- Ethereum stabilizes near $3,350 as futures activity signals renewed investor focus

- Rising open interest above $39B highlights institutional confidence in ETH recovery

- Persistent exchange outflows suggest growing accumulation and reduced selling pressure

Ethereum (ETH/USD) is showing renewed stability after weeks of downward pressure, signaling potential recovery momentum in the broader crypto market. The asset found a temporary base near the $3,320–$3,350 region, where buyers stepped in to defend key technical levels. This stabilization coincides with increasing participation in Ethereum futures, suggesting renewed investor engagement despite ongoing volatility.

Price Structure and Key Technical Levels

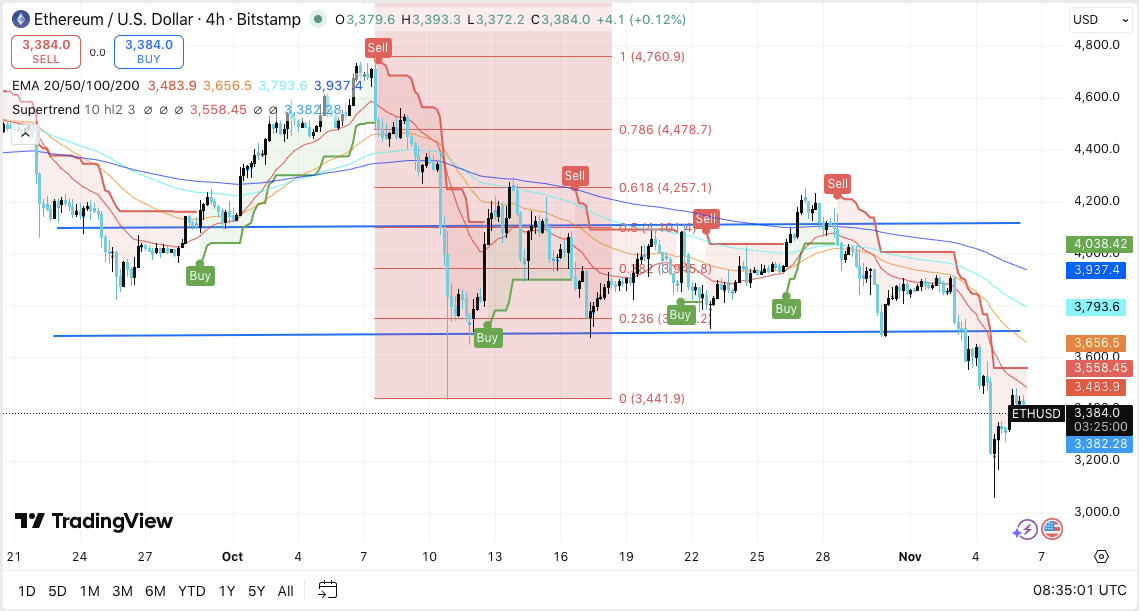

On the 4-hour chart, Ethereum is consolidating above a critical support zone near $3,382, with a secondary cushion at $3,320. Holding above these levels is crucial to maintain short-term structure.

The first resistance level appears at $3,558, aligning with the Supertrend resistance line. Beyond this, the $3,656–$3,793 band hosts a dense cluster of the 20- and 50-day exponential moving averages, which traders are closely monitoring for directional confirmation.

A decisive break above $3,937 could validate a bullish continuation toward $4,038, where the 200-EMA and psychological resistance converge. Conversely, failure to sustain above $3,382 could trigger a pullback toward $3,200, exposing Ethereum to deeper correction risk.

Market Dynamics and Derivatives Activity

Ethereum’s derivatives market continues to show strong participation, underscoring rising speculative activity. Futures open interest rose to $39.99 billion on November 6, marking one of the highest levels this quarter.

This trend indicates expanding liquidity and capital flow into Ethereum-linked derivatives. Besides, the steady increase in open interest since early 2025 suggests institutional traders remain active, betting on mid-term recovery prospects.

