- ETH is currently trading at $1,182.89 after a 0.41% drop in price.

- The token’s NVT Signal (7d MA) has just reached a 1-month high of 1,472.933.

- Technical indicators for Ethereum are telling a very bearish story today.

Another one of the many cryptocurrencies in the red after the weekend is Ethereum (ETH). Data from the crypto market tracking website CoinMarketCap indicates that the leading altcoin is currently trading at $1,182.89 after a 0.41% drop in price over the last 24 hours. The crypto is also still in the red by more than 5% over the last week.

ETH also weakened against its biggest competitor in the market, Bitcoin (BTC), by about 0.31% over the last day. The altcoin’s 24-hour trading volume, however, is in the green zone at the moment to now stand at $4,028,253,855 after a 10% increase. In terms of market cap, ETH stands at $144,719,247,850.

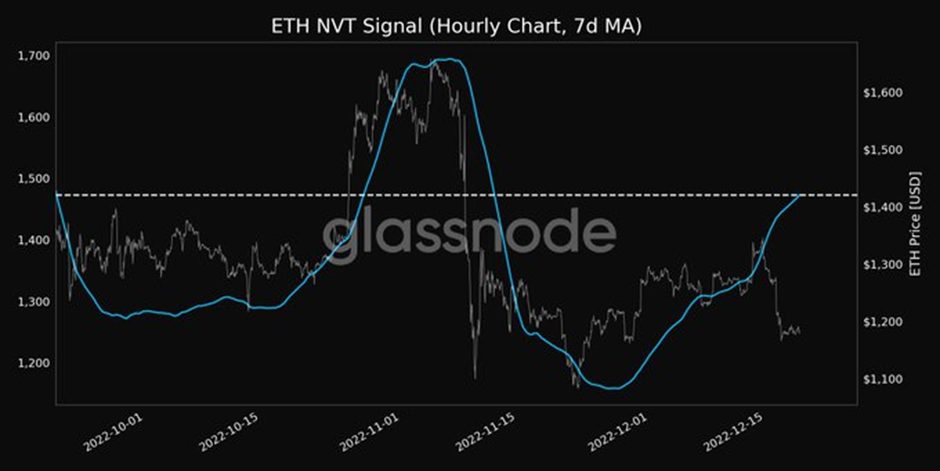

The on-chain metrics platform known as Glassnode took to Twitter earlier this morning to share some data on ETH. According to the post, ETH’s NVT Signal (7d MA) has just reached a 1-month high of 1,472.933.

ETH NVT signal (Source: Glassnode

An NVT Signal (NVTS) is a derivative of NVT Ratio by Dimitry Kalichkin which provides more emphasis on predictive signaling ahead of price peaks. This could mean that good things are in store for the ETH price in the coming days.

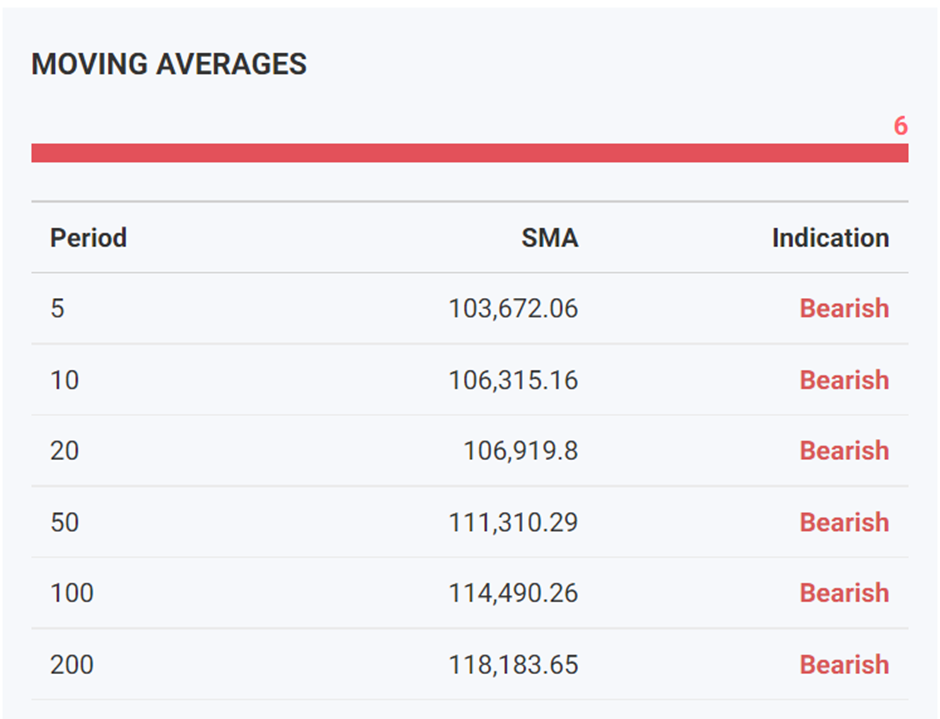

On the other hand, ETH’s technical indicators are telling an entirely different story at the moment. Most of the altcoin’s moving averages are bearish and so are many of its other technical indicators, according to data from the moneycontrol website. In addition to this, ETH’s moving average crossovers are also bearish.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.