- The Fed injected $125 billion into the U.S. banking system over five days.

- This “stealth easing” contradicts the Fed’s hawkish tone, easing short-term funding stress.

- Markets have responded, with the CME FedWatch Tool now showing a 67.3% chance of a December rate cut.

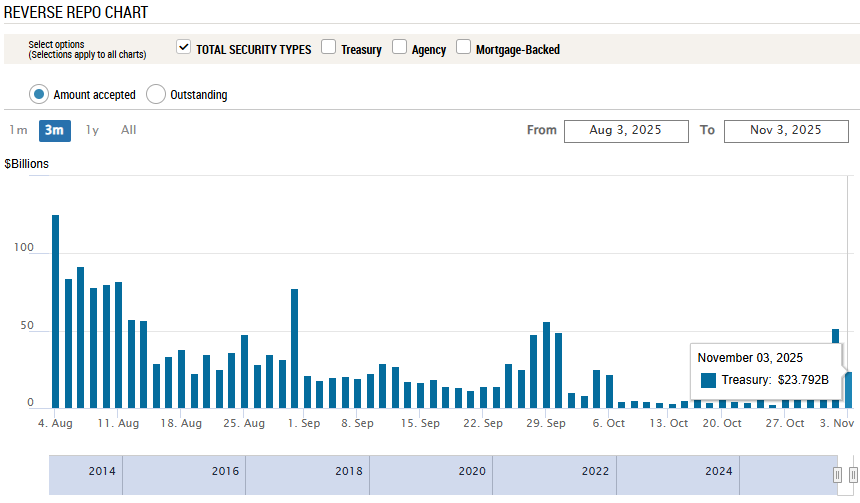

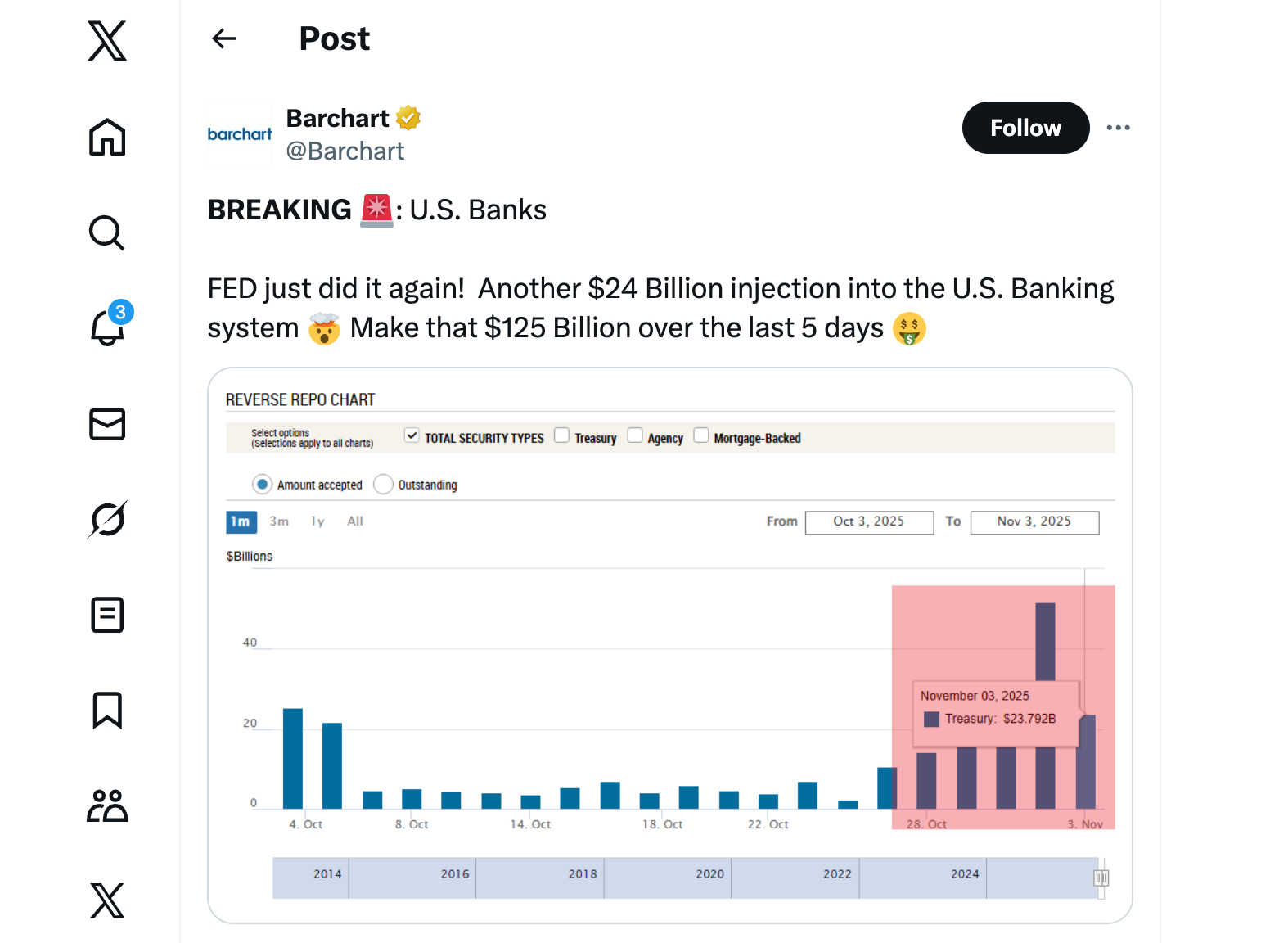

The U.S. Federal Reserve has injected $125 billion into the banking system over the past five days, its biggest short-term liquidity move since early 2020. The largest single-day injection, $29.4 billion, came on October 31 through overnight repo agreements, according to official Fed data.

Repos allow banks to trade Treasuries for cash overnight, helping to ease short-term funding stress. The action follows a drop in bank reserves to $2.8 trillion, the lowest in over four years.

Powell Talks Tough, But Actions Show ‘Stealth Easing’

Analysts say these injections show a split in Fed strategy. While Powell still talks tough on inflation, the Fed is quietly adding liquidity. This action appears designed to prevent cracks in the financial system, especially for smaller banks under strain.

This apparent “stealth easing” seems to be what the market is trading on. Fed Chair Jerome Powell continues to stress the need for restrictive policy to fight inflation. Yet, the repo injections effectively add reserves, lower short-term borrowing costs, and ease credit conditions — the opposite of tightening.

Analysts say Powell’s strategy looks pragmatic: project strength publicly while quietly stabilizing liquidity behind the scenes.

Related: China Is Printing Money Faster Than The U.S. And Bitcoin Likes That Path

Markets Price in 67.3% Chance of December Rate Cut

Traders see a 67.3% chance the Fed will cut rates by 25 basis points in December, per the CME FedWatch Tool. Another 22.3% expect deeper cuts by January, while only 32.7% think rates will stay unchanged.

