- Ethereum’s RSI at 38.49 suggests it may be oversold, signaling a possible price reversal if confirmed by other indicators.

- Mixed sentiment in Ethereum’s derivatives market shows decreased open interest but increased options trading volume.

- Large holders dominate 89% of Ethereum supply, creating potential volatility if significant selling occurs in the market.

Ethereum’s realized price has held steady, even as the market experienced a significant downturn over the past five months, according to a new analysis by CryptoQuant. This price level has historically acted as strong support, and when Ethereum’s performance surpasses it, it has often signaled the start of altcoin bull markets. Traders are keenly observing these trends for any signs of an upward shift.

Currently, Ethereum’s price is $2,500.09, with a 24-hour trading volume of $13.78 billion. It has slipped 2.37% in the past 24 hours, and its market cap is valued at $300.76 billion. There are approximately 120.3 million ETH coins in circulation.

The Relative Strength Index (RSI) on the daily chart reads 38.49, which suggests that Ethereum might be oversold and could see a price reversal. Traders are monitoring other technical indicators and market conditions to confirm any potential trends before making trading decisions.

Moreover, Ethereum’s Moving Average Convergence Divergence (MACD) indicator is slightly above the signal line, hinting at a potential bullish trend. This technical setup could present a buying opportunity for traders looking to capitalize on prospective price increases.

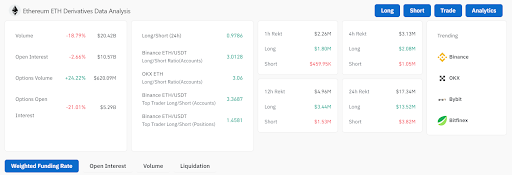

However, sentiment in Ethereum’s derivatives market is mixed, with recent data showing an 18.79% decrease in trading volume to $20.42 billion. Open interest also dipped by 2.66% to $10.57 billion, reflecting cautious market behavior.

On the other hand, options trading activity experienced growth, with volume surging by 24.22% to $620.09 million. Nevertheless, options open interest dropped by 21.01% to $5.29 billion. Long/short ratios indicate a slight preference for shorts overall, but exchanges like Binance and OKX exhibit a strong long bias.

Liquidations over the past 24 hours totaled $17.34 million, with $13.52 million coming from long positions. Despite these notable long liquidations, traders on major platforms remain bullish, with exchanges like Binance and OKX playing a key role in Ethereum derivatives trading.

A closer look at Ethereum’s market dynamics shows that only 8% of holders are currently in profit, while 71% are at a loss, highlighting the challenging market conditions. Large holders dominate with 89% ownership of Ethereum, suggesting potential volatility if these entities decide to sell.

In addition, Ethereum’s strong correlation of 0.73 with Bitcoin indicates that its price movements are often tied to Bitcoin. Most Ethereum holders (64%) have held their positions for 1-12 months, while 35% are newer investors.

High-value transactions above $100,000 reached $3.6 billion in the past week, indicating strong interest from high-net-worth individuals. Besides, netflows on exchanges amounted to $1.86 million, showing active trading. Geographically, trading participation is balanced, with 52% coming from the West and 48% from the East.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.