- Ethereum trades near $4,456, with $4,800 breakout eyed for targets at $5,000–$5,200.

- Jack Ma’s reported Ethereum reserve boosts optimism and draws market attention.

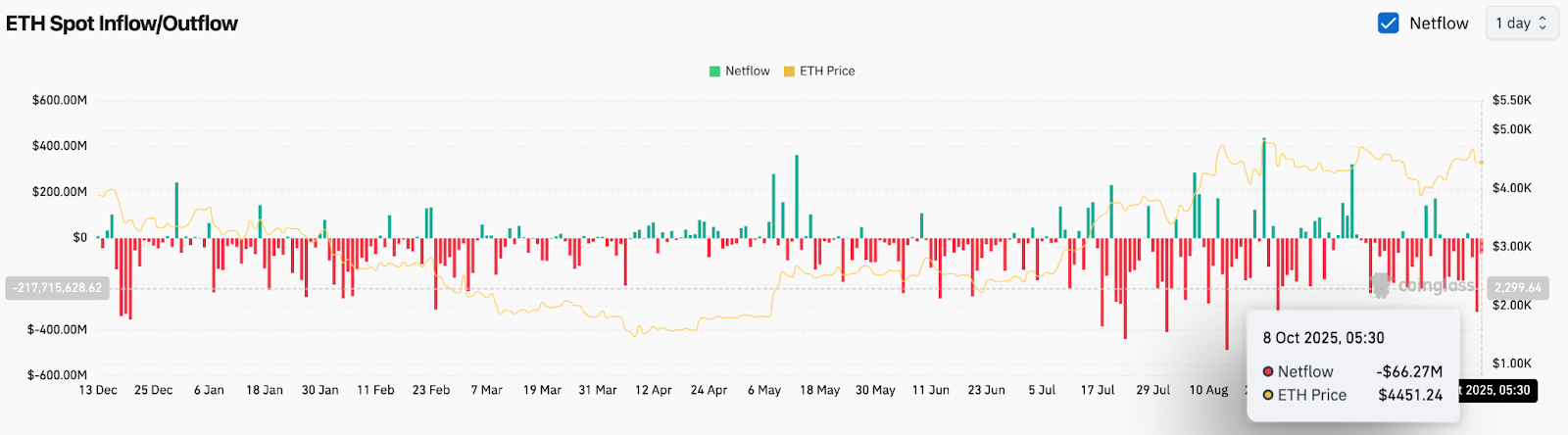

- Net outflows of $66M show profit-taking, but derivatives data supports bullish bias.

Ethereum (CRYPTO: ETH) price today is trading near $4,456, consolidating just below a critical descending trendline that has capped upside attempts since August. The market is holding above its short-term supports, with buyers defending the $4,390–$4,290 zone where the 20-day and 50-day EMAs converge.

Ethereum Price Holds Ascending Support

On the daily chart, Ethereum continues to trade within an ascending triangle pattern, defined by rising support from June and a horizontal ceiling near $4,750–$4,800. This structure suggests an impending breakout as price nears the triangle apex.

Momentum indicators remain neutral but stable. The RSI sits around 53, showing room for movement in either direction. Meanwhile, the 20-day EMA at $4,390 and 100-day EMA at $3,964 reinforce the broader uptrend. A close above $4,800 would signal the continuation of the bullish phase and open a path toward $5,000–$5,200, while a failure to hold $4,290 could expose deeper pullbacks to $3,960.

Related: Monero Price Prediction: Bulls Eye $343 as Market Interest Rebounds

Outflows Resume Despite Derivatives Strength

According to Coinglass, Ethereum recorded $66 million in net outflows on October 8, indicating mild profit-taking after last week’s rally. While short-term outflows often cool overheated price action, persistent weakness in exchange balances has historically preceded mid-cycle consolidations.

Still, the outflow comes amid a sharp 55% jump in trading volume over 24 hours, signaling heightened activity rather than panic exits. This contrast suggests traders are rotating capital rather than leaving the market entirely, a dynamic often seen before structural breakouts.

