- GameStop (GME) led online discussions amid revived short-squeeze speculation.

- Bitcoin surged past $108K as capital flows shift from gold to digital assets.

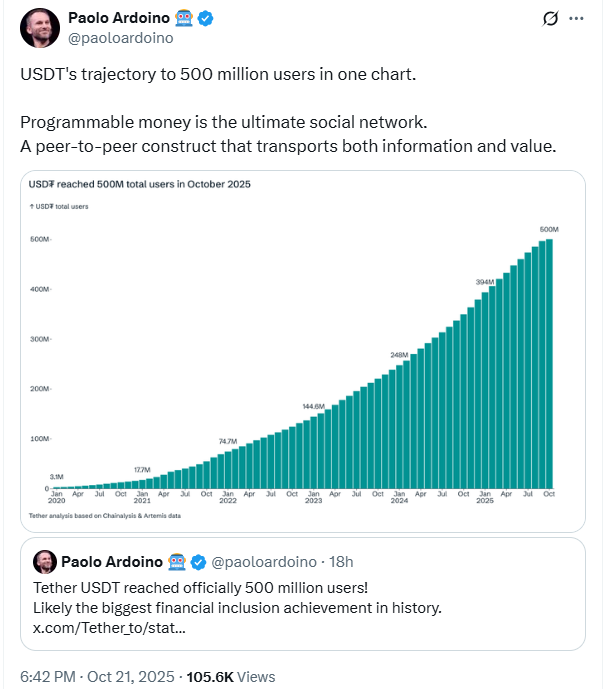

- Tether celebrated 500 million users, marking a breakthrough in financial inclusion.

Bitcoin (BTC), Chainlink (LINK), and Ethereum (ETH) are among the most discussed cryptocurrencies today, driven by strong fundamental developments and market optimism, as per blockchain analysis platform Santiment.

Meanwhile, GameStop (GME). though a traditional stock has found itself at the center of online speculation once more, dominating digital conversations with renewed short-squeeze theories.

GME Returns to Social Spotlight With Short-Squeeze Theories

The word ‘GME’ has reemerged as a trending topic across social media platforms, as traders and retail investors draw parallels between current market conditions and the infamous 2021 short squeeze.

Discussions focus on short interest, retail activity, and the potential for another surge in GameStop’s stock price.

The conversation has expanded to include other heavily shorted equities like Beyond Meat (BYND) and AMC, indicating that the retail trading movement is once again seeking high-risk, high-reward opportunities.

Bitcoin Price Today: Reclaims $108K as Traders Talk Rotation From Gold

Bitcoin climbed above $108,000 after a sharp increase in trading volume. Analysts attribute the move to a wave of capital rotation from gold to BTC, as investors embrace Bitcoin’s digital scarcity and performance amid macro uncertainty.

Related: Gold Jumps First, Bitcoin Often Follows Next on the 80-Day Cue – Analyst

The narrative of Bitcoin as the “digital gold” continues to strengthen, with market participants stating that the asset could double in price if the trend persists.

Tether Hits 500 Million Users, Setting a Global Milestone

Stablecoin leader Tether (USDT) reached an extraordinary milestone with 500 million users worldwide, representing crypto’s growing role in global financial inclusion, particularly in regions underserved by traditional banking.

Tether claims this figure represents actual individuals rather than wallet addresses, amounting to about 6.25% of the global population.

The milestone was followed by a short documentary showcasing how people in countries like Kenya use USDT not for speculation, but as a tool for stability and survival in economies plagued by inflation and limited banking access.

Chainlink and Ethereum Drive Innovation

Chainlink Conversations Rise on Payments Innovation Conference Mentions

Chainlink’s participation in the Federal Reserve’s Payments Innovation Conference has caused a surge in conversations surrounding LINK.

Major players such as BlackRock, Google Cloud, and Circle have reportedly shown interest in its oracle technology and real-world asset integration, with market participants expecting LINK to benefit from the demand.

Ethereum Stays Central to DeFi and Governance

Ethereum, on the other hand, remains at the core of DeFi and blockchain governance discussions. The platform is undergoing its Fusaka Hard Fork while navigating debates surrounding the Ethereum Foundation’s internal decisions and its connections with projects like Polygon.

Related: ETH and SOL Show a Weekly Bollinger ‘W’ as BTC Dominance Eases

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.