However, fluctuations in open interest during October reflected profit-taking behavior and market repositioning as investors adjusted to wider crypto market volatility. Hence, sustained momentum above $3,650 remains essential to confirm a genuine reversal rather than a temporary relief rally.

Exchange Outflows and Investor Sentiment

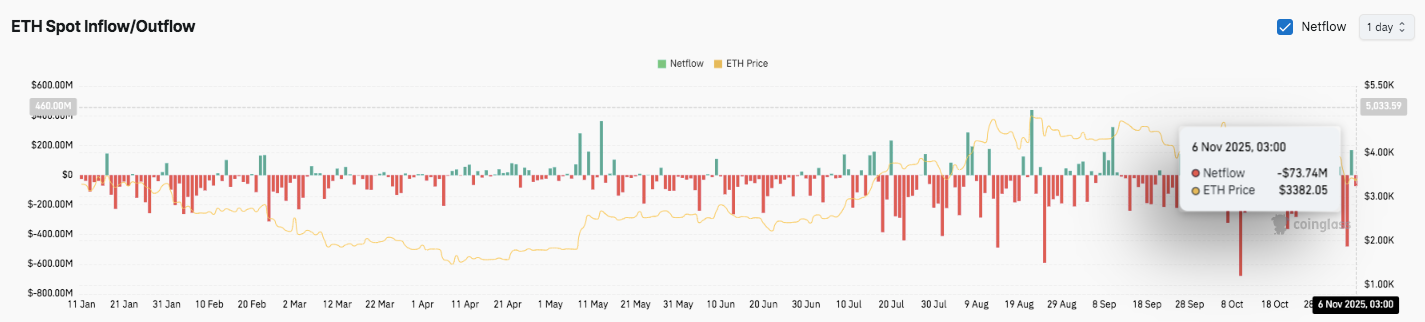

Ethereum’s on-chain data reveals consistent negative netflows, with $73.74 million in outflows recorded on November 6. This shows stronger withdrawals than deposits across major exchanges. Historically, such patterns often align with accumulation trends, as coins move from exchanges to cold storage.

Moreover, the persistence of red netflow bars since mid-October highlights investor caution. Although this trend reduces exchange liquidity, it may eventually limit selling pressure if long-term holders dominate activity. Consequently, for a stronger recovery, fresh inflows are needed to stabilize liquidity and confirm renewed bullish conviction across trading platforms.

Technical Outlook for Ethereum (ETH/USD) Price

Key levels remain well-defined heading into November. Upside hurdles appear at $3,558, $3,656, and $3,793, aligned with short-term resistance clusters and EMA intersections. A decisive breakout above $3,937 (100-EMA) could propel Ethereum toward $4,038 and $4,257, where the 200-EMA and 0.618 Fibonacci retracement converge.

On the downside, immediate support rests near $3,382, followed by a stronger base at $3,320. If sellers regain control below this zone, Ethereum risks a deeper retracement toward $3,200, the next structural support level. The 20- and 50-EMA cluster around $3,650 remains the primary level to flip for medium-term bullish momentum.

The current chart suggests ETH is compressing between $3,320 and $3,650, forming a consolidation channel that could trigger a volatility breakout in either direction. The Supertrend indicator continues to issue a Sell signal, but decreasing downside pressure and improving futures participation hint at early accumulation.

Will Ethereum Regain Momentum?

Ethereum’s short-term direction depends on whether buyers can defend $3,320 and reclaim the $3,650–$3,790 resistance range. Sustained strength above this band could confirm a bullish reversal and open the path toward $4,038 and $4,257.

However, a rejection near $3,650 without significant inflows could reintroduce selling pressure, exposing ETH to $3,200 and lower. Historical behavior near similar retracement zones shows Ethereum often consolidates before major trend expansions. Consequently, the next few sessions may determine whether this stabilization marks the beginning of a broader recovery or an extended sideways phase.

For now, Ethereum remains in a pivotal range. Futures inflows and exchange outflows both highlight cautious optimism, but traders will need confirmation through stronger volume and sustained closes above $3,650 to validate a bullish continuation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.