- The price of ETH climbed by 0.39% in a recent price review.

- ETH finds support around $1,327.85 and resistance at $1,355.17

- Further bullish momentum is predicted using technical indicators.

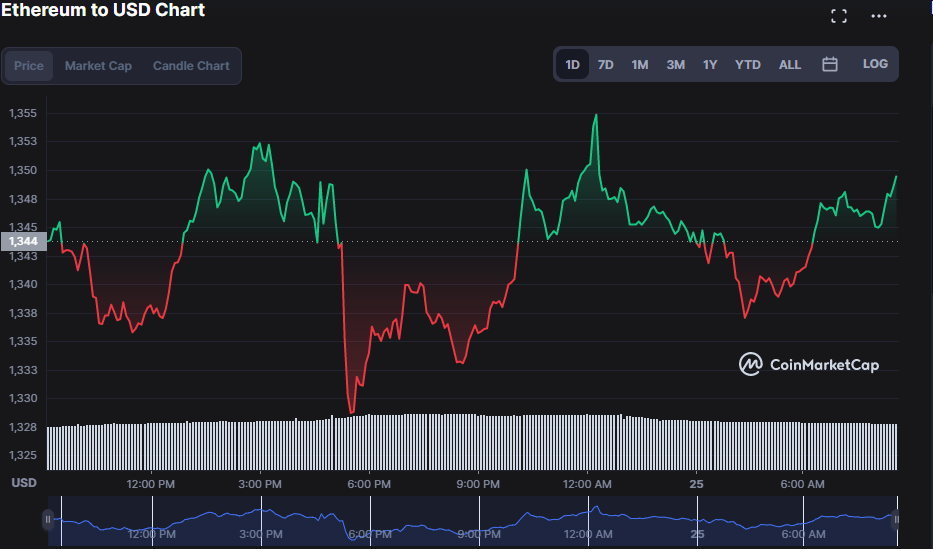

The price movement of Ethereum over the last day has been erratic, with both bullish and negative momentum being ephemeral each time. However, bulls have just taken control of the market, as the price increased by 0.39% to a value of $1,347.71.

The market capitalization increased by 0.46% to $165,043,050,003 and the 1-day trading volume increased by 6.62% to $12,122,577,347, hence contributors to the price increase.

The top and lower bollinger bands cross at 1367.35 and 1287.48, respectively. This suggests a steady market because the Bollinger Band is moving linearly. Additionally, the market is moving in the direction of the upper band, indicating that the positive momentum may continue.

A reading of 60.88 and a rising gradient that is veering into the overbought area are displayed by the Relative Strength Index (RSI). If the RSI score stays constant, the market will be in a bullish mood because it indicates that buying and selling activity is equal.

The Bull Bear Power (BBP), which has a rating of 20.37 and is in the positive range, suggests that the bullish attitude on the Ethereum market may endure in the near future.

A golden cross pattern formed by the 5-day Moving Average crossing above the 20-day Moving Average indicates a bullish market trend. 1345.17 is where the 5-day MA touches, and 1327.40 is where the 20-day MA hits.The market is also above both MAs, which supports the bullish sentiment.

The Stoch RSI is at 38.99 and is trending north, indicating market stability. The current trend on the ETH market is likely to continue in the near term because the market is neither overbought nor oversold.

Overall, the current bullish trend will be invalidated if the bears are successful in seizing control of the market. However, the positive trend will continue if the bulls successfully hold the resistance and raise prices without experiencing another drop.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.