- Sui saw over $200 million in inflows this month and now has 225 million total accounts.

- Solana’s first U.S. staking ETF began trading this week, offering exposure with zero management fees.

- Chainlink whales withdrew $188 million from Binance as accumulation picks up again.

A sharp macro divergence is underway just hours before today’s FOMC rate decision. Bitcoin holds firm near $114,000, climbing over 4% this week while gold, a traditional safe-haven, has fallen nearly 3%. This pattern signals a “risk-on” rotation as traders appear to front-run the Fed, moving capital into crypto.This macro-shift provides the backdrop for key altcoins moving on strong, independent catalysts.

Why is SUI Network Gaining Traction Today?

Money is flowing into Sui, with October’s net inflows surpassing $200 million. The network just crossed 225 million total accounts.

Sui’s ecosystem has been buzzing with new launches. CoinMetro recently listed SUI, bringing faster trades, lower fees, and direct fiat access. With consistent updates, expanding integrations, and new trading incentives, Sui is quietly positioning itself as one of the more resilient Layer-1 performers this quarter. SUI is currently down by more than 4% and is trading at $2.49.

Related: Ripple vs. Bitcoin Debate Rekindles as Viral Post Questions Leadership Conviction

Solana Gains Institutional Access as Bitwise ETF Goes Live

Solana is entering a new era. The Bitwise Solana Staking ETF (BSOL) officially began trading this week, offering 100% exposure to spot Solana and targeting 7% annual staking rewards with zero management fees. This makes it the first U.S. ETF to provide direct staked exposure to Solana.

Grayscale is competing with its own Grayscale Solana Trust (GSOL), now allowing staking through select U.S. brokerage accounts. With both products live, institutional investors finally have regulated ways to access Solana yield without handling tokens directly.

Solana has outperformed other top 10 coins in the past week, fueled by ETFs. However, short-term consolidation continues near $190–$200, ahead of events like the upcoming FOMC meeting.

