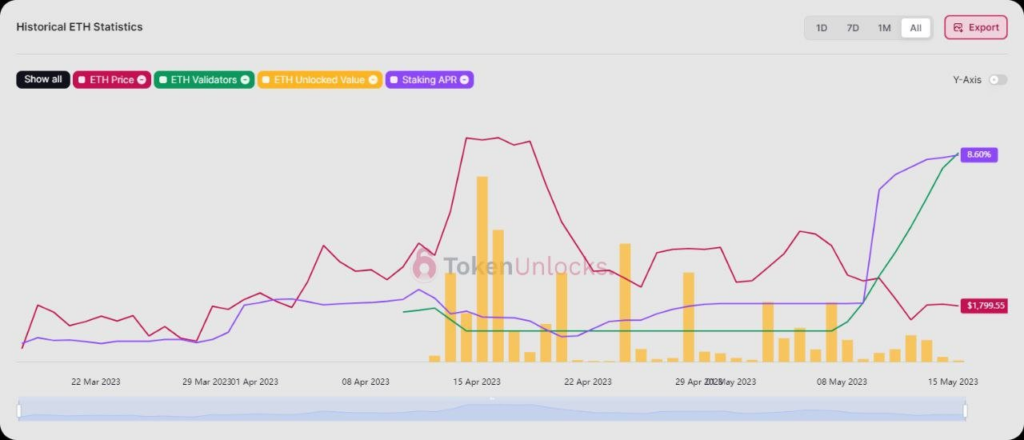

- Token Unlock shared Ethereum staking reached a record high with 8.6% annualized rate of return.

- 3.4 million ETH were deposited and 2.67 million ETH were withdrawn after Shanghai upgrade.

- stETH APR has surged to an unprecedented 8%, highlighting Ethereum’s earning potential.

Token Unlock reported that the current annualized rate of return for ETH staking stands at 8.6%, reaching a record high. Following the implementation of the Shanghai upgrade, a total of 3.4 million ETH has been deposited into ETH2.0 contracts.

Meanwhile, 2.67 million ETH has been withdrawn, resulting in a net pledge of 734.92k ETH, equivalent to $1.4 billion. Additionally, the stETH APR has surged to an unprecedented level of 8%.

This news comes following the successful implementation of the Shanghai upgrade on the Ethereum network. The upgrade specifically targets enhancing scalability and efficiency, addressing longstanding concerns such as high fees and sluggish transaction speeds.

As a direct consequence of the upgrade, a significant amount of activity has been observed. Notably, 3.4 million ETH has been deposited into ETH2.0 contracts, demonstrating growing confidence among investors in the potential of Ethereum. Additionally, 2.67 million ETH has been withdrawn, suggesting an active engagement with the network. These trends highlight a willingness among stakeholders to stake their Ethereum holdings, showcasing a belief in the network’s future prospects.

A Binance feed post highlighted that Ethereum staking offers a notable advantage of earning rewards, and currently, the annualized rate of return has reached an unprecedented level. This implies that individuals who have staked their Ethereum holdings are now reaping greater rewards than ever before.

Moreover, the stETH APR has surged to a remarkable high of 8%, further enhancing the earning potential for stakers. These achievements serve as a testament to the strength and potential of the Ethereum network. The substantial net pledge of 734.92k ETH, equivalent to $1.4 billion, is a clear indication of the high level of confidence that investors have in Ethereum. This considerable amount of capital demonstrates the immense interest in staking ETH and capitalizing on the associated rewards.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.