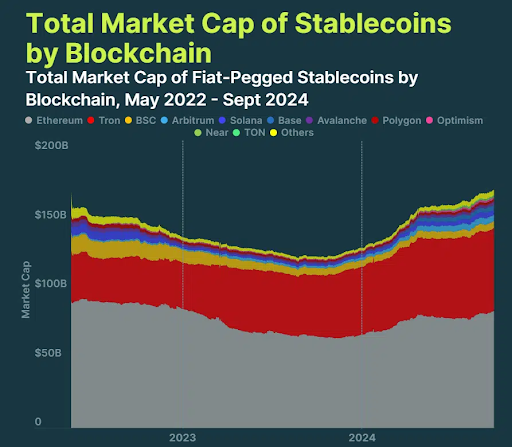

- Ethereum holds 49.1% of the stablecoin market, despite recent volatility and market shifts.

- TRON and Ethereum dominate the stablecoin market with a combined value of $144.4 billion.

- ETH price dropped below $2,500, yet long-term outlook remains optimistic among analysts.

Ethereum remained the top platform for stablecoins even with the fluctuations in the market.

According to CoinGecko, Ethereum holds about $84.6 billion in stablecoins, representing 49.1% of the total stablecoin supply as of September. The smart contract platform plays a crucial role in DeFi, holding nearly half of all stablecoins in the market.

TRON also has a strong presence, holding 83.9% of the $144.4 billion stablecoin market. TRON holds $59.8 billion, giving it a 34.8% share. However, Ethereum’s market share has slightly decreased.

This decline may be due to the increasing usage of layer 2 solutions and the recent failure of Terra’s UST stablecoin. In fact, Ethereum’s stablecoin supply grew by $17.2 billion this year, but its market share still decreased.

ETH Price Faces Pressure, But Long-Term Outlook Stays Positive

The price of Ethereum’s native token, ETH, recently fell below $2,500. It dropped by nearly 4% in 24 hours, reaching $2,480. This decline reflects broader market uncertainty, partly driven by geopolitical tensions in the Middle East.

Read also: Top 5 Layer-1 Blockchains: Beyond Ethereum in 2024

As ETH prices dropped, liquidations jumped, with $87 million in ETH positions liquidated within a day. Most of these positions were long, showing overextended bullish sentiment.

Technical indicators suggest the market may continue to experience bearish pressure. ETH has fallen below crucial moving averages – the 50 SMA, 100 SMA, and the 200 SMA. Analysts are now watching for the next support level of $2,395.

Despite the short-term volatility, many still believe in future ETH growth. Historically, Ethereum has seen a strong return in the fourth quarter, averaging 20.8%.

Whale activity also indicates growing confidence. Addresses holding between 100,000 and 1 million ETH have accumulated more since August, now controlling 44.17% of the total supply. This accumulation suggests that large investors remain bullish.

Meanwhile, Ethereum-based ETFs have lagged behind Bitcoin ETFs in terms of performance. BlackRock executives say their Ethereum ETF has underperformed expectations. They attribute this to a more complex investment narrative compared to Bitcoin’s “digital gold” positioning. Despite this, Ethereum continues to dominate the stablecoin market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.