- Ethereum trades at $3,870 after $400M ETF outflows led by $118M in BlackRock redemptions.

- Futures open interest rises to $47.2B as leverage skews long despite weak spot demand.

- Key support at $3,600 holds within symmetrical triangle, keeping breakout hopes intact.

Ethereum price today trades near $3,870, posting a modest 1.7% rebound after a volatile session that saw ETF outflows pressure sentiment. The broader market tone remains cautious as institutional selling from BlackRock and others caps upside momentum despite rising futures open interest.

Heavy ETF Outflows Weigh on Ethereum Price Action

Ethereum price action continues to struggle beneath its $4,000 resistance zone, constrained by consecutive ETF redemptions. Data shared by market analyst Ted Pillows shows a $184 million net outflow from spot ETH ETFs on October 30, led by $118 million in sales from BlackRock.

The move reflects renewed institutional caution following recent macro softness and uncertainty in staking yields. Across the week, total ETF outflows have exceeded $400 million, weakening the near-term demand structure for Ethereum even as on-chain metrics hold steady.

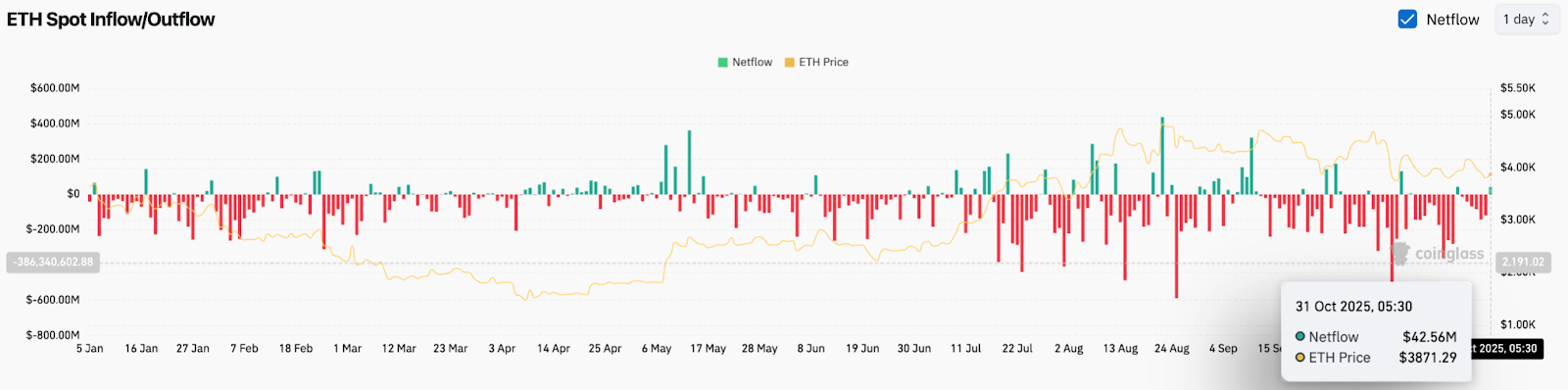

Spot Outflows Suggest Traders Are Taking Profit

CoinGlass data confirms deepening spot net outflows totaling $386 million this week, with only limited offsetting inflows. The consistent red bars indicate sustained selling from large holders as price fluctuates around the ascending trendline near $3,600.

Related: XRP Price Prediction: XRP Poised for Breakout Ahead of ETF Approval

This behavior points to defensive positioning among traders, many of whom appear to be rotating into stablecoins or short-term instruments ahead of November’s macro data cycle. Despite that, short-term netflow turned slightly positive at $42 million, hinting that some accumulation is quietly returning at lower levels.