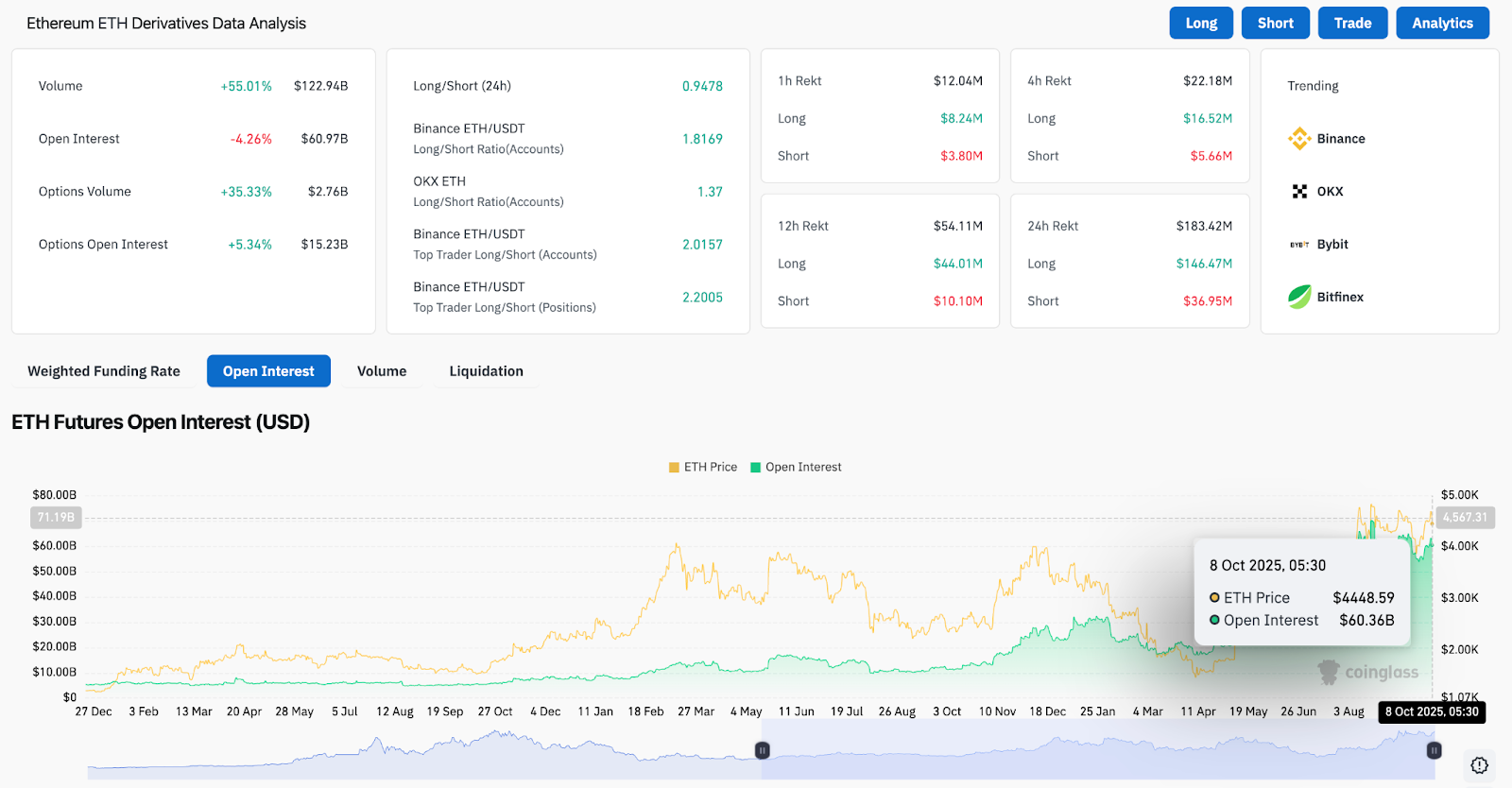

Derivatives Show Mixed Sentiment

Derivatives data shows open interest at $60.9 billion, down 4% on the day, while options open interest climbed to $15.2 billion. The shift points to traders reducing leveraged positions but increasing exposure through hedged strategies.

Notably, the Binance long/short ratio stands at 2.02, showing top traders maintaining a strong long bias. Over $180 million in positions were liquidated over 24 hours, with $146 million in long positions, reflecting aggressive profit-taking after Ethereum’s latest upswing.

Related: Stellar Price Prediction: XLM Consolidates Near $0.40 as Traders Watch for Breakout

If open interest continues to normalize while options volumes rise, it would imply consolidation before a potential volatility expansion.

Jack Ma’s Ethereum Reserve Sparks Investor Optimism

Market sentiment received a fresh boost after Crypto Rover reported that Jack Ma is building a strategic Ethereum reserve, a headline that quickly gained traction among traders. Although the details remain unverified, the post has drawn parallels to corporate accumulation trends seen earlier in Bitcoin’s cycle.

Such narratives tend to attract speculative inflows, especially from Asian markets where Ethereum’s developer adoption and staking participation have expanded rapidly. The combination of symbolic investor confidence and technical positioning could drive renewed interest above the $4,800 resistance.

Technical Outlook For Ethereum Price

Ethereum price prediction for the near term revolves around these key levels:

- Upside targets: $4,800, $5,000, and $5,200 if bullish momentum returns.

- Downside supports: $4,390, $4,290, and $3,960 as near-term defense zones.

- Trend support: $3,500 (200-day EMA), marking the longer-term line of control.

A sustained close above $4,800 would validate the ascending triangle breakout and potentially mark the beginning of Ethereum’s next impulse wave.

Outlook: Will Ethereum Go Up?

Ethereum remains in a constructive technical position as long as price holds above the $4,290–$4,390 band. Despite short-term outflows, derivatives data and accumulation headlines suggest the market retains a bullish undertone.

Related: Cronos (CRO) Price Prediction: Traders Eye Breakout as Open Interest Surges

If buyers can reclaim $4,800, the breakout could accelerate toward $5,200, reaffirming Ethereum’s leadership in the ongoing market cycle. Conversely, failure to defend support would signal extended consolidation before the next major move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.