- Ethereum price today holds $3,946, supported by its long-term trendline near $3,850.

- Resistance sits at $4,032 and $4,134, with liquidity clusters forming above $4,200.

- CPI data and Fed policy loom as catalysts that could trigger a breakout or deeper retest.

Ethereum price today trades near $3,946, holding a modest gain after bouncing from recent lows. The token remains supported by its long-term ascending trendline but faces pressure from clustered resistance levels. Traders are now weighing liquidity data, exchange flows, and macro catalysts ahead of critical U.S. economic events.

Buyers Defend Ascending Trendline

The daily chart shows Ethereum respecting its rising trendline from July, with buyers stepping in around the $3,850 zone. This ascending base remains the key structure that has contained ETH price action for months, keeping the broader uptrend intact.

ETH continues to struggle below its 20-day and 50-day EMAs, with resistance stacked at $4,032 and $4,134. Above these levels, the declining trendline from September’s highs near $4,800 looms as a structural ceiling. Until these levels are reclaimed, Ethereum price action remains compressed between long-term support and short-term resistance.

Related: Bitcoin Price Prediction: BTC Rebounds Ahead of Trump–Xi Meeting

The RSI hovers near 45, reflecting neutral momentum after weeks of selling pressure. A sustained move above 50 would signal the start of a potential bullish reversal.

Exchange Flows Hint At Near-Term Relief

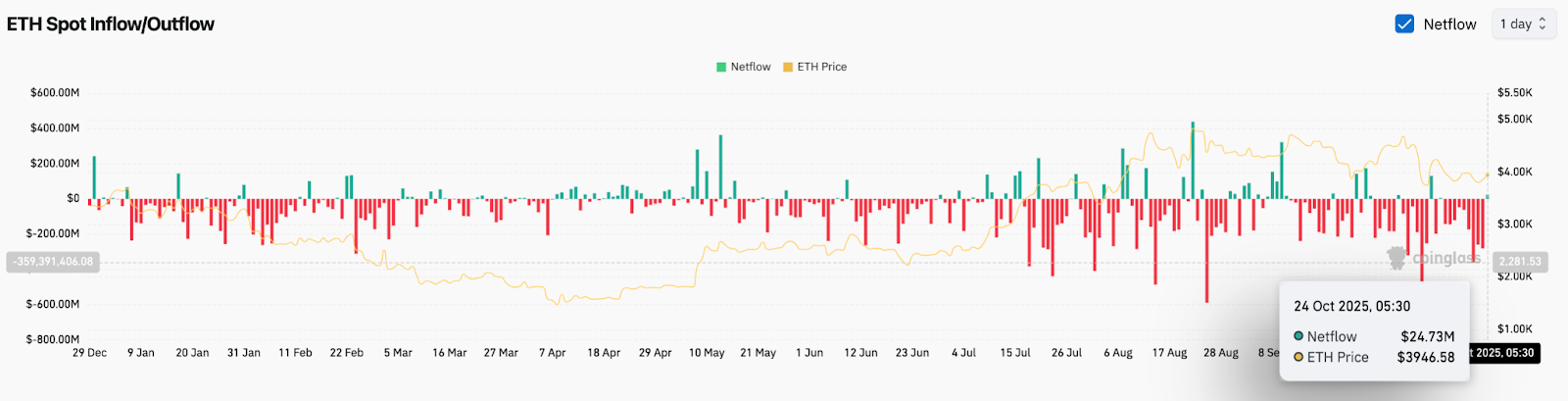

Spot exchange flow data highlights modest inflows of $24.7 million on October 24, a small shift compared to weeks of persistent outflows. While this suggests traders are taking profit into strength, the overall outflow trend since September still reflects reduced exchange supply which is often a supportive factor for price.

Ethereum price volatility has mirrored these flow swings, with downside tests toward $3,800 coinciding with heavy inflow days. If outflows resume, it would bolster confidence in holding the trendline and open room for a push toward $4,200.

Liquidity Clusters At $4,200 Attract Traders

Liquidity heatmaps shared by market analysts show dense buy and sell orders stacked above $4,200, creating a zone where short covering could accelerate. With sentiment broadly bearish in October, the risk of a sharp squeeze grows if ETH price reclaims resistance zones.

Related: Shiba Inu Price Prediction: Holder Base Hit 1.54M But Key Support Faces Pressure

Macro catalysts add weight to this setup. CPI data due today could fuel volatility across risk assets, while the Federal Reserve’s policy meeting next week may provide direction for liquidity flows. The U.S.-China summit also looms, with expectations of trade agreements influencing investor risk appetite.

Outlook: Will Ethereum Go Up?

The Ethereum price prediction remains balanced. Bulls must defend the $3,850–$3,880 trendline zone to keep the long-term structure intact. A clean break above $4,134 and follow-through toward $4,200 would trigger bullish momentum, with scope for a retest of $4,400.

On the downside, failure to hold the ascending base could expose ETH to deeper tests at the 200-day EMA near $3,576. That level marks the final buffer before the broader uptrend risks breakdown.

For now, Ethereum price action hinges on flows and macro catalysts. If outflows resume and liquidity clears above $4,200, ETH could shift momentum back in favor of buyers. A rejection here, though, would likely extend the consolidation phase and keep volatility elevated into the FOMC decision.

Ethereum Forecast Table (Oct 25, 2025)

| Indicator | Level/Signal | Implication |

| Current Price | $3,946 | Holding above ascending support |

| Key Support | $3,850 / $3,576 | Must hold to preserve uptrend |

| Key Resistance | $4,032 / $4,134 | Breakout needed for bullish shift |

| RSI (14) | 45 | Neutral, needs >50 for momentum |

| Exchange Flows | +$24.7M inflow | Mixed, relief rally possible |

| Liquidity Zone | $4,200 | Cluster may spark squeeze |

Related: Pi Price Prediction: Pi Price Stabilizes Amid 3.36M KYC Approvals

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.