Combined with the Fed’s plan to stop balance-sheet runoff on December 1, markets see this as a signal that tightening is nearly over.

Impact on Crypto and Risk Assets

Crypto traders are watching closely. Bitcoin and other risk assets tend to benefit when liquidity improves. Currently, Bitcoin trades at $104,218, down 3.4% in the past day and 16% over the past month.

Analysts note that while repos aren’t the same as long-term QE, the sudden $125 billion liquidity boost could still act as a short-term tailwind for crypto by easing funding stress and improving sentiment.

The AI platform Grok noted that Fed liquidity injections have historically been bullish for Bitcoin, as they raise inflation expectations and support BTC as a hedge against fiat currency devaluation.

Trader Merlijn on X argued that global liquidity is about to rise again. He cites Fed repo inflows, Treasury spending, Asian stimulus, and potential credit easing. To him, this setup could trigger a broader market rebound, with altcoins likely to follow once liquidity fully returns.

Meanwhile, Thomas Kralow warned that the current repos reflect tight liquidity, not easing. He said Bitcoin often struggles when liquidity dries up, but tends to lead recoveries once conditions improve.

Analysts Divided on Policy Direction

Market observers remain split on what this means for future Fed policy. Some view the liquidity moves as preemptive action to prevent a funding crunch, while others interpret them as an early pivot toward easing.

Related: Bitcoin Price Prediction: Fed QT Pause And Trump–Xi Summit Put $118K In Play

Andy Constan of Damped Spring Advisors said it’s likely just a short-term imbalance, adding: “If reserves really are scarce, the Fed will need to act more aggressively. For now, it’s mostly worth ignoring.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.