- Ethereum price today trades near $4,048 after reclaiming the $4,000 level, with buyers defending $3,900 support.

- UK approval of retail Bitcoin and Ethereum ETPs sparks optimism, potentially driving long-term inflows.

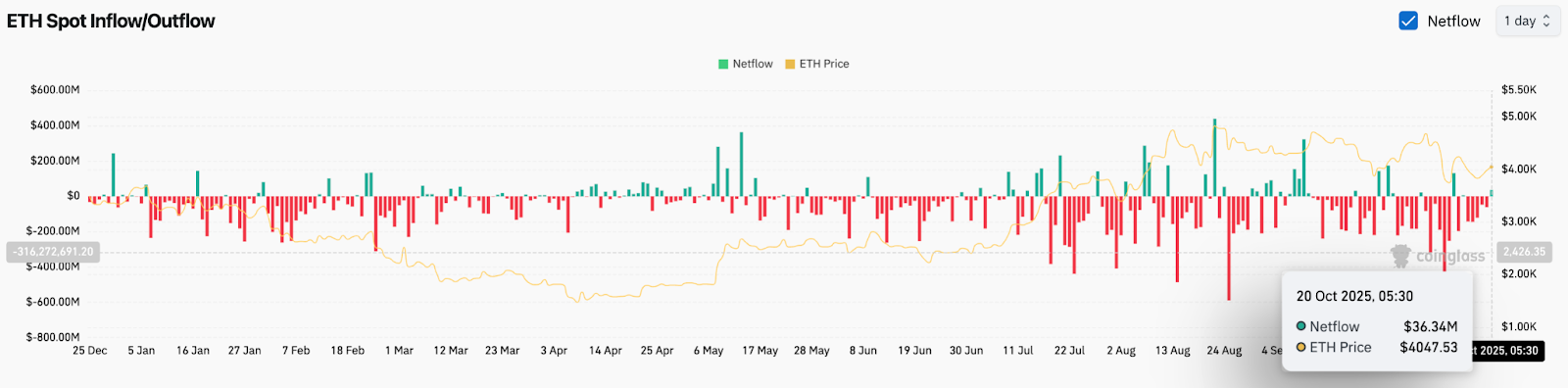

- Exchange netflows show $36.3M in ETH inflows, suggesting sellers are losing momentum after weeks of heavy outflows.

Ethereum (CRYPTO: ETH) price today trades near $4,048, testing resistance after reclaiming the $4,000 psychological mark. Buyers are attempting to extend gains from last week’s $3,700 low, but the token remains capped under the descending trendline that has shaped the market since early September. With UK regulators approving retail access to crypto exchange-traded products, investors now weigh whether this catalyst is enough to drive ETH out of its consolidation zone.

Buyers Defend Key Support Around $3,900

ETH price action has been volatile through October, with sharp selloffs breaking below major moving averages before buyers stabilized the market. The $3,900–$4,000 region has repeatedly acted as a demand zone, supported by the 100-EMA cluster.

On the 4-hour chart, Ethereum is pressing against the Supertrend resistance near $4,100, aligned with the 50-EMA. A breakout above this level would open a path toward $4,180 and potentially $4,300. Failure to hold above $4,000, however, risks a retest of $3,850, where ascending trendline support is building.

Traders note that Ethereum price volatility has narrowed, with compression suggesting an imminent move. The near-term question is whether inflows from new ETP listings can offset broader selling pressure.

UK Retail ETP Approval Sparks Optimism

The fundamental driver this week is the UK Financial Conduct Authority’s decision to lift a four-year retail ban on crypto ETNs, opening access to Bitcoin and Ethereum ETPs on the London Stock Exchange.

Asset managers 21Shares, Bitwise, and WisdomTree have all launched ETH products, while BlackRock listed its iShares Bitcoin ETP. Analysts see this as a landmark move for European markets, expanding access to millions of retail investors via standard brokerage accounts.

Related: Solana Price Prediction: Traders Eye Key Breakout as Market Stabilizes

For Ethereum, the addition of staking-backed products with reduced fees could attract long-term flows. Market participants argue that easier access through regulated channels improves sentiment and bolsters the bull case for ETH. Still, traders caution that immediate demand may be gradual as investors assess risks.

Exchange Flows Show Mixed Positioning

On-chain data from Coinglass highlights that ETH netflows flipped positive on October 20, with $36.3 million in inflows coinciding with price recovery to $4,047. While modest, this marks a shift from heavy outflows seen earlier in the month, where single-day losses exceeded $300 million.

Sustained outflows in prior weeks had amplified downside risk, but the latest stabilization suggests sellers may be losing momentum. Analysts say further confirmation is needed, with larger inflow streaks required to sustain a broader rally.

The Ethereum price update shows that retail demand from the UK launch could help reinforce this trend if exchange balances continue to contract, reducing immediate selling supply.

Technical Outlook: Upside Hinges On $4,100 Break

For the near term, the Ethereum price prediction depends on whether bulls can reclaim $4,100. Clearing this barrier would confirm momentum, setting targets at $4,300 and $4,500. Above this, the descending trendline near $4,650 becomes the key obstacle before a push toward $4,800.

On the downside, immediate support rests at $4,000, followed by $3,850. A break below the rising trendline would expose ETH to $3,700 and $3,500, zones where buyers previously staged strong rebounds.

Outlook: Will Ethereum Go Up?

Ethereum’s outlook for October 21 remains balanced. The launch of regulated ETH ETPs in the UK is a significant sentiment boost, but technical confirmation is still needed. A breakout above $4,100 would likely invite further momentum, while failure to hold $4,000 risks another swing lower.

For now, the Ethereum price action is caught between strong fundamental support from ETP adoption and technical resistance overhead. Traders will be watching exchange flows and volume closely to judge whether this bounce has enough conviction to turn into a full recovery.

Related: Pump.fun Price Prediction: PUMP Price Defends Structural Support

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.