- Ethereum consolidates near key EMAs as traders await breakout confirmation

- Rising open interest and exchange outflows hint at strong accumulation phase

- Developer tensions highlight governance challenges amid scalability ambitions

Ethereum (ETH) is showing renewed volatility as traders watch both price compression and internal community tension unfold. After failing to sustain momentum above the $4,254 Fibonacci resistance, ETH has entered a corrective phase, consolidating below key exponential moving averages (EMAs). The 20-EMA at $3,947, 50-EMA at $3,987, and 100-EMA at $4,075 now form critical resistance zones limiting upside recovery. The broader trend remains cautious as market sentiment shifts amid rising derivatives activity and developer discord.

Price Consolidation and Key Support Levels

The 4-hour chart indicates that Ethereum’s price structure is tightening between the 0.382 Fibonacci level at $3,943 and the 0.236 retracement near $3,750. This compression reflects a short-term accumulation zone where traders await confirmation of direction. A close below $3,850 could expose ETH to deeper losses toward $3,750 and possibly $3,439, its recent local low.

However, if buyers defend the $3,850–$3,900 area, the first resistance challenge lies at $4,075, aligned with the 100-EMA. A decisive break above $4,166, near the 200-EMA, would signal a reversal and open paths toward $4,254 and $4,476.

Related: Bitcoin Price Prediction: BlackRock Selling Challenges Bullish Sentiment

Consequently, ETH’s next move hinges on its ability to hold above $3,850. The zone between $3,400 and $3,450 remains a safety net if selling pressure intensifies. Higher timeframe support at $3,750 continues to attract buyers expecting a rebound, especially if Bitcoin stabilizes above $108,000.

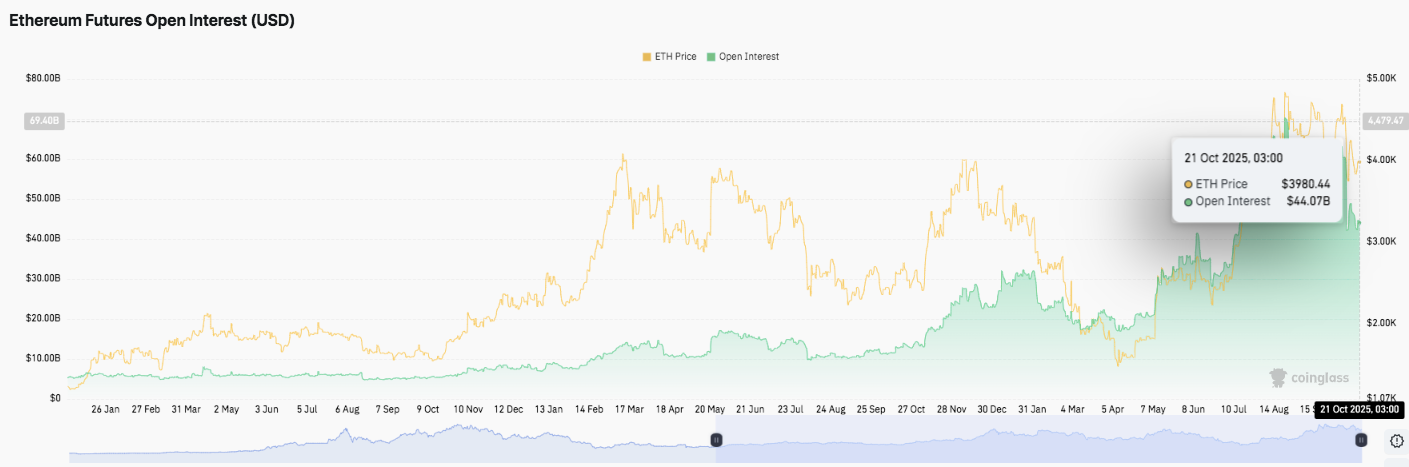

Futures Market Shows Strong Participation

Significantly, Ethereum’s futures open interest has more than doubled in 2025, rising above $44 billion by mid-October. This growth indicates robust trader participation and capital inflows.

The correlation between open interest and spot price suggests speculative demand is building, often preceding larger price movements. Sustained growth in both metrics reflects renewed institutional confidence and could trigger a volatility expansion phase as traders position for a breakout.

On-Chain Outflows Signal Accumulation

Moreover, Ethereum’s spot outflows have dominated October, with nearly $97.6 million exiting exchanges on October 21. These consistent outflows suggest investors are shifting assets to self-custody or staking, signaling supply reduction on exchanges. Historically, such patterns precede medium-term recoveries once selling stabilizes.

Developer Rift Raises Community Tension

Amid these market shifts, Ethereum’s leadership faces internal strain. Core developer Péter Szilágyi recently accused founder Vitalik Buterin and his inner circle of holding excessive control over network decisions.

Related: Cardano Price Prediction: ADA Faces Range-Bound Pressure as Momentum Cools

In response, Buterin acknowledged the challenges while commending Polygon’s role in Ethereum’s scalability drive. Analysts believe the ongoing debate underscores the growing pressure within Ethereum’s ecosystem as it targets a 10x scalability milestone within a year.

Technical Outlook for Ethereum (ETH) Price

Key levels remain well-defined as Ethereum enters its next consolidation phase. Upside levels: $4,075, $4,254, and $4,476 act as immediate resistance zones. A confirmed breakout above $4,254 could extend the rally toward $4,600 and $4,850.

Downside levels: $3,850 forms the near-term pivot support, followed by $3,750 and $3,439 the recent local low. The 200-EMA at $4,166 stands as the medium-term ceiling that bulls must reclaim to shift momentum decisively upward.

The technical picture shows Ethereum compressing between the 0.382 and 0.236 Fibonacci zones ($3,943–$3,750), suggesting an accumulation range before the next trend expansion. A decisive move above $4,075 (100-EMA) could signal renewed bullish control, while a breakdown below $3,750 risks opening a path toward $3,400–$3,450.

Will Ethereum Rebound?

Ethereum’s near-term trajectory depends on how it reacts around the $3,850–$3,900 support range. Sustained defense at this level could trigger renewed momentum toward $4,254 and higher.

Related: Chainlink Price Prediction: Will Fed Recognition And Oracle Strength Be Enough To Halt The Slide?

However, failure to hold may expose ETH to deeper corrections before the next recovery leg. With rising open interest and consistent exchange outflows, volatility expansion appears imminent, hinting that Ethereum could soon break out of its tightening range.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.