $92.8M signal strong accumulation ahead of potential breakout.

- Robinhood tokenization deal boosts ETH’s role in real-world assets and long-term demand.

Ethereum (CRYPTO: ETH) price today is trading near $4,542, up about 1.1% after extending its rebound from the $4,260 region. The token is now approaching a decisive resistance trendline near $4,700, where sellers have repeatedly capped upside momentum. Bulls are attempting to defend rising support levels as on-chain inflows return and sentiment shifts to “greed.”

Ethereum Price Holds Rising Support

The daily chart shows Ethereum price coiling within a symmetrical triangle formed by the ascending trendline from mid-September and the descending resistance from the $4,900 peak. Support remains well-defined at $4,260 and $4,000, aligning with the 50-day and 100-day EMAs.

The 20-day EMA at $4,346 has turned upward, confirming renewed short-term momentum. A breakout above $4,700 could trigger an acceleration toward $4,900 and $5,000, while a failure to hold above $4,260 risks revisiting $3,930. The RSI stands at 58.7, indicating improving momentum but not yet overbought conditions.

Overall, Ethereum price action suggests accumulation near current levels as buyers regain control within a broader bullish channel that remains intact since July.

On-Chain Inflows Return As Confidence Builds

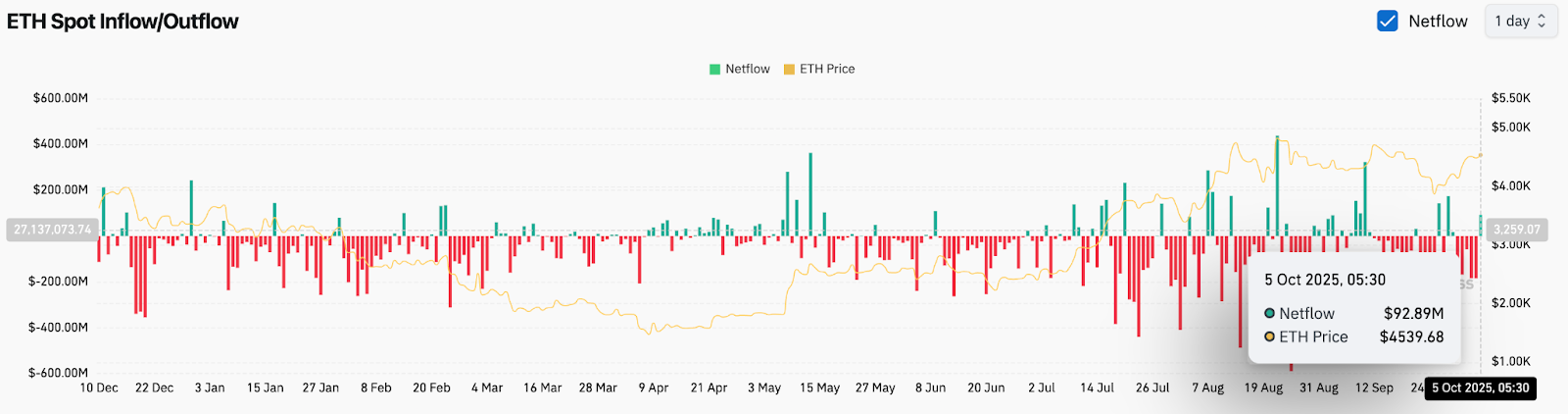

On-chain data from Coinglass shows a net inflow of $92.8 million into Ethereum on October 5, marking one of the strongest accumulation days in recent weeks. This shift follows a prolonged period of outflows through late September, reflecting renewed interest from both retail and institutional investors.

Such inflows often precede short-term rallies as traders accumulate in anticipation of a breakout. Analysts note that sustained positive netflows above $50 million could provide a stronger foundation for a move toward the $4,700–$4,900 resistance range.

Meanwhile, Ethereum price volatility remains moderate, allowing spot buyers to add exposure while maintaining tight risk control.

Sentiment Turns Greedy Amid Tokenization Momentum

The Ethereum Fear and Greed Index registered a score of 66 (Greed) on October 5, signaling growing market optimism. The index’s shift from neutral to greed mirrors the ongoing recovery in both price and investor participation.

Adding to the bullish sentiment, Robinhood announced a partnership with Ethereum and Arbitrum to launch tokenized stock assets such as OpenAI and SpaceX. In the past 30 days, Ethereum has led with 200+ tokenized assets, a 558% growth rate, solidifying its dominance in the real-world asset (RWA) tokenization narrative.

Analysts argue that Ethereum’s positioning as the base layer for tokenized securities could drive long-term institutional demand, particularly as regulated platforms like Robinhood expand their offerings.

Technical Outlook For Ethereum Price

Ethereum’s short-term trajectory remains bullish as long as price holds above $4,260. Key levels to watch:

- Upside targets: $4,700, $4,900, and $5,000 if breakout confirms.

- Downside supports: $4,260, $3,930, and $3,477 as key defenses.

- Trend structure: Higher lows since September reinforce the bullish bias.

Momentum indicators support this view, with the RSI trending higher and EMAs tightening into a bullish alignment. The next decisive move will depend on whether ETH can close above $4,700 and maintain strength amid rising speculative interest.

Outlook: Will Ethereum Go Up?

Ethereum’s price outlook for October 6 hinges on its ability to sustain momentum above the $4,260 support and break through $4,700 resistance. The combination of positive inflows, a “greed” sentiment reading, and strong tokenization catalysts provides a constructive setup for buyers.

As long as ETH remains above the 50-day EMA and rising trendline, analysts expect continuation toward the $4,900–$5,000 region. Failure to clear $4,700 could lead to consolidation between $4,260 and $4,450.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.