- Ethereum consolidates within key Fibonacci zones as traders gauge next direction.

- Momentum slows but structure remains firm with strong EMA-based support zones.

- Rising institutional interest and Fusaka upgrade strengthen Ethereum’s mid-term outlook.

Ethereum’s short-term pullback has placed it in a crucial technical zone after its recent rally to $4,768. The current price near $4,339 reflects a controlled correction rather than a full reversal, with traders closely watching Fibonacci retracement levels and the next major network upgrade. The market’s reaction around $4,294 and $4,406 will likely define the next phase of momentum as investors balance technical signals and network fundamentals.

Consolidation Around Critical Fibonacci Zones

The current retracement of Ethereum is in line with Fibonacci levels between $3,820 and $4,768. Price has settled on the 0.5 retracement at $4,294 and the 0.618 retracement at $4,406. Such levels tend to be accumulation levels, at which short-run sellers tend to leave and long-run buyers tend to resume.

Intermediate support would be close to $4,294 and a more notable correction would be around $4,182 or $4,043. Resistance forms at $4,406 and $4,611, with a confirmed breakout above $4,611 potentially signaling a return to the $4,768 swing high. Consequently, traders view this zone as a make-or-break region that may set Ethereum’s direction into late October.

Related: Bitcoin Price Prediction: Polymarket and Ex PayPal Chief See $1.3M BTC

Momentum Weakens but Structure Holds

Moreover, moving averages indicate a stagnation in bullishness. The 20-EMA of $4,494 and the 50-EMA of $4,458 are flattening, with minimal upward pressure. This is backed up by the 100-EMA and 200-EMA, both slightly above $4,400, creating a confluence of support that strengthens the pivot of $4,294 as a defensive barrier.

Nonetheless, a price action falling below the 200-EMA may welcome short-term fluctuations to $4,182. Nevertheless, traders are hopeful that a recovery above $4,406 can trigger buying power again, backed by institutional buyers and the future developments.

Institutional Interest and Upcoming Fusaka Upgrade

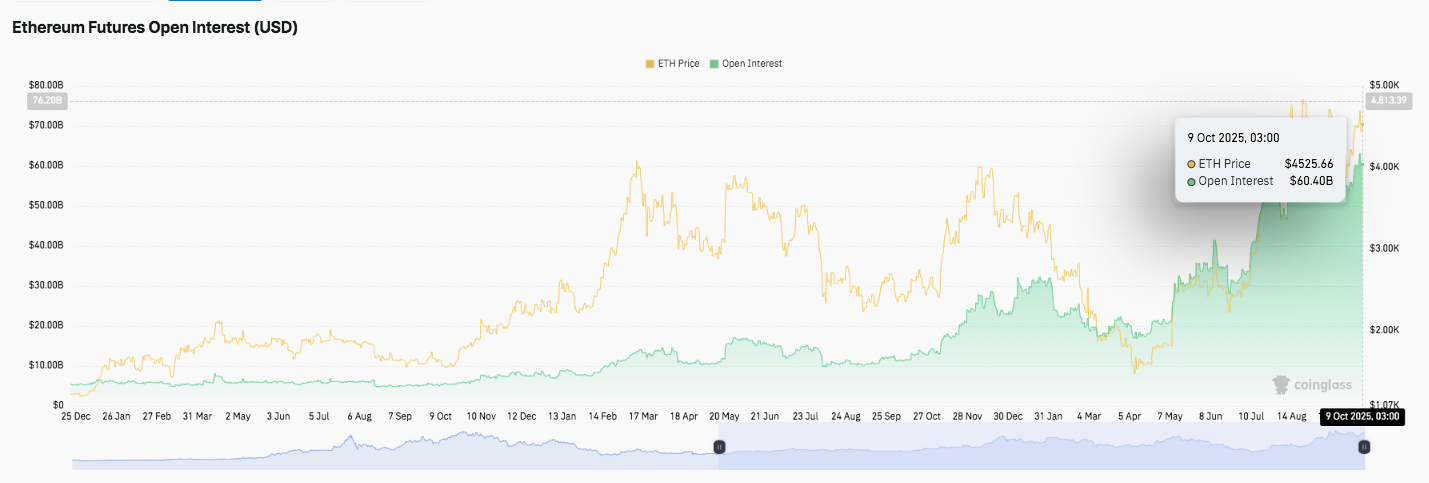

In addition, Ethereum futures open interest has reached a high of 60.4 billion, the highest it has been since the middle of the year. This increase points to growing trader confidence and high institutional investor involvement. It coincides with ETF-driven inflows that resumed interest in Ethereum following a summer lull.

Related: Dogecoin Price Prediction: DOGE Holds $0.25 as CleanCore Buys 710M Coins

Significantly, attention is also shifting toward the upcoming Fusaka upgrade. Now active on the Holesky testnet, it introduces PeerDAS, a system that divides Ethereum’s 128kB blobs into smaller fragments for efficient data handling. According to core developers, the mechanism improves scalability by nearly eightfold, reducing bandwidth and enabling smoother participation for smaller stakers.

Technical Outlook for Ethereum Price

Key levels remain tightly aligned as Ethereum trades near $4,340 after last week’s retracement.

- Upside levels: $4,406 and $4,611 are the next resistance zones, followed by $4,768 the previous swing high. A breakout above $4,611 could clear the path toward $4,950 and $5,120 if bullish volume returns.

- Downside levels: $4,294 and $4,182 form immediate supports, with deeper cushions at $4,043 and $3,820. The 200-day EMA near $4,358 remains a key line of defense for medium-term holders.

Ethereum’s price action is currently coiling within a mid-range Fibonacci channel, suggesting compression before a larger directional move. The flattening 20- and 50-day EMAs indicate reduced momentum, but long-term structure remains intact.

Will Ethereum Resume Its Uptrend?

The future direction of Ethereum in October depends on whether bulls will be able to defend the $4,294 to $4,182 zone and keep the interest in futures rising. Stability above $4,406 over a longer period may restart the movement to reach $4,768 and above, particularly with the Fusaka upgrade in sight. Nevertheless, a strong breakdown beneath $4,182 can result in a revealing of ETH to $4,043 or even 3,820 which will indicate a prolonged consolidation.

Related: PancakeSwap (CAKE) Price Prediction 2025–2030: Can Deflationary Tokenomics Drive Growth?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.