- Text messages reveal that Sam Bankman-Fried was interested in buying Twitter.

- More evidence shows that Bankman-Fried was willing to give $5 billion for a joint deal with Elon Musk.

- The text messages were disclosed during Musk’s legal battle with Twitter.

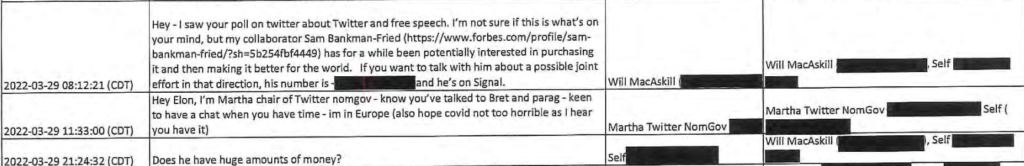

Text messages presented during Elon Musk’s legal battle with Twitter show that FTX’s CEO, Sam Bankman-Fried, was “potentially interested” in buying the social media giant.

In a Twitter v. Musk text exhibits contributed by New York Times reporter Kate Conger on Thursday, William MacAskill, Bankman-Fried’s advisor, texted Musk in March in hopes of setting up a meeting between the two billionaires to discuss a possible joint Twitter deal.

“Does he have huge amounts of money,” Musk replied on text. MacAskill, who is also a member of FTX’s Future Fund and associate professor at the University of Oxford, quipped, “[d]epends on how you define ‘huge’!”

The FTX CEO, whose net worth is $9.44 billion, as per Bloomberg’s Billionaire’s Index, was claimed to be willing to pitch $8-15 billion for the Twitter deal. However, during a financing discussion in April, Michael Grimes, the head of Global Technology Investment Banking, told Musk that Bankman-Fried would only be willing to part $5 billion.

In an effort for the Tesla and SpaceX CEO to “like” the FTX chief, Grimes talked up Bankman-Fried and called him an “ultra genius and doer builder.”

A Bankman-Fried and Musk one-two crypto billionaire punch seems improbable as Forbes’ richest man in the world has lost interest in buying Twitter due to the social network’s spam bot infestation.

On October 17, Musk is set for a five-day trial that will determine whether he will be forced to buy Twitter.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.