- FOMC expected rate cut may boost crypto liquidity and support Bitcoin’s next move.

- Bitcoin risks a drop to $87k if resistance rejects before policy announcement.

- Breakout above key levels could push Bitcoin toward the $100k price region.

Bitcoin (BTC) and the wider crypto market are heading into a key Federal Reserve week as traders position around today’s FOMC decision. The Federal Reserve’s FOMC will announce its policy decision today at 2 PM ET, with markets expecting a 0.25% rate cut, bringing the target range to 3.5–3.75%.

Why This FOMC Meeting Matters for Crypto

The FOMC meeting is seen as pivotal because investors are watching not only for the rate cut but also for Jerome Powell’s tone on future monetary policy. Several Fed officials have recently leaned dovish, hinting at more rate cuts in 2025–2026.

Liquidity is rising as quantitative tightening has ended and the Fed continues debt buybacks, which injects money into the system. Historically, such periods of liquidity combined with rate cuts have triggered sharp rallies in Bitcoin and other risk assets.

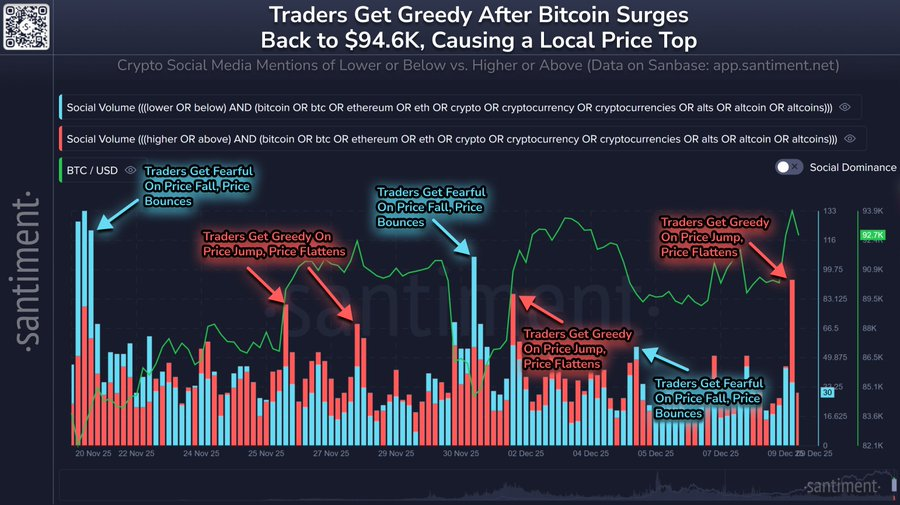

Despite momentum, Bitcoin remains vulnerable to short-term swings On-chain metrics show rising FOMO on platforms like X, Reddit, and Telegram, with retail traders pushing calls for “higher” and “above.” Santiment stressed that markets often move opposite to retail sentiment.

Related: Crypto Market Stabilizes as Flows Concentrate in BTC and ETH Ahead of Fed Decision

Can Bitcoin Price Hit $100k?

However, experts warn that pre-FOMC rallies can be risky, often leading to short-term traps. One expert said that Ethereum looks strong on every metric, but Bitcoin continues to lag and is still struggling to break out. The OBV and volume both look solid, yet the market may need to wait for tomorrow’s catalyst to push higher.

A strong rejection at this level could send BTC back toward $87,000, but if it breaks through today, a move toward $100,000 becomes the next target.

Macro Risks: Fed Cuts vs Bank of Japan Tightening

Analyst Benjamin Cowen pointed out a possible complication. While the Fed is expected to cut, the Bank of Japan is expected to raise interest rates. A similar setup in mid-2024 triggered a brief capitulation in global markets. He says a short-term low could form again before a gradual recovery in early 2026.

Cowen added that Bitcoin typically forms major cycle tops in the fourth quarter of the post-halving year. He expects rallies next year but says they may form lower highs before stronger recoveries later in 2026.

Related: Massive Ethereum Inflow To Binance Collides With Bullish ETH/BTC Reversal Structure

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.