- Ethereum struggles below $4,000 as 200-day EMA limits bullish recovery momentum

- Institutional activity rises with $47B futures open interest showing strong demand

- On-chain outflows and network growth signal sustained investor accumulation trend

Ethereum (ETH) is showing signs of renewed volatility after its price failed to hold above the $4,000 mark. The cryptocurrency is currently trading near $3,892, reflecting a mild bearish tone as it consolidates below a crucial resistance region. This move follows multiple failed attempts to regain the 200-day exponential moving average (EMA), which continues to act as a ceiling for upward momentum.

Price Action and Key Technical Levels

Ethereum’s chart shows the 50% Fibonacci retracement level at $4,101 serving as the near-term resistance. The 38.2% level at $3,949 is another key zone to monitor, as a break above could open the path toward $4,257. On the downside, immediate support lies near the 23.6% Fibonacci level at $3,753, which aligns with prior demand zones from mid-October.

If Ethereum maintains its footing above $3,753, it could stabilize before making another attempt at higher resistance levels. However, sustained trading below $3,900 could encourage further downside pressure toward $3,441, marking the full retracement of the previous swing. Hence, traders are watching whether ETH can decisively close above $4,100 to confirm a bullish reversal.

Related: XRP Price Prediction: Massive Whale Accumulation Clashes With Weak Flows

Derivatives and Institutional Trends

Open interest in Ethereum futures has reached $47.03 billion, signaling strong institutional activity. This steady rise since mid-2025 highlights growing confidence among professional traders. The data also suggests that large investors are building long-term positions rather than engaging in short-term speculation.

Besides, the divergence between steady open interest and low volatility indicates active hedging strategies. If open interest remains above $45 billion, analysts expect an extended bullish phase supported by institutional inflows.

On-Chain Momentum Strengthens

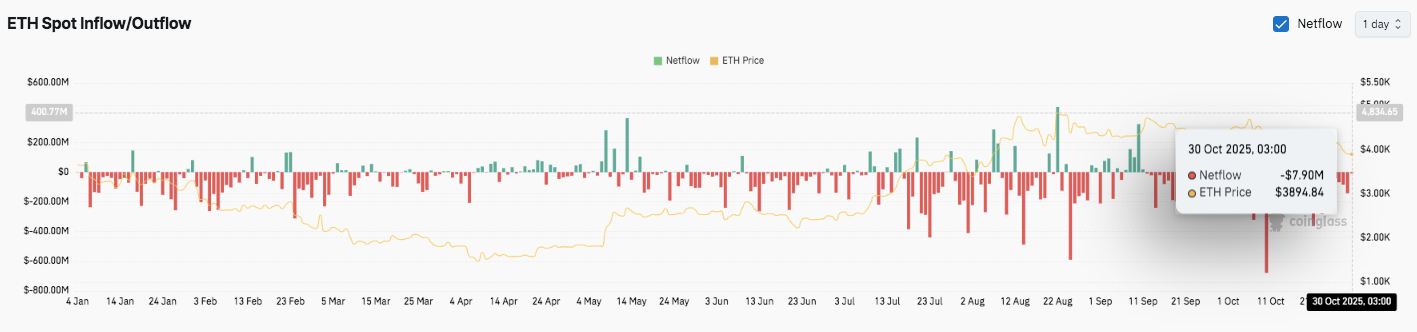

Ethereum’s on-chain data reinforces the optimistic outlook. Exchange netflows show persistent outflows throughout 2025, with investors withdrawing assets from trading platforms. On October 30, outflows totaled $7.90 million as ETH traded near $3,894. This pattern often reflects accumulation and reduced selling pressure.

Moreover, Token Terminal data reveals that Ethereum’s Layer-1 network has achieved record transaction and user activity. Daily transaction counts and active addresses have surged, fueled by rising use of DeFi platforms and NFTs. The network’s ability to handle this activity efficiently shows improved scalability and strong demand for on-chain services.

Related: Dogecoin Price Prediction: DOGE Consolidates as Open Interest Climbs

Technical Outlook for Ethereum Price

Ethereum (ETH) price remains in consolidation after facing rejection at the $4,100 resistance level. The asset trades near $3,892, with key support and resistance levels defining the next directional move.

- Upside levels: $3,949 and $4,101 act as immediate resistance zones, aligned with the 38.2% and 50% Fibonacci retracements. A sustained breakout above $4,101 could trigger momentum toward $4,257 and possibly $4,478.

- Downside levels: The 23.6% Fibonacci level at $3,753 remains the key short-term support. A decisive break below this floor may expose ETH to deeper correction targets near $3,441 the full retracement of its prior upswing.

- Resistance ceiling: The 200-day EMA near $4,089 stands as the main barrier to reclaim medium-term bullish control. Closing above this level would confirm a reversal toward the $4,250–$4,480 range.

The technical structure suggests ETH is trading within a compression phase between $3,750 and $4,100, where a breakout in either direction could drive strong volatility expansion.

Will Ethereum Reclaim $4,000?

Ethereum’s short-term trend depends on buyers defending the $3,753 zone while maintaining futures open interest above $45 billion. Sustained exchange outflows and growing institutional positioning indicate underlying accumulation.

If bullish inflows strengthen and price closes above $4,100, ETH could regain upward momentum toward $4,257 and $4,478. However, a failure to hold above $3,753 may trigger renewed selling pressure toward $3,441.

Related: Bitcoin Price Prediction: Analysts Warn Of Deeper Pullback as BlackRock Sells $2B BTC

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.