- Fan tokens face a storm as sentiment plummets, raising doubts about their future as investments.

- PSG and BAR tokens struggle, while OG shows signs of a bullish comeback.

- CITY token hovers near crucial support, with the potential for a rebound or further decline.

Fan tokens displayed negative sentiment, with the majority of them experiencing 30-day lows in price performance. This rapid collapse has alarmed investors, raising concerns about the long-term sustainability of fan tokens as an investment.

Furthermore, the Federal Reserve of the United States’ position on interest rate rise has turned the crypto market on its head, adding to the uncertainty surrounding fan tokens.

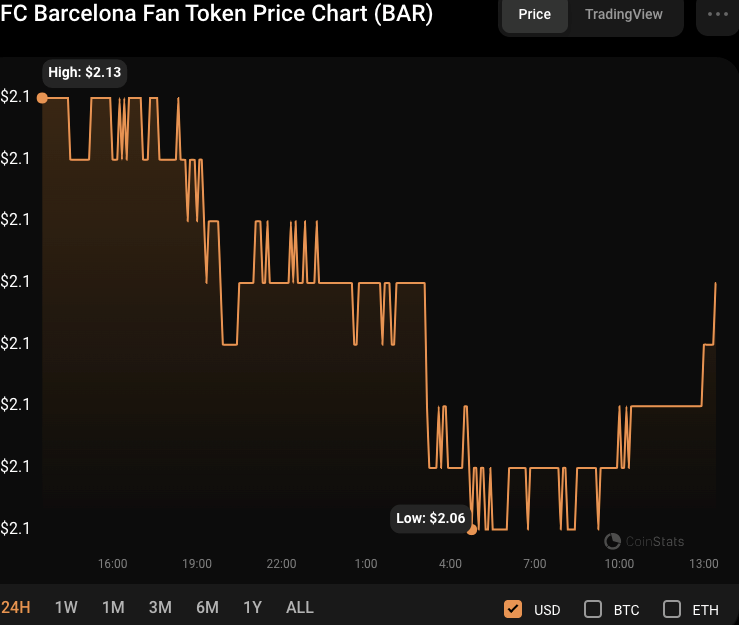

BAR (FC Barcelona Fan Token)

FC Barcelona Fan Token (BAR) was trading around $2.17 at the start of the day before encountering resistance and succumbing to negative pressure. As a result, the BAR price fell to a four-week low of $2.06, where support was formed.

BAR was trading at $2.09 as of press time, down 3.45% from its 24-hour high. However, if bearish pressure continues to mount, a drop below $2.06 might lead to a steep decline, with the next support level at $2.00.

BAR’s market capitalization and 24-hour trading volume declined 2.52% and 4.81%, respectively, during the recession, to $21,685,856 and $1,052,631. This decline in market capitalization and trading volume indicates a drop in investor confidence and activity in the BAR market.

PSG (Paris Saint-Germain Fan Token)

The Paris Saint-Germain Fan Token (PSG) experienced a significant price dip in the past day, dropping from a peak of $3.04 to a monthly low of $2.98 before finding support. However, if this decline persists and breaks the $2.98 level, the support levels to watch are the $2.92 and $2.86 thresholds.

The market capitalization of the PSG token dropped by 0.34% to $19,502,621. Furthermore, its trading volume decreased 70.34% to $1,116,074, reflecting a decrease in investor interest.

However, a positive reversal is possible if the PSG Fan Token regains strength and breaks over its previous intra-day high of $3.04.

