- Binance confirmed Falcon Finance (FF) as the 46th HODLer Airdrop project.

- 150 million FF tokens will be distributed to eligible BNB holders.

- Tokenomics include a dual-token model, staking, and governance utilities for FF holders.

Binance has announced Falcon Finance (FF) as the latest addition to its HODLer Airdrop lineup, marking the 46th project under the program. The exchange said it will distribute 150 million FF tokens, or 1.5% of supply, to BNB holders ahead of the token’s market debut.

Distribution will occur ahead of the project’s official listing on Binance scheduled for September 29 at 13:00 UTC.

Related: Falcon Finance’s Answer to “Is It Safe?”: A 116% Over-Collateralized Reserve

Airdrop and Listing Details

Binance confirmed that deposits will open on September 26 at 10:00 UTC, with tokens allocated directly to users’ Spot Accounts at least one hour before trading begins. Trading will launch with pairs against USDT, USDC, BNB, FDUSD, and TRY.

FF will debut with a seed tag, indicating higher volatility risk given its early-stage status.

At the time of listing, Falcon Finance will have a circulating supply of 2.34 billion FF (23.4% of its total supply). The token is supported on both the BNB Smart Chain and Ethereum networks, with contracts already audited by leading firms.

A strict holding cap ensures no user claims more than 4% of the total BNB pool used for eligibility.

Tokenomics and Allocation

As per an updated whitepaper, Falcon Finance has designed FF as a governance and utility token complementing its synthetic dollar protocol powered by USDf and sUSDf.

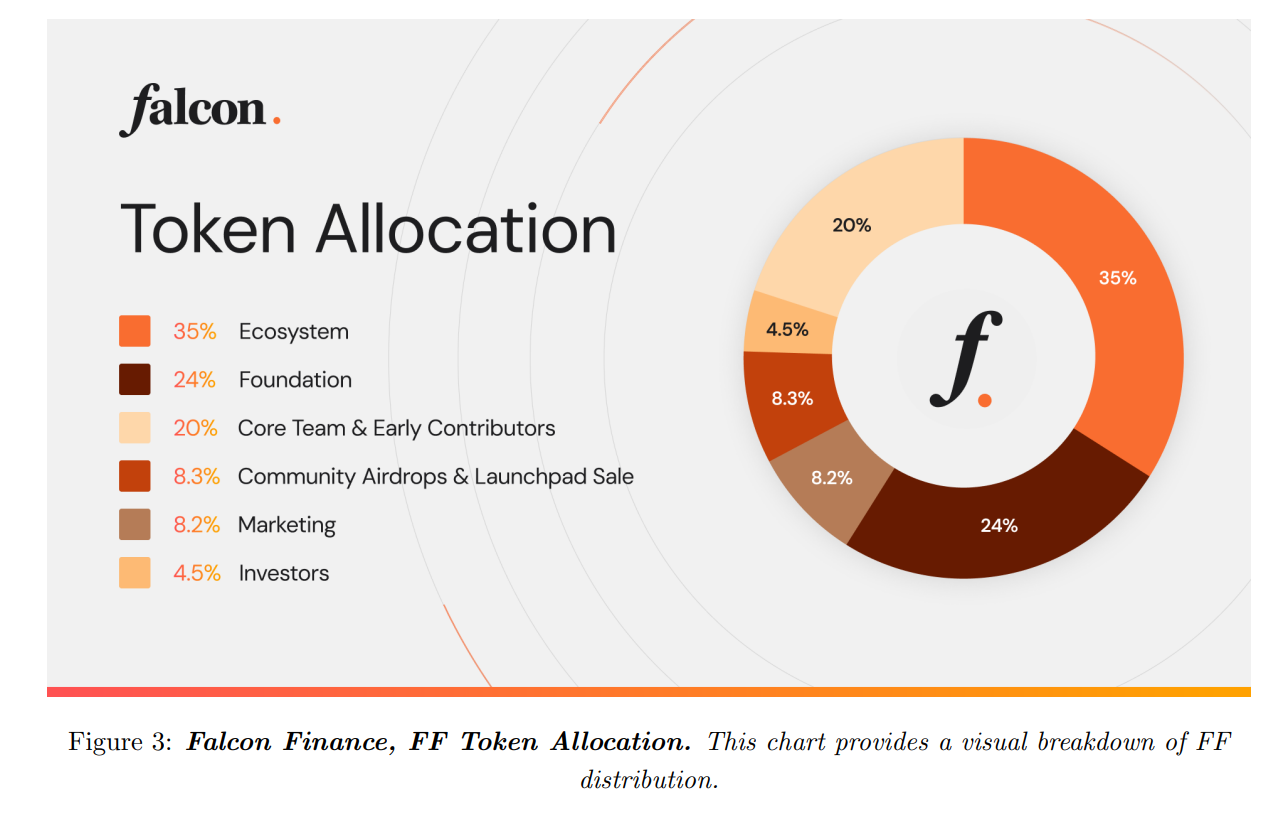

35% of the token supply will be directed toward ecosystem growth, 32.2% reserved for the Foundation, 20% for the team and contributors, 8.3% for community rewards and launchpad initiatives, and 4.5% for early investors.

Team and investor allocations are subject to a one-year cliff and three-year vesting schedule to ensure long-term alignment.

Utility for FF Holders

Holders of FF will be able to participate in governance, stake their tokens for rewards, and unlock preferential economic terms, including improved efficiency in minting USDf, reduced haircut ratios, and lower swap fees.

The roadmap for 2026 includes plans for a Real World Asset (RWA) engine to tokenize institutional assets such as corporate bonds, T-bills, and private credit, alongside fiat rails expansion and gold redemption offerings in the UAE.

Strong Debut?

Originally announced by DWF Labs in October 2024 as a yield-bearing synthetic stablecoin project, Falcon Finance has since evolved into a universal collateralization platform aimed at powering liquidity and yield across ecosystems. Interestingly, leading crypto trading platform Gate has announced that it will launch Falcon Finance (FF) spot trading for the first time at 21:00 (UTC+8) on September 29.

Related: Can BNB Reclaim $1,000? Analyst Warns of Bearish Momentum

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.