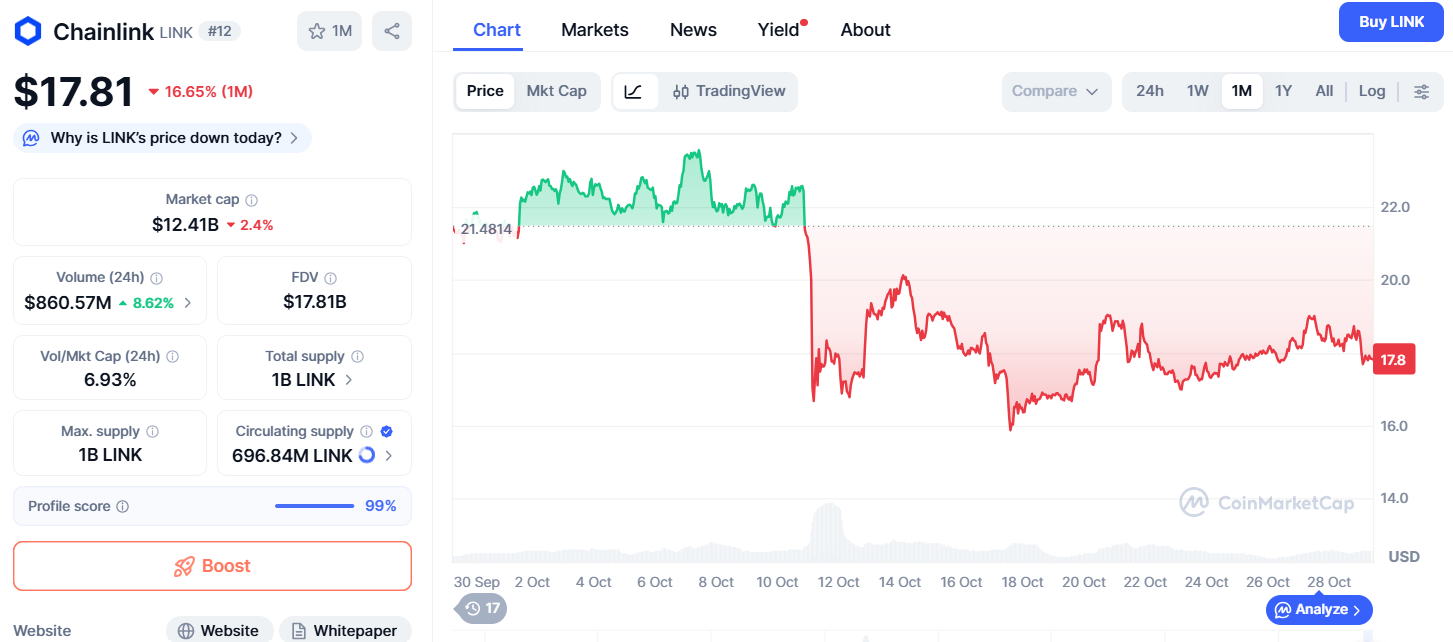

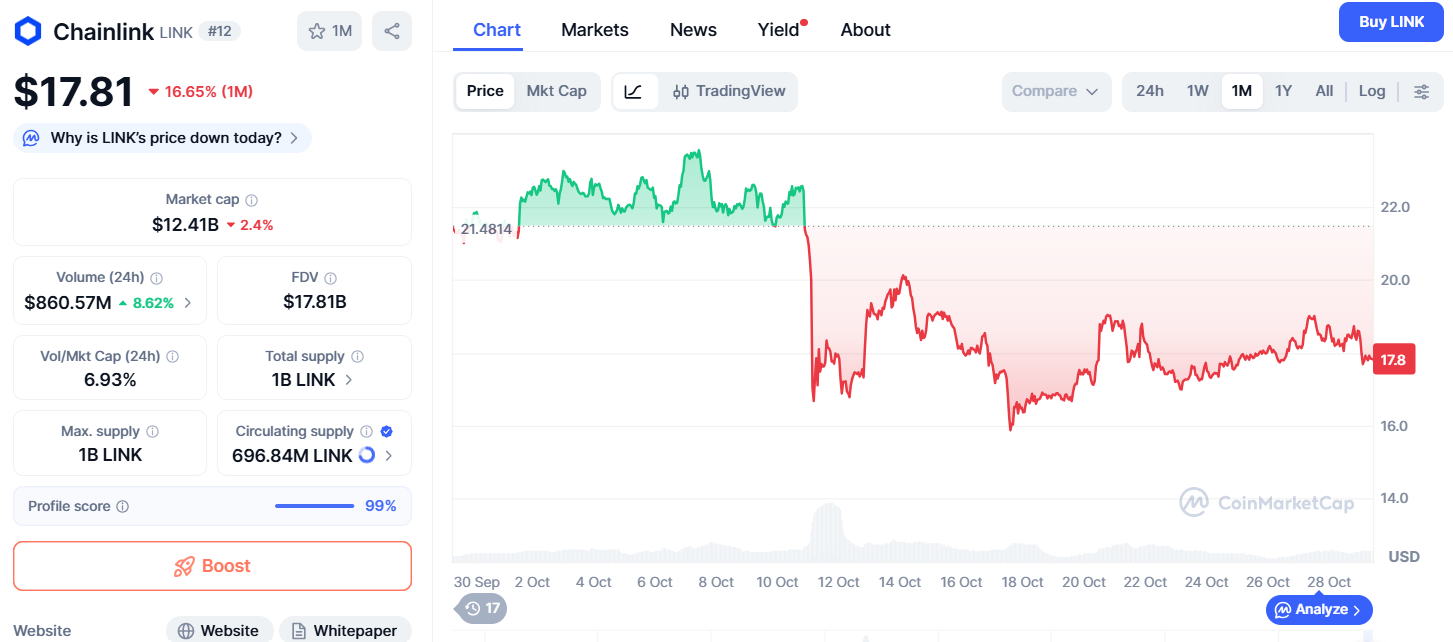

Chainlink Whales Pull $188M From Binance in Fresh Accumulation

Whales are accumulating Chainlink again. Since October 10, 39 new wallets have withdrawn nearly $188 million worth of LINK from Binance.

On-chain data shows a rise in wallets holding 100,000 to 1 million LINK, echoing accumulation patterns from the 2021 bull run. Transaction volume has also reached its highest level since that cycle.

LINK’s current chart mirrors its last cycle before a big breakout. If that pattern repeats, LINK could retest $50 in the next altcoin rally. For now, it trades near $18, with a breakout level to watch around $19.90.

Aptos Leads RWA Push With $1.2B in Tokenized Assets

Aptos has seen one of the largest stablecoin inflows this month, over $545 million in just 24 hours.. BlackRock’s involvement has been a driver, contributing to $1.2 billion in tokenized assets now live on the Aptos chain.

A16Z’s State of Crypto 2025 report also ranked Aptos among the top three blockchains for real-world assets (RWAs), highlighting its growing institutional relevance.

Bitwise has also filed for an Aptos ETF. Still, Aptos’ price action remains muted, consolidating around $3.50–$3.80 after breaking below key support levels.

A recovery above $6.70 would confirm a strong bullish reversal, but until then, Aptos may remain range-bound as the ecosystem builds out new partnerships and RWA integrations.

Related: Arthur Hayes Uses 100 Years of Stock Data to Predict Crypto Graveyard – 99% Failure

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.