- Ethereum consolidates near $2,000 as BlackRock files amended S-1 revealing 18% staking fee for iShares ETF.

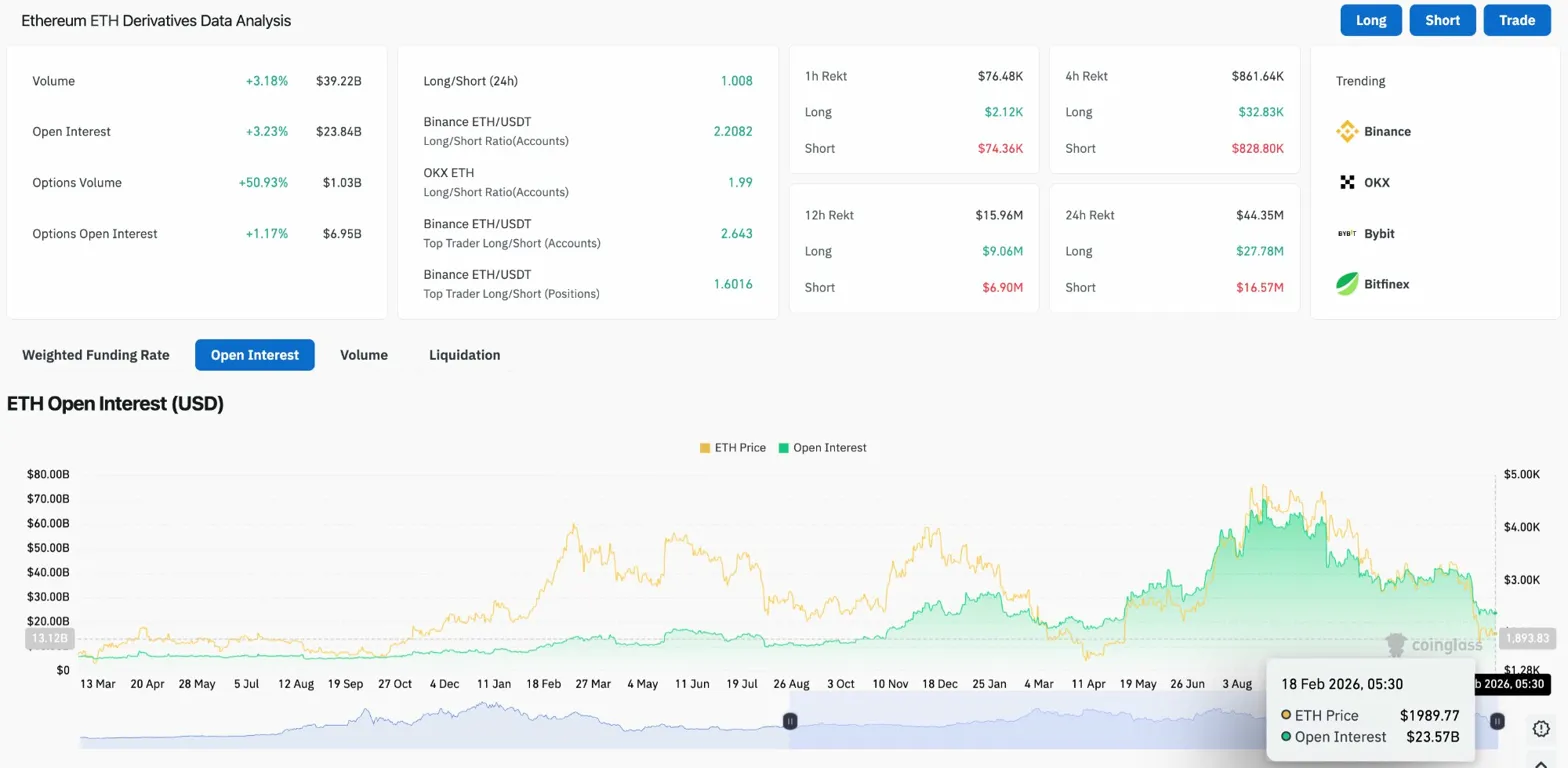

- Open interest rises 3.23% to $23.84B while volume climbs 3.18%, signaling renewed participation after February crash.

- Price tests critical support zone between $1,957 and $2,008 with Supertrend bearish at $2,395.

