- Changpeng Zhao tweeted about Bitcoin’s performance on Binance in the last three months.

- Zhao claimed that FUD is temporary but that he couldn’t teach people to ignore it without addressing it.

- Forbes published an article stating that Binance lost $12 billion in just 60 days.

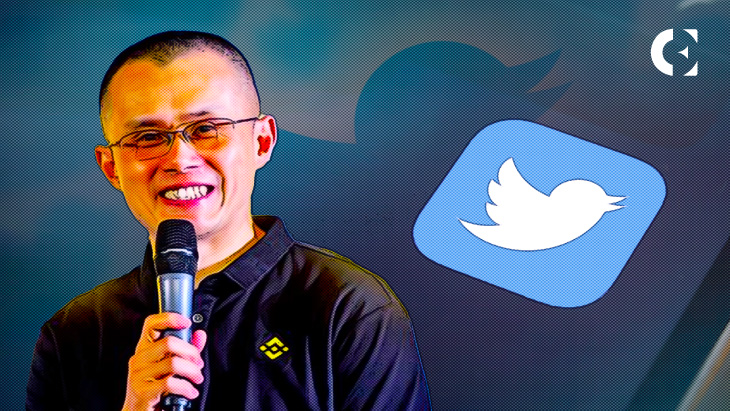

Leading cryptocurrency exchange Binance’s CEO Changpeng Zhao tweeted a picture of Bitcoin’s last three months’ performance metrics on the platform. The image highlighted that BTC’s price suddenly dropped $15,461 in December of last year with a very strong recovery in January 2023.

The tweet showed that Bitcoin recently experienced a rise in value worth up to $23,821, alongside a 24-hour low worth $22,338, while currently trading at $23,017. Moreover, BTC’s 24-hour volume on Binance stood at 201,027.

Zhao claimed that “FUD is temporary,” to which a SHIB supporter replied that FUD is temporary as long as it is not talked about. The Binance CEO then shared that it is not possible to teach users to ignore FUD without speaking about it.

On January 10, Zhao tweeted “More FUD incoming, will ignore!” When a user inquired why he doesn’t pay any attention to FUDs, Zhao replied:

Working in it (ignoring). But when sweeping Twitter to see what our community is up to, sometimes, can’t hold back to comment. Will try to improve.

This was a reaction to a previous report released by Forbes claiming that Binance was losing assets. The analysis of Binance’s financial status goes in-depth, covering everything from BUSD stablecoin activities to the general health of the BNB token. The study states that more than $360 million of the $12 billion in losses the exchange reported over the previous sixty days occurred on Friday, January 6.

Additionally, Nomics estimates that the value of the BNB coin is down 37% from a year ago. According to Forbes, by stopping to levy fees for spot Bitcoin trading during the bear market, the exchange lost $3 billion a year.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.