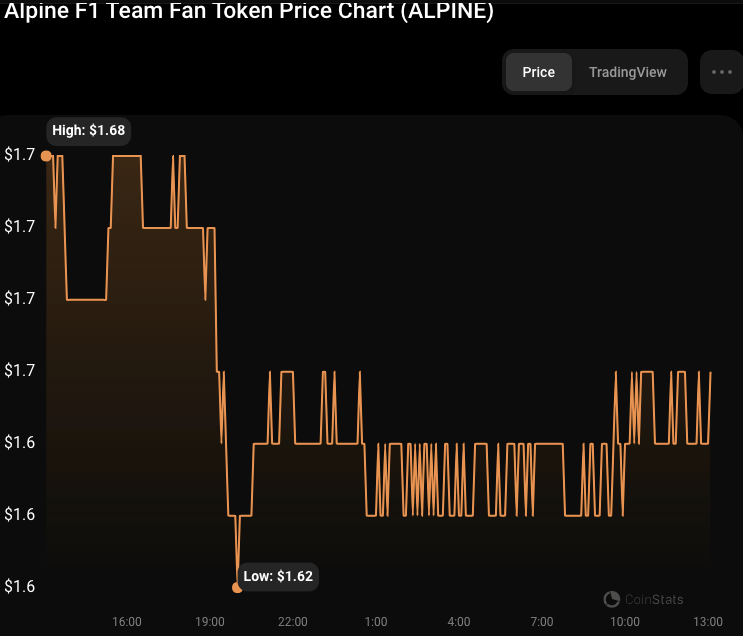

ALPINE (Alpine F1 Team Fan Token)

Bears have also gained ground over Alpine F1 Team Fan Token (ALPINE), the third most significant fan token by market cap. The mood shift has led to a drop in ALPINE’s price, from a daily peak of $1.68 to a month’s low of $1.62.

The price would need to surpass resistance levels at $1.68 and $1.72 for a turnaround to be signaled. On the other hand, a break below the $1.62 support level might reaffirm the negative attitude and bring ALPINE to its next support level at $1.60.

ALPINE’s market capitalization and 24-hour trading volume fell 1.80% and 1.55%, respectively, to $18,712,601 and $2,176,529. This drop in market capitalization and trading volume indicates a reduction in investor interest and might imply that ALPINE’s present decline will continue.

OG (OG Fan Token)

Bearish domination has reigned supreme in the OG Fan Token market, lowering the price to a monthly low of $4.24 from a 24-hour high of $4.44. However, as of press time, bulls had overwhelmed bears, with OG trading at $4.38, a 2.85% rise from its intraday low.

Moreover, OG’s market capitalization and 24-hour trading volume grew by 2.48% and 41.09%, respectively, to $16,812,933 and $8,723,623. This increase in market value and trade volume indicates increased interest in OG Fan Token, which might indicate a change in mood toward bullishness.

If bulls break over the $4.44 barrier, the next level to monitor is $4.60. A decrease in trading volume or failure to break through the resistance level might indicate a probable consolidation or bearish reversal in the price of OG.

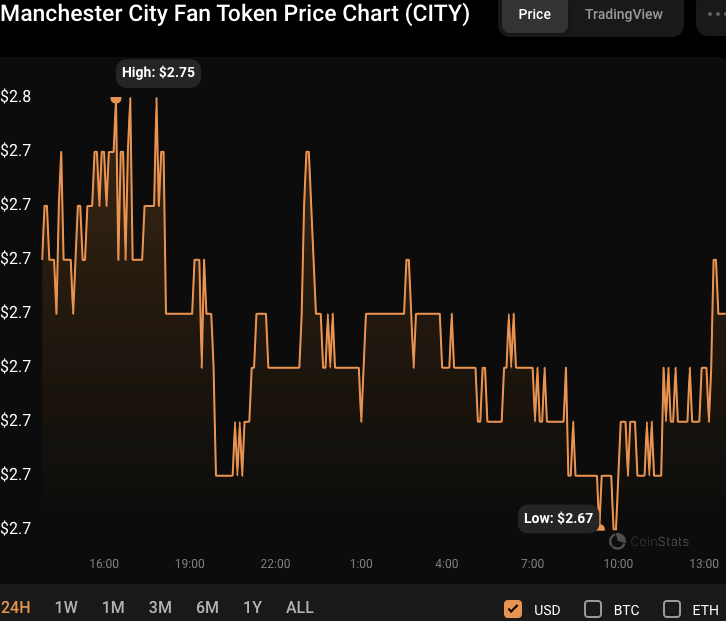

CITY (Manchester City Fan Token)

With bears driving the price from an intraday high of $2.75 to a 4-week low of $2.67, the CITY token has also witnessed a downward trend in recent trading sessions. However, at press time, the CITY price had found some stability around the $2.71 level.

Furthermore, CITY’s market capitalization and 24-hour trading volume dropped to $15,722,919 and $1,488,093, respectively, owing to the slump.

If the bears break through the $2.67 support level, the next level to look for is around $2.60.

This level has historically attracted some purchasing activity and may serve as a solid support zone for the CITY token. However, if pessimistic sentiment continues to rule the market, additional downward action towards the $2.50 level is possible.

In conclusion, fan tokens like BAR, PSG, ALPINE, OG, and CITY face bearish trends, raising concerns for long-term investors amid market uncertainties.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.