Ethereum price today trades near $1,997, up 0.35% in the past 24 hours as the token consolidates in a tight range after recovering from the $1,588 February low. The move comes as BlackRock filed an amended S-1 for its iShares Staked Ethereum Trust ETF, revealing an 18% cut of staking rewards split between the sponsor and prime execution agent.

BlackRock Reveals 18% Staking Fee Structure

BlackRock’s amended S-1 filing for its iShares Staked Ethereum Trust shows the fund will take 18% of all staking rewards earned by the ETF. Coinbase, serving as both custodian and prime execution agent, will split this fee with BlackRock.

Investors keep the remaining 82% of staking income. On top of that, they pay BlackRock’s standard 0.25% management fee, reduced to 0.12% for the first year on assets up to $2.5 billion.

The math: A $2.5 billion fund earning 3% staking yield would generate $75 million annually. The 18% cut removes $13.5 million, leaving shareholders with $61.5 million before the management fee. That works out to roughly 2.46% effective yield.

The ETF will trade on Nasdaq as ETHB once regulators approve the registration. The fee structure gives Coinbase significant influence over the staking infrastructure while BlackRock collects fees on both management and staking operations.

Open Interest Rises As Participation Returns

According to Coinglass, Ethereum’s open interest increased 3.23% to $23.84 billion, while volume climbed 3.18% to $39.22 billion. The metrics show renewed participation after the February crash that sent ETH below $1,600. Long/short ratios remain elevated at 2.21 on Binance and 1.99 on OKX, indicating leverage still skews bullish despite the 60% correction from highs.

Top trader positioning shows $9.06 million in longs versus $4.90 million in shorts on 12-hour timeframes, confirming large accounts are positioned for recovery. Options open interest rose 1.17% to $6.95 billion, suggesting traders are building positions ahead of the next move.

When both open interest and volume rise together, it typically indicates new capital entering the market rather than short covering. The sustained increase over recent sessions confirms accumulation is occurring at current levels.

Price Tests Critical Support Between EMAs

On the daily chart, Ethereum is testing a critical support zone marked by multiple horizontal levels at $2,987 and $2,349. The token broke below these levels during the February crash and now trades well below the Supertrend at $2,395, confirming sellers retain control of the daily trend.

The chart shows:

- Price consolidating between $1,800 and $2,100 after 60% correction

- Supertrend bearish at $2,395, capping recovery attempts

- Critical resistance at $2,349 and $2,987 overhead

- $1,471 demand zone as ultimate support if breakdown occurs

Ethereum dropped from above $4,300 in late December to $1,588 on February 11, marking one of the sharpest corrections in years. The current consolidation near $2,000 represents a 26% recovery from those lows, but the structure remains decisively bearish. Multiple resistance levels stack overhead, creating significant friction for sustained recovery.

A daily close above $2,349 would reclaim the first major horizontal resistance and place $2,395 Supertrend back in range. Until that happens, every bounce remains a relief rally inside a corrective phase.

2-Hour Chart Shows Tight Consolidation

The 2-hour chart reveals Ethereum trapped in a narrow range between $1,957 and $2,023. Bollinger Bands show the middle band at $1,982, with the upper band at $2,008 and lower band at $1,957. Price is compressing between these bands, indicating reduced volatility after the sharp February moves.

The structure shows:

- All major EMAs converging between $1,986 and $2,023

- Tight Bollinger Band compression signaling potential breakout

- Price oscillating around the $2,000 psychological level

The EMA cluster and Bollinger Band compression suggest a significant move is approaching. When bands tighten to this degree, it typically precedes a breakout or breakdown. The direction of the move will depend on whether buyers can reclaim $2,023 or sellers break below $1,957.

A breakout above $2,023 would expand the Bollinger Bands and place $2,100 back in range. A breakdown below $1,957 would trigger another leg down toward $1,900 and eventually retest the $1,800 demand zone.

Outlook: Will Ethereum Go Up?

The next move depends on whether ETH can hold $1,957 and break above $2,023.

- Bullish case: A close above $2,023 with volume would break the compression and place $2,100 in range. Reclaiming $2,349 confirms the corrective phase is ending and shifts momentum back toward recovery.

- Bearish case: A breakdown below $1,957 exposes $1,900, with further downside toward $1,800 if selling pressure returns. Losing $1,800 retests the February lows near $1,588.

If Ethereum breaks above $2,023 and holds, momentum shifts toward continuation. Losing $1,957 turns the consolidation into a breakdown back toward $1,800.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.