- Ethereum price today trades near $4,148 after breaking below $4,250–$4,300, pressuring key supports.

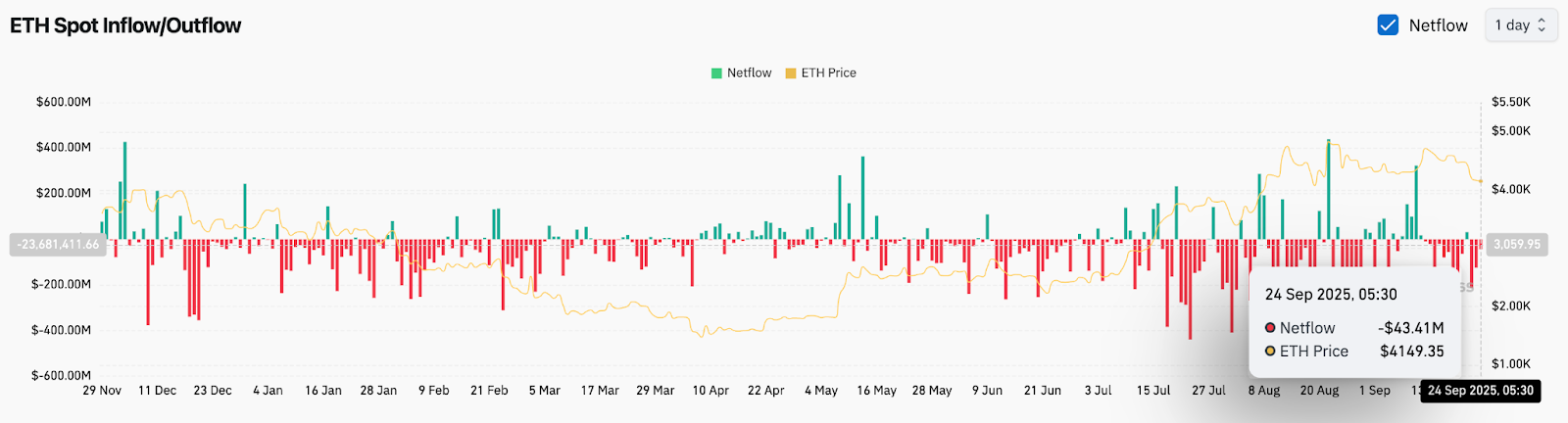

- On-chain flows show weak demand with $43.4M outflows, keeping ETH vulnerable to further downside.

- SEC rule change for Ethereum ETFs offers long-term boost despite short-term neutral-to-bearish setup.

Ethereum price today is trading near $4,148, extending its decline after breaking below the $4,250–$4,300 support zone. The rejection at the descending trendline and the cluster of EMAs above $4,350 has reinforced bearish pressure, with traders now eyeing the $4,100 and $4,000 levels as the next critical defenses.

Ethereum Price Slides Toward Key Support

The 4-hour chart shows Ethereum trapped inside a descending channel, with repeated lower highs confirming seller control since the mid-September peak near $4,750. The breakdown through $4,255, aligned with the 20 and 50 EMAs, triggered a decisive change of character, leaving $4,100 as the immediate line of defense.

The 100-EMA at $4,367 and the 200-EMA at $4,411 continue to slope lower, signaling trend exhaustion. Unless Ethereum price reclaims $4,300 in the short term, downside momentum could deepen toward the $4,000 liquidity pocket.

On-Chain Flows Highlight Weak Demand

Exchange flow data on September 24 showed a $43.4 million net outflow, suggesting mild accumulation. However, the trend across September has leaned toward persistent inflows, highlighting fragile conviction among buyers. Ethereum price action has struggled to find sustained support, with spot demand unable to absorb consistent selling pressure.

Open interest has also flattened across futures markets, reflecting cautious positioning rather than aggressive long exposure. Without stronger inflows, Ethereum price volatility is likely to persist, keeping risks skewed to the downside.

SEC Rule Change Boosts ETF Narrative

Beyond short-term weakness, Ethereum received a major structural catalyst from the U.S. Securities and Exchange Commission. On September 19, the SEC approved a rule change allowing Grayscale’s Ethereum ETFs to trade under streamlined generic standards.

The shift eliminates the need for individual case-by-case approvals, ensuring faster listings and clearer oversight for Ethereum-based funds. Analysts note that this aligns ETH ETFs with commodity trust shares and could pave the way for broader institutional adoption. While the immediate price reaction has been muted due to technical weakness, the regulatory clarity provides a supportive backdrop for long-term valuation.

Technical Outlook For Ethereum Price

- Upside levels: $4,255, $4,367, and $4,420 as immediate hurdles.

- Downside levels: $4,100 and $4,000 as key defenses, with $3,850 the deeper risk zone.

- Trend markers: 200-EMA near $4,411 as the pivot for cycle direction.

Outlook: Will Ethereum Go Up?

Ethereum’s short-term outlook remains pressured after the breakdown under $4,250. If buyers manage to defend the $4,100–$4,000 support band, a rebound toward $4,367 and $4,420 is possible, with a breakout above $4,450 needed to revive bullish momentum.

However, failure to hold $4,100 could expose Ethereum to $3,850, delaying recovery despite supportive ETF headlines. For now, Ethereum price prediction leans neutral-to-bearish in the immediate term, with long-term optimism tied to ETF adoption and on-chain growth.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.