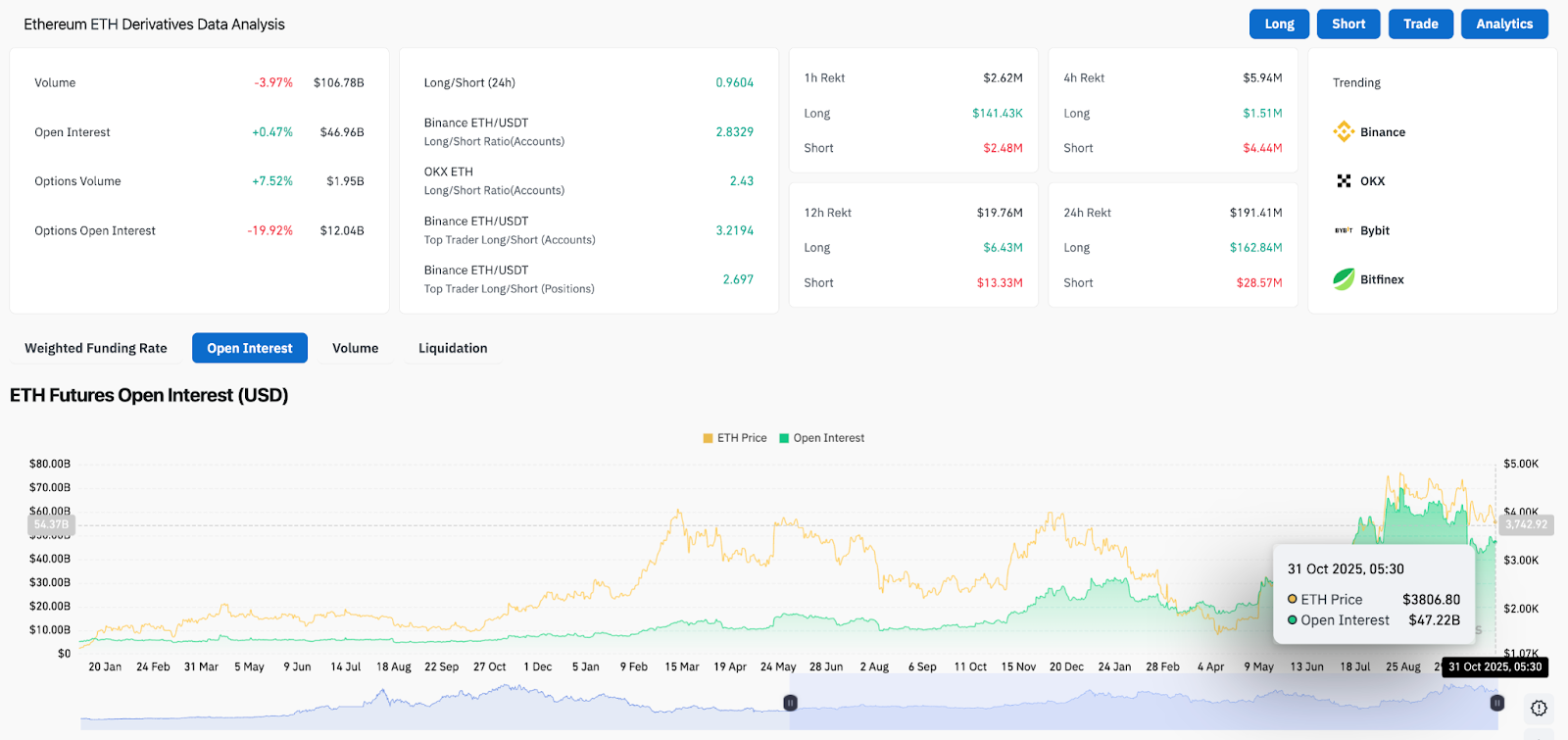

Futures Data Shows Leverage Still Active

In derivatives markets, Ethereum’s open interest has climbed to $47.2 billion, up 0.47% on the day, reflecting that traders remain engaged despite spot selling. Long/short ratios on Binance and OKX sit above 2.6, suggesting leverage is skewed toward the long side.

Yet, liquidation data reveals $28.5 million in short positions wiped out in the last 24 hours, signaling aggressive positioning amid high volatility. Funding rates have normalized, which may support a short-term bounce, but a deeper rally will require confirmation from volume expansion and consistent ETF inflows.

Technical Structure Tightens Ahead of Breakout

Technically, Ethereum trades inside a large symmetrical triangle pattern stretching back to April. The upper boundary aligns near $4,460, while the lower ascending trendline provides strong support around $3,600.

Related: Bitcoin Price Prediction: BTC Holds Strong as Market Eyes Breakout

The 20-day EMA near $3,990 acts as immediate resistance, followed by the 50-day EMA at $4,092, both of which must be reclaimed to confirm bullish intent. On the downside, the 200-day EMA at $3,603 is a key level to watch — a decisive break below it could extend losses toward $3,300.

Momentum indicators suggest neutrality, with RSI near 46 and a flat MACD histogram, reflecting that Ethereum remains in a consolidation phase awaiting a breakout trigger.

Outlook: Will Ethereum Go Up?

For now, the Ethereum price prediction stays balanced between bullish resilience and institutional pressure. A rebound above $4,000 could attract fresh momentum and set up a retest of the $4,460 resistance, where a breakout would target $4,800–$5,000.

Conversely, sustained ETF outflows or a breakdown below $3,600 could deepen losses toward $3,300, potentially testing the integrity of the year-long ascending trendline.

Ethereum’s broader outlook depends on whether inflows return to ETF products and if macro sentiment stabilizes in early November. Until then, traders should monitor volume near $3,800–$4,000 for clues on the next directional move.

Related: Solana Price Prediction: Bears Target Key Support Level as Momentum